What is DowJones30 Strategy? – A lesson on how to trade the DowJones30 index.

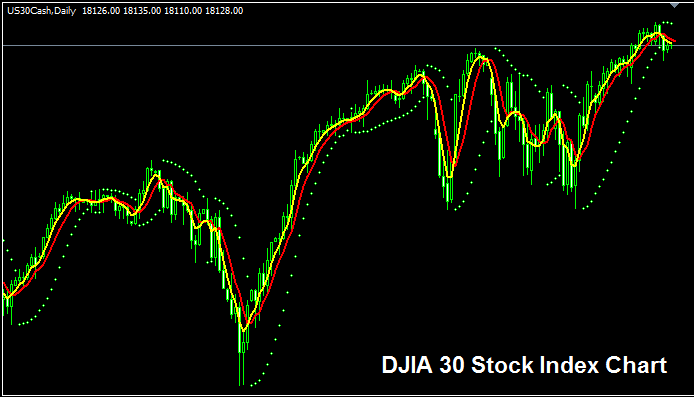

DowJones30 Trade Chart

The Dow Jones 30 index is displayed and depicted in the chart above. The name of this financial instrument on the aforementioned diagram is USA 30CASH. In order to begin trading it, you should look for and find a broker that provides a DowJones 30 chart. The instance The Dow Jones 30 Index on the MT4 Forex Platform Software is seen above.

Strategy for Trading/Transacting DowJones30 Index

The way the DowJones30 Stock Index is calculated makes it move up and down more, so its price changes a lot. But usually, this index goes up over a long time because the US economy also grows a lot and is the biggest economy in the world.

As an index trader, you want to be biased and keep purchasing as the index rises and advances. This positive market trend is more likely to be dominant when the American economy is doing well, which is the majority of the time. Purchasing the dips would be a wise approach to trading a stock index.

During Economic SlowDown & Recession

When the economy slows down and there are recessions, companies start to say that they are making less money and getting less revenue, their profits are slower, and they are expecting less growth. Because of this, traders start to sell shares of companies that are saying that their profits are lower, and the Stock Index watching these shares will also start to go down.

Therefore, during these times, market trends are a lot more likely to be heading downwards and you as a trader should also adjust your trading strategy accordingly to suit the ruling downwards trends of the index which you as a trader are trading.

Contracts & Specs

Money Needed for 1 Lot - $150

Value per Pips - $ 0.5

Quick note: trends point up overall, but markets zigzag. Some days, indexes drift flat or dip. Pullbacks can hit hard. Time your buys with care. Follow good money rules. This keeps you safe in sudden swings. On index money management: learn these tools and equity plans.

Explore Additional Lessons & Topics:

- SMA vs Exponential Moving Average EMA vs Linear Weighted Moving Average LWMA

- A Guide on Trading AEX 25 Index

- Method for Analyzing Base and Quote Currencies within Trading Software

- SMA XAU/USD Indicator, EMA XAU/USD Indicator, LWMA XAU/USD Indicator

- Meaning of a Micro Contract in FX Described

- Instructions for Placing the GDAXI30 Index within the MT5 GDAXI30 App.