Identifying and Setting Up Trade Opportunities Based on RSI Hidden Bullish and Hidden Bearish Divergences

The hidden divergence trade setup is used to show that a market trend might keep going. It happens when the price goes back to test the high or low from before.

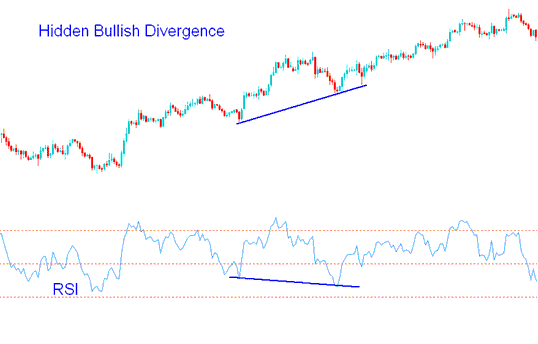

Hidden RSI Bullish Divergence

A hidden RSI bullish divergence trade setup occurs when the price creates a higher low, while the oscillator displays a lower low.

Hidden bullish divergence occurs when there is a retracement in a uptrend.

RSI Hidden Bullish Divergence - Hidden Divergence Trading Setup

This hidden divergence setup confirms a price retracement has finished. It shows there's underlying strength in the upward trend.

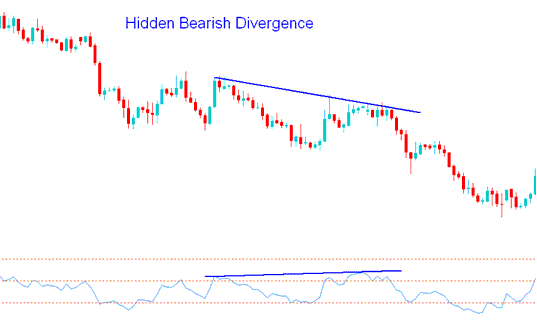

Hidden RSI Bearish Divergence

Hidden RSI bearish divergence happens when price forms a lower high. Yet the RSI shows a higher high.

Hidden bearish divergence occurs when there is a retracement in a down-trend.

Hidden Bearish Divergence - Hidden Bearish Divergence Trade Setup

This hidden setup on the RSI showing things are going down says that the move back up is done. The difference shows the push of a trend going down.

Learn More Courses & Courses:

- How to Calculate a Pip on MetaTrader 4

- Buy Long Trades: What Is Opening Long?

- Used Margin and Free Margin Example for XAU/USD on the MT4 Platform

- What is the Method to Set Forex Trading Buy Orders in MT4 Forex Charts?

- Finding the Value or Size of a Single Pip and What 1 Pip Means for DowJones30 Index Pips

- Downloading the MetaTrader 5 platform for trading XAU USD on an iPad.

- Steps to Figure Out Leverage in 1:200 & 1:100 Forex Leverage

- How to Use MetaTrader 4 DeMark Projected Range Indicator on MetaTrader 4 Platform

- How to Analyze Instant Market Execution Orders

- Utilizing the MT5 Bollinger Bandwidth Indicator