Trading Reversal Patterns & Continuation Patterns - Reversal vs Continuation Patterns

Forex Patterns - Analysis Chart Patterns StrategiesForex chart patterns are graphical illustrations of repeating price action patterns that are commonly used in the market to analyze price movement.

Forex Chart Patterns is one of the studies used in technical analysis to help traders learn how to recognize these repeating Chart Patterns formations.

These Chart Patterns are important in trade because when the market is not heading in a particular direction it is forming a chart pattern. It is important to know these Chart Patterns formations so as to have an idea of what might be the next likely move in the market.

When price movements are plotted there are several Chart Patterns formations that occur naturally & repeat themselves over & over again. These Chart Patterns formations are used by a lot of technical traders to predict the next market move.

Forex traders often study these Chart Patterns formations to measure supply & demand forces that form the basis for price fluctuations.

These Chart Patterns are classified into Three different categories:

1. Reversal Patterns

- Double tops Chart Patterns

- Double bottom Chart Patterns

- Head & Shoulders Patterns

- Reverse head & shoulders Chart Patterns

2. Continuation Setup Patterns

- Rising triangle Chart Patterns

- Falling triangle Chart Patterns

- Bull flag/pennant Chart Patterns

- Bear flag/pennant Chart Patterns

3. Bilateral

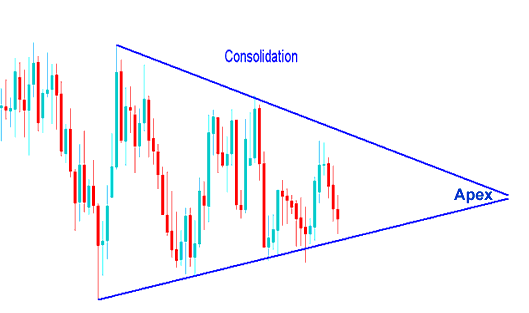

- Symmetric triangle - Consolidation Setup Patterns

- Rectangle - Range Chart Patterns

Reversal Patterns - Reversal Patterns - confirm the reversal of the market trend once this reversal chart pattern setup is confirmed. These Reversal Patterns are formed after extended market trend either upwards or downward & these reversal patterns signal that the market is ready to reverse.

Continuation patterns Chart Patterns - are formations that set up the market for a trend continuation move in direction of previous trend. These Continuation Chart Patterns are formed when the market is taking a pause before continuing in same direction of previous trend.

Consolidation patterns Chart Patterns - form when the market is taking a pause before deciding the next market trend direction to take. When these Consolidation Chart Patterns are formed - the market is trying to decide which direction to trade.

Technical Chart Analysis of Chart Patterns

There are two types of chart analysis, these two may seem similar but are not: the two are:

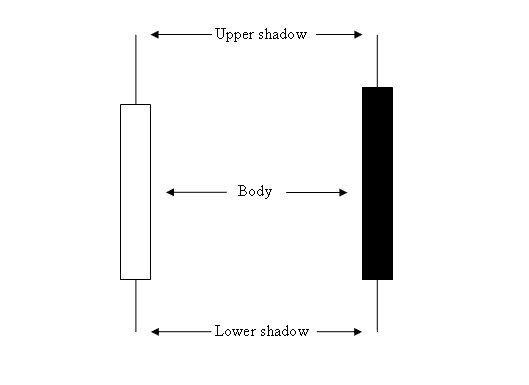

- Japanese Candlesticks Patterns - Study of a single candlestick - Read Japanese Candles Patterns

- Forex Patterns - Study of a series of candlesticks formations

(This learn tutorial is about the second option above - Chart Patterns)

The different tutorials for these two types analysis are:

Japanese Forex Candles

Forex Chart Patterns Lessons

The examples below also illustrate the difference of the arrangements of these two technical analysis methods.

Candlesticks Patterns - Study of a single candle

FX Chart Patterns - Study of a series of candle s