Developing a Bitcoin System: Indicator Based Bitcoin System

A Bitcoin System constitutes a predetermined set of rules that a trader follows to manage their positions. These written bitcoin guidelines will dictate precisely when a bitcoin trade should be entered and when it should be exited. A comprehensive bitcoin trade strategy is formulated by integrating two or more indicators.

For illustration, the Stochastics Indicator Technical technical technical indicator can be combined together with other indicators to make a cryptocurrency trading system. For this example - stochastics oscillator can be combined with the crypto indicators below to come up with the following cryptocurrency system strategy.

- RSI indicator

- MACD

- MAs technical indicators

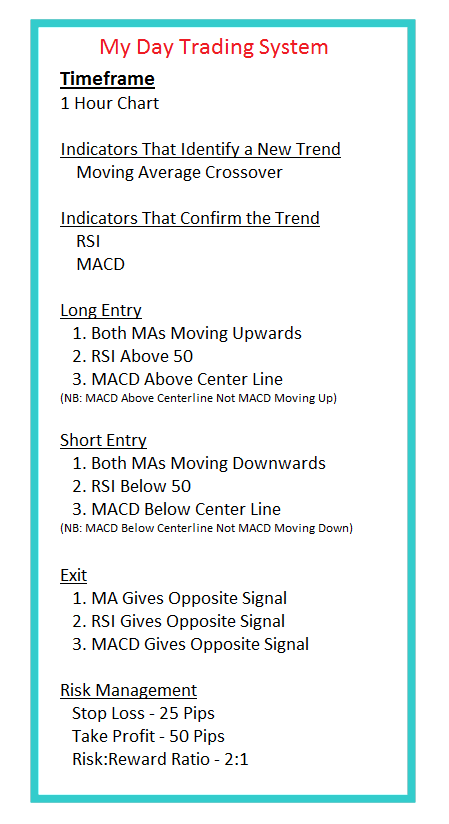

Example - MT4 Template System Example

Developing a System - Crypto System Examples Template

Therefore, the critical inquiry is how a trader can develop effective bitcoin trading systems, mirroring the example provided, and how to formally document the rules governing that system. Follow the steps below to draft your bitcoin system rules.

Seven steps to creating/developing an technical indicator based trading system

To create these set of bitcoin rules we shall make use of the following 7 steps.

1. Choose your Time-frame

The first step depends on how many hours you want to dedicate to bitcoin trading. Whether you prefer sitting in front of the Desktop computer constantly for several hours interpreting short crypto chart time-frames OR you prefer setting up your crypto charts using larger crypto chart timeframes once or twice a day. Selecting a chart time-frame will mainly depend on what type of trader you're.

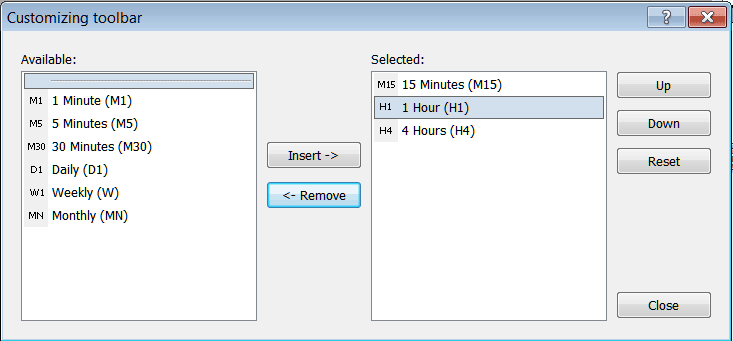

Chart Time-frames in MT4 Platform Software

While testing your new bitcoin system you may want to find out about its performance on different crypto chart timeframes & then choose and select the most accurate and profitable crypto chart time-frame for you.

2. Choose indicators to identify a new bitcoin trend

The objective is to enter the trade at the earliest possible juncture to maximize the potential gains from bitcoin price fluctuations.

One of the common ways to identify a new bitcoin trend as fast as possible is to use MAs Indicator. A simple strategy is to use a MA cross-over system that will identify a new trading opportunity at its earliest stage.

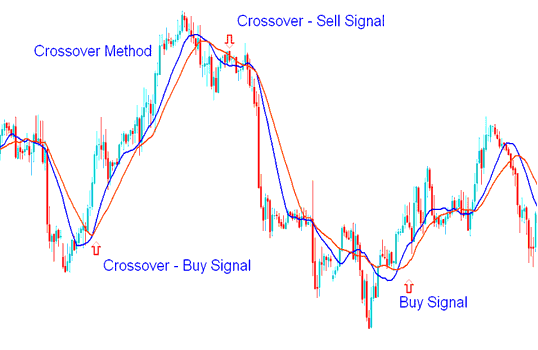

MA Cross over Strategy Method

Sell and buy signals for cryptocurrencies are derived using the Moving Average crossover method applicable for Bitcoin trading decisions.

3. Determine accompanying technical indicators to validate the established Bitcoin trend.

a After identifying a fresh bitcoin trend, we must employ more technical indicators to validate the entry cryptocurrency signals and either give the all clear for action or protect the trader from whipsaws and fake outs.

To confirm the bitcoin signals we use RSI and Stochastic Oscillator indicator.

RSI for Crypto and Stochastic Oscillator for Bitcoin Trading System

4. Finding crypto entry and btcusd exit points

Once you choose indicators so one gives the signal and another checks if the signal is correct, then it's time to start a bitcoin trade.

A trader should enter a bitcoin trade as soon as a cryptocurrency signal is derived & generated & confirmed after a candle closes.

Traders who take more risks start a trade right away, not waiting for the current bitcoin price bar to end.

Other people trading wait for the present bitcoin cost chart to be done and then start trading if the trade plan is still the same and the trading advice is still good. This way is more careful and keeps away extra wrong trades and quick changes in trading.

Generating Bitcoin Signals - how to Generate Signals.

Generating Crypto Signals

For exits, a trader can either set an amount that they want to earn per trade or use technical bitcoin trading tools that help to set profit objectives like Fib expansion tool or set a protective stop loss order depending on the btcusd market volatility at any given time. Alternatively a trader can exit when the indicators give a signal in the opposite trend signal.

Always consider how much you're prepared to lose if the trade goes against you before initiating a new trade position. It's crucial to be able to identify where you'll give up and reduce your losses before initiating a bitcoin trade, even if the objective is to develop the greatest bitcoin trading strategy in the world.

5. Calculate risks in each bitcoin trade setup

With Bitcoin trading, you need to calculate your risk for every trade. Serious traders only place a trade if the risk-to-reward ratio is at least 2:1.

If you use a high risk:reward ratio like 2:1, you significantly increase and improve your chances of becoming profitable in the long run.

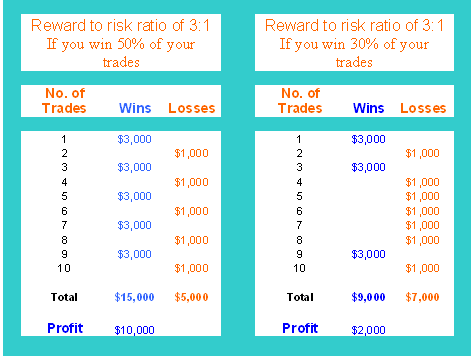

The Risk to Reward Chart below indicates to you how:

Crypto Money Management Risk Reward Chart - Example Template for the Crypto System

In the first illustration of Risk Reward Ratio, you can get-to see that even if the system only won 50% of your trade positions, you'd still make profit of $10,000. Read more on this btcusd money management topic: Here Bitcoin Trade Capital Management Rules - MT4 Template System and Bitcoin Trade Money Management Methods - Template Strategy Example.

Before opening a new bitcoin trade, a bitcoin trader should define the point which they will close the bitcoin trade if it turns to be a losing bitcoin trade. Some traders use Fib retracement levels tool and support and resistance zones. Other traders just use a pre-determined stop loss to set stop loss crypto orders once they've opened a btcusd trade.

6. Write down the bitcoin systems rules and follow them

A Bitcoin Trade Strategy is defined as a predefined set of operational guidelines that a trader adheres to for managing their market positions.

The important thing is A SET OF TRADE RULES that you have to follow. If you don't follow the rules for bitcoin, then you don't really have a plan for bitcoin.

The next lesson on Bitcoin trading systems shows an example. It covers how to use these steps to build your own online Bitcoin trading setup.

Next Lesson: Example Illustrations of Writing Bitcoin Trading Systems Rules

7. Practice on a Practice Practice Demo Account

You need enough trades to see your strategy's real profits.

Once you've written down your bitcoin trading system rules, it's time to test and tweak your system by running it on a demo account.

Establish a complimentary virtual account and deploy your bitcoin trading system to evaluate its operational consistency.

It's best to start with a demo account and practice for a month or two. That way, you really get a feel for how the BTCUSD market works.

After you get going and start making some good money in your practice account, you can try opening a real account and begin trading with real money.

More Lessons and Tutorials & Courses: