Bollinger Bands for Reversals - Double Tops and Bottoms Trades

Before concluding that a forex reversal is occurring, one should wait for price to change course in the opposite market direction after hitting one of the Bollinger bands.

Even better a fx trader should see the price crossover the moving average.

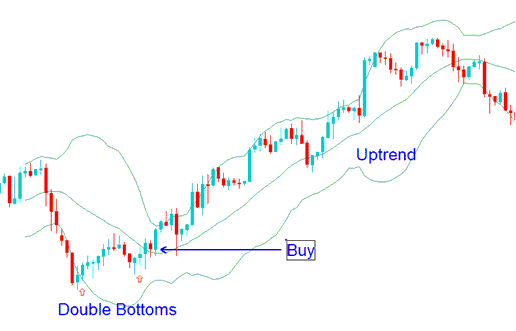

Double Bottoms Trend Reversals

A double bottom signals a buy. It forms when price drops below the lower Bollinger band, bounces to make the first low, then hits another low above the band.

The second low point recorded in price must not fall below the initial low. Crucially, this second price low must not breach or pierce the lower Bollinger Band. Confirmation for this bullish Forex setup is achieved when the price action subsequently moves and settles above the central band (which represents the simple moving average).

Double Bottoms - Utilizing the Double Bottom Setup Pattern within a Bollinger Band Trend Reversal Strategy

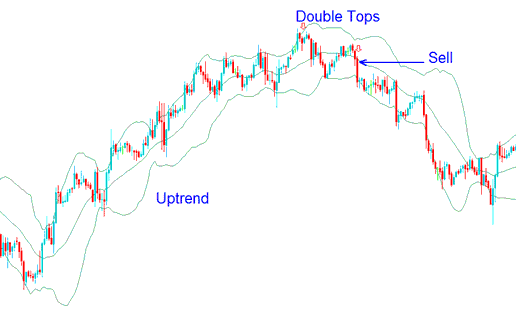

Double Top Trend Reversals

The double top pattern is a signal for a potential sell trade. It forms when price activity exceeds the upper Bollinger Band before reversing downward, creating the first high. A second high then emerges below the upper band over time.

The second price high must not be higher than the first one & it important is the second price high does not touch or penetrate the upper Bollinger band. This bearish Forex set-up is confirmed when price action moves & closes below the middle band (simple moving average).

Trend Reversal Indications from Bollinger Bands During Double Top Formations Utilizing Double Top Setups

Get More Topics & Courses:

- The Calculation Method Behind the Nasdaq100 Index

- No-Nonsense Pivot Points: Buy and Sell Signal Indicator

- Essential Foundational Knowledge for FX Traders

- Utilizing the MT4 ATR Indicator for Trading

- Using the acceleration/deceleration indicator on MetaTrader 5 efficiently explained.

- How much is one pip worth in a nano account?

- McClellan Histogram: Buy and Sell FX Signals

- Learn about different types of XAU/USD charts.

- Setting Up the Kase Peak Oscillator and Kase DevStop 2 EA

- Automated EAs and Strategies