What's Ultimate Oscillator? - Definition of Ultimate Oscillator

Ultimate Oscillator - Ultimate Oscillator Technical indicators is a popular indicator which can be found in the - Indicators List on this site. Ultimate Oscillator is used by the FX traders to forecast price movement based on the chart price analysis done using this Ultimate Oscillator Technical indicator. Traders can use the Ultimate Oscillator buy & Sell Trading Signals explained below to figure out when to open a buy or sell trade when using this Ultimate Oscillator. By using Ultimate Oscillator and other forex indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Ultimate Oscillator? Ultimate Oscillator

How Do You Combine Indicators with Ultimate Oscillator? - Adding Ultimate Oscillator on MT4

Which Indicator is the Best to Combine with Ultimate Oscillator?

Which is the best Ultimate Oscillator combination for trading?

Most popular indicators combined with Ultimate Oscillator are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Ultimate Oscillator combination for trading? - Ultimate Oscillator Technical MT4 indicators

What Indicators to Combine with Ultimate Oscillator?

Find additional indicators in addition to Ultimate Oscillator that will determine the trend of the price and also others that confirm the market trend. By combining forex indicators which determine trend and others that confirm the trend and combining these technical indicators with FX Ultimate Oscillator a trader will come up with a Ultimate Oscillator Technical based system that they can test using a demo account on the MetaTrader 4 platform.

This Ultimate Oscillator Technical based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Ultimate Oscillator Technical Based Trading? Indicator based system to analyze and interpret price & provide signals.

What's the Best Ultimate Oscillator Strategy?

How to Choose & Select the Best Ultimate Oscillator Strategy

For traders researching on What is the best Ultimate Oscillator strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for trading forex market based on the Ultimate Oscillator system.

How to Make Ultimate Oscillator Strategies

- What is Ultimate Oscillator System

- Creating Ultimate Oscillator Technical System Template

- Writing Ultimate Oscillator Technical System Rules

- Generating Ultimate Oscillator Technical Buy and Ultimate Oscillator Technical Sell Trading Signals

- Creating Ultimate Oscillator Technical System Tips

About Ultimate Oscillator Technical Described

Ultimate Oscillator Technical Analysis & Ultimate Oscillator Signals

Originally developed & used to trade stock & commodities markets.

This oscillator aims at striking a balance between leading signals and lagging signals given by common indicators.

- Leading - some indicators lead the market & give signals earlier than the ideal optimum time

- Lagging - some technical indicators lag the market so far that half of the move is over before a signal gets generated.

This is the balance that the oscillator indicator seeks to strike, not to lead the market too much or lag the market too much - this way this oscillator will always give a signal at the ultimate time, thus its title.

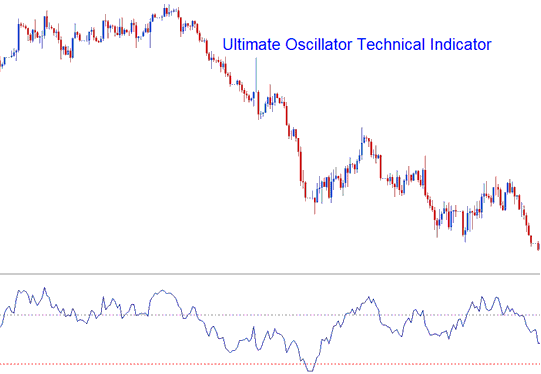

This indicator uses 3 different n-number of candlesticks and calculates the combined weighted sums of price action from these candles and plots these values on a scale ranging from 0 to 100. Values of above 70 are regarded and considered to be overbought levels while values of below 30 are considered and regarded to be oversold levels.

The time periods used to calculate ultimate oscillator technical indicator are 7 periods (short term trend), 14 periods (intermediate term trend) and 28 periods (long-term trend).

FX Analysis and How to Generate Trading Signals

This indicator can be used in generating buy and sell signals using various methods.

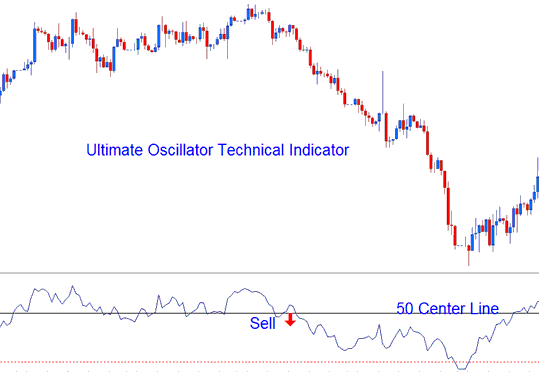

Center line Forex Crossover Signal

Buy Signal - readings above 50 centerline level

Sell Trade Signal - values/readings below 50 centerline level

Center line Forex Crossover Signal

Overbought/Over-sold Levels in Trading Indicator

Overbought - levels above 70 - sell trade signal

Oversold - levels below 30 - buy signal

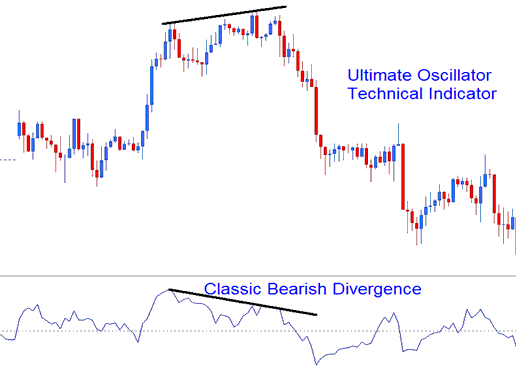

Divergence Forex Trading

The oscillator technical indicator can also be used to trade divergence signals, below is an example of a classic bearish divergence trade setup.

Technical Analysis

Learn More Tutorials and Topics:

- USD SGD System USD SGD Trade Strategy

- How to Set and Place a Forex Stop Loss Order in MT5 Android App

- UK100 Indices Strategy List & Best UK100 Stock Indices Trade Strategy to Trade UK100

- EU50 Strategy Guide Tutorial

- Forex DeMarks Projected Range Automated Expert Advisor(EA) Setup

- How Can I Use Linear Regression Slope Indicator in Forex?

- How to Set Zigzag Technical Indicator in Forex Chart on MT4 Software

- Coppock Curve MetaTrader 4 Trading Indicator in Trade Forex

- MA Strategy Analysis Trade Forex Strategies