AEX25 INDEX - Amsterdam Stock Market Index

AEX Index is a Stock Indices used to keep track of the performance of the top 25 stocks & shares on NYSE Euronext Amsterdam Stock Market in Netherlands. The NYSE Euronext Amsterdam Stock Exchange Market was previously known & referred to as Amsterdam Stock Exchange Market.

The 25 companies used to figure out this stock index are checked every three months of the year. This Stock Index keeps track of the capitalization of the top 25 companies.

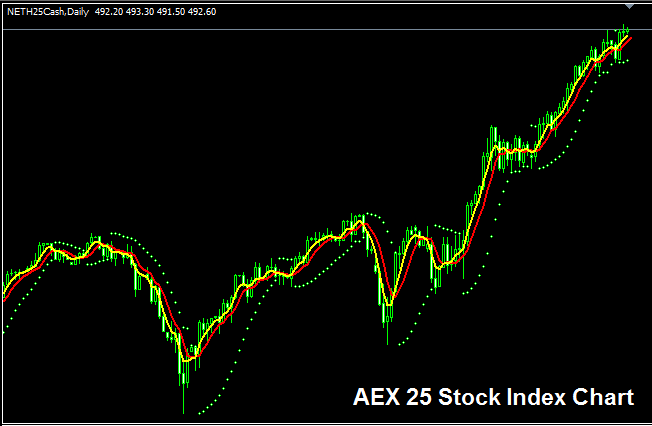

AEX25 Chart

AEX25 chart is shown/illustrated and shown above. On above example this Index is named NETH 25CASH. The example Which is illustrated & shown above is the one of AEX25 Index on MT4 FX and Stock Indices Software Platform.

Other Info about AEX25 Index

Official Index Symbol - AEX:IND

The 25 stocks that make up AEX25 Index are chosen from the best companies in the Netherlands. These 25 stocks account for most of the trading that happens in NYSE Euronext Amsterdam Bourse. The numbers are checked every three months of the year.

Strategy to AEX25 Index

AEX25 Index monitors capitalization of top 25 corporations in Netherlands. This Index in general moves upwards over long term because Netherlands economy also shows strong economic growth.

As a stock index trader you want to be biased & keep on buying as the index heads & moves upward. When Dutch economy is performing good most of these top 25 shares/stocks will continue to move up and threfore this index will also move in an upward trend. A good stock index trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down and Recession

During the economic slowdown & recession times, companies start reporting slower earnings, slower profits and lowers growth projections. It's due to this reason that traders begin to sell shares of firms that are reporting & posting lower profits and hence Indices monitoring these specified stocks/shares will also start and begin to move downwards.

In these periods, market trends often head down. Traders should tweak strategies to match the falling index direction.

Contracts and Details

Margin Requirement for 1 Contract - € 5

Value per Pips - € 0.1

Note: Although the general trend tends to be upward, as a trader, it is essential to take into account the daily market price volatility. On certain days, the indices may fluctuate within a range or even experience retracements. The market pullback or retracement can sometimes be significant, which necessitates that you time your trade entries accurately using this strategy: Stock strategy. Additionally, it is crucial to implement appropriate money management methods and guidelines to prepare for any unexpected volatility in the market trend. Regarding index equity management methods and guidelines courses: What are Stock Index money management strategies and guidelines, as well as the Stock Index equity management plan.

Learn More Topics & Tutorials:

- How Can I Add XAGUSD Chart in MetaTrader 4 Platform Software?

- AUDSGD Pip Value Explanation

- Indicators for Trade Described

- Mastering S&P ASX200 Index Trading Strategies

- Analysis of Market Conditions Based on Forex Economic Data Reports

- Chart Properties in Charts Menu on MT4 Platform

- Best Moving Average Setting for Swing Trade

- Generating Buy and Sell Signals Using the Stochastics Indicator

- McClellan Oscillator XAU/USD Indicator Analysis in XAU USD

- How to Use MT5 Moving Average(MA) Envelopes Indicator on MT5 Platform