What's Gold Margin Requirement?

Margin Level XAUUSD Calculator - MT4 Margin Level Percentage Calculation - Margin Calculation Example on MetaTrader 4.

Initially developed for analytical purposes in Stock and Commodity trading research, this indicator was later adapted for the Forex market.

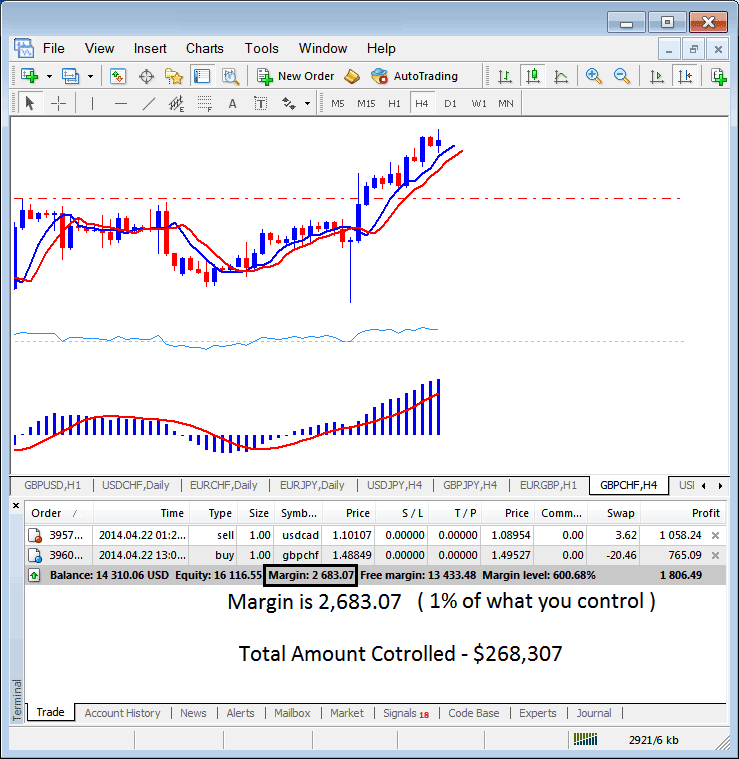

Demonstrative Calculations Showing Margin Level Percentage Determination on the MT4 Interface

If leverage = 100:1

1,000 / 100,000 * 100= 1 percent

Margin required = 1 percent

(1/100 *100= 1%)

Query: "FX Trading - Could you perhaps simplify the explanation, as I am a novice trader?"

Let's make this simple: If you have $1,000 in equity and use leverage to control $100,000, your margin requirement is $1,000 - that's 1% of $100,000.

Regarding margin examples within the MT4 Platform Software below, when the leverage option is set to 100:1, the required margin, equivalent to 1 percent, is $2683.07. Consequently, the total capital controlled by the online investor amounts to $268,307. This outcome stems from the leverage mechanism where the trader commits only a small portion of personal funds and borrows the rest. Under this 100:1 configuration, the online trader is utilizing 1% of their account equity, equating to $2683.07. Thus, if 1% is valued at $2683.07, the entirety (100 Percent) corresponds to $268,307.

MT4 Gold Margin Calculator - MT4 margin level % calculator Example

Now if Your Leverage is 100:1

If you are trading with a $1,000 balance and have access to a leverage option of 100:1 for a Mini lot valued at $10,000, your margin for this trade in your XAUUSD Mini account stands at $1,000. This margin reflects the amount at risk if your open position moves unfavorably. The broker will automatically close your XAUUSD trades if your balance falls to zero due to market conditions.

But this is if your broker has set 0 percent Margin Requirements before stopping out your positions mechanically/automatically.

If your account balance reaches $200 while maintaining a 20% margin requirement, your open positions will be automatically liquidated (stopped out) before any further automatic trade closure occurs.

If the margin requirement reaches 50% before automatic liquidation, trades will be stopped once the account balance declines to $500, ensuring that transactions follow margin compliance.

If your broker requires a full 100% margin before closing positions on its own, your trades will shut down when your account hits $1,000. This setup means positions close right away after a trade. A single pip spread drops the balance to $990, below the needed margin. So, at $1,000, trades stop out instantly.

Most brokers do not require you to put up all your money, but some do. Those who ask for the whole amount may not be the best choice. It's better to pick brokers who ask for a 50% or 20% margin requirement. In fact, brokers with a 20% margin requirement are often considered good since they are less likely to end your trade unexpectedly, as demonstrated in the examples shown earlier.

MT4 Margin Level Percent Calculator

In the MT4 XAUUSD screenshot example, the trader is using $2683.07 with a total controlled amount of $268,307, while maintaining account equity of $16,116.55. Accordingly, the leverage applied calculates to 16.64:1 ($268,307 ÷ $16,116.55).

16.64 : 1 Used Leverage Ratio

The Margin is 600% which is 580% above the required 20% Margin requirement by the broker.

MT4 automatically calculates your margin level and shows it as “XAU/USD Margin Requirements.” It appears as a percentage - the higher the percentage, the less likely your positions will get closed out.

Example: Using a Broker with 20% Margin Requirement

Using 100:1 gold leverage

With 100:1 leverage employed and a transaction volume of 10 Mini Lots, this equates to a notional value of $100,000.

$100,000 divided by 100:1, used equity is $1000

Calculation:

= Capital Used * Percentage

= $1,000/$1000 * Percent(100)

XAU/USD Margin Requirement = 100%

Trader has 80% above the required margin level amount

Using 10:1

If leverage is 10:1 & you transact 1 Mini Lot, equals to $10,000

$10,000 divided by 100:1, used equity is $100

Calculation:

= Capital Used * Percent(100)

= $1,000/$100 * Percent

XAU/USD Margin Requirement = 1000 percent

Trader has 980% above the required margin level amount

Using 1:1 gold leverage

At 1:1 leverage with 0.1 mini lot, that's $1,000 exposure.

$1,000 divided by 100:1, used equity is $10

Calculation:

= Capital Used * Percentage

= $1,000/$10 * Percent(100)

XAU/USD Margin Requirement = 10,000%

Trader has 9800% above the required margin level amount

More Courses:

- Participants of Forex Market Retail Forex Traders

- Demonstration and Explanation of the Kauffman Efficiency Ratio Indicator

- MACD Centerline Crossovers for Bullish and Bearish Forex Signals

- Method for RSI 50 Center Line Crossover

- What is the FX (Forex) Market?

- How Do I Read MT4 Downwards FX Channel in MT4 Software Platform?

- Analysis of the Acceleration/Deceleration (AC) Indicator for XAU/USD

- How Do I Trade System Signals?

- Learn Indices MT5 Courses

- Forex Pin Bar Reversal Signals