Indices Trade Strategy

The top way to trade indices uses a system paired with retracement entries. This approach boosts your risk-reward ratio. It raises your odds of higher profits from index charts.

Pull Back - Retracement

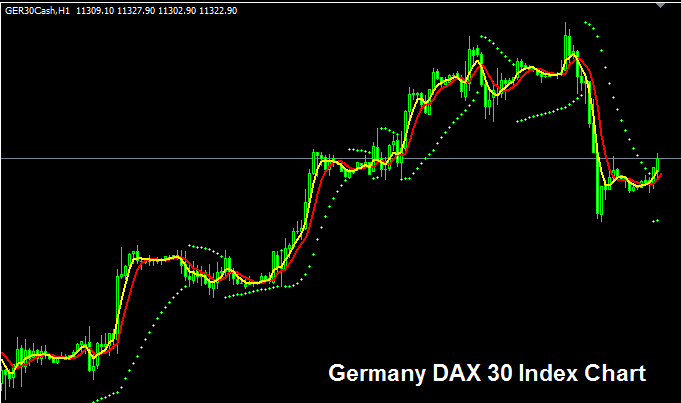

As a indices trader even before implementing your trade system you want to wait for a retracement, but how does a pull back look like - The price retracement is illustrated below.

In the example above, the chart shows the Germany DAX30 Index - The 1 Hour chart is used to find a price pullback. In this chart, the long term direction is up - also, the main investing idea that is being used for the Germany DAX30 and all European Stock Indexes right now is QE - we will talk about this in our market feeling for indexes course. For now, let's keep going with the explanation of our plan.

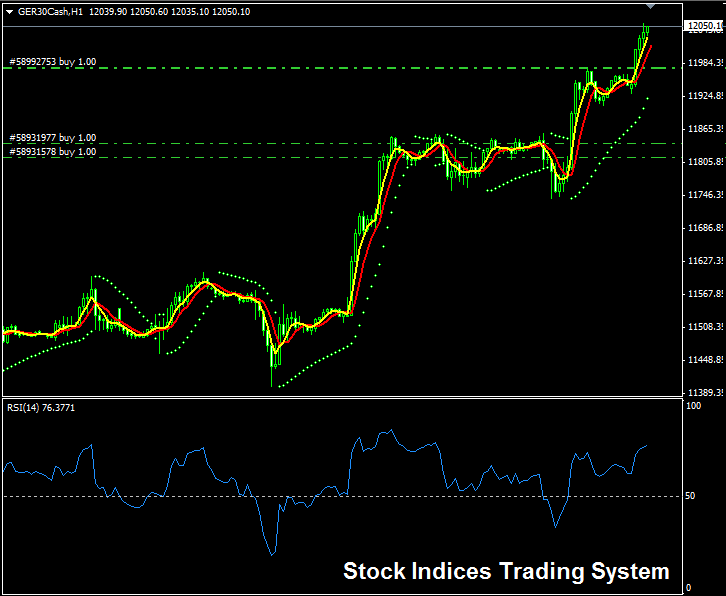

For the above set-up, you can see there was a pull back on this stock index, but now the moving averages have turned & are starting to move upward - this is our entry signal where as a trader you open/execute a buy trade on this stock index. You also can add another indicator such as the RSI to confirm this signal.

Looking at the example above - we waited for prices to fall back a bit, but this quickly changed, and the upward trend went on, the moving average went up, and the RSI went above 50, which confirmed that we should buy: a buy trade was then started at 11,810, and the upward trend continued up to 12,050. Throughout this time, our system showed that the market was trending upward with increasing strength, as the two indicators and the MAs cross-over system kept rising, and the RSI indicators stayed above 50 - RSI levels above 50 show that prices are ending higher than where they started.

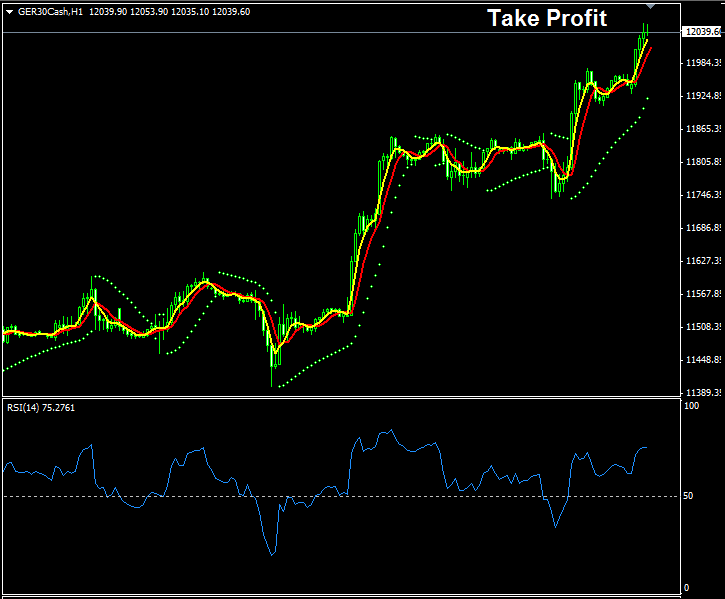

Take-Profit

Concurrently with this setup, given that our trade holdings are currently profitable, we aim to set a take-profit order while we still have an advantage. Observe that our trading methodology still indicates a buy signal: however, since we intend to secure and lock in our gains while in a favorable position, we will liquidate this trade. This transaction has moved 2,400 points in our favor, netting a $236 profit per standard lot. We initially opened 2 lots, resulting in approximately $560 in total profit. Furthermore, we added an extra 2 contracts/lots at the 11,980 level, from which we realized an incremental profit of 700 points.

For indices, one pip per lot equals $0.10. That differs from forex at $10 per pip. Indices move 500 to 2,000 points daily. Forex sees 50 to 100 pips on average. In indices, a 2,000-point gain yields $200 total. Each point brings just $0.10, as the example shows.

The other issue is that whereas the forex lot calls for a margin of $1,000 dollars, a standard contract for the aforementioned trade needs barely € 85 ($90), implying the average lot/contract for indices is 10 times smaller than that one in FX - The lot traded above therefore corresponds to a small lot.

The chart below shows our index after closing the trade and grabbing profits.

Strategy Specifications

Indicators

- 5 and 7 LWMA - Moving Average Crossover Technique

- RSI - The 50 Centerline Crossover Trading Method

Trading Rules

- Wait For Pullback

- After Pull-back, look for entry signal - Both Moving Averages MAs Moving Averages should be moving upward & RSI should be above 50 center mark.

Remember that the long term trend for this stock index is upward, thus we only create/execute buy trade positions (Trend is Your Friend).

Learn More Lessons and Courses:

- Studying XAU/USD with Ichimoku in XAU USD charts.

- Analyzing Support and Resistance Levels on Index Trade Charts

- What's FX Candles Charts in Trade?

- Exploring Automated Expert Advisors and Strategies

- How to trade the DJ 30 Index - A Lesson?

- Where to Place a Stop Loss Order in Your Trade

- Developing a Trade Trading Strategy To Trade Currencies with

- Configuring CAC40 Index on MetaTrader 5 Platform

- Trading Systems and Strategies Tailored for the HSI 50 Index.

- Downloadable Guide Covering US30 Strategies