What's CCI Indicator? - Definition of CCI Indicator

CCI - CCI indicators is a popular technical indicator which can be found in the - Indicators Listing on this website. CCI is used by the traders to forecast price movement based on the chart price analysis done using this CCI indicator. Traders can use the CCI buy & Sell Trading Signals explained below to identify when to open a buy or sell trade when using this CCI indicator. By using CCI and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's CCI Indicator? CCI Indicator

How Do You Combine Indicators with CCI? - Adding CCI in the MT4 Software

Which Indicator is the Best to Combine with CCI?

Which is the best CCI combination for trading?

Most popular indicators combined with CCI are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Band

- Stochastic Trading Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best CCI combination for trading? - CCI MT4 indicators

What Indicators to Combine with CCI?

Get additional indicators in addition to CCI that will determine the trend of the market price and also others that confirm the market trend. By combining indicators which determine trend and others that confirm the trend & combining these indicators with Forex CCI a trader will come up with a CCI based system that they can test using a demo account on the MetaTrader 4 platform.

This CCI based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is CCI Based Trading? Indicator based system to analyze and interpret price and provide trade signals.

What's the Best CCI Strategy?

How to Select and Choose the Best CCI Strategy

For traders researching on What is the best CCI strategy - the following learn forex tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the CCI system.

How to Develop CCI Systems - Best Indicators Combination for CCI

- What is CCI Strategy

- Creating CCI Strategy Template

- Writing CCI Strategy Rules

- Generating CCI Buy and CCI Sell Trading Signals

- Creating CCI System Tips

About CCI Example Explained

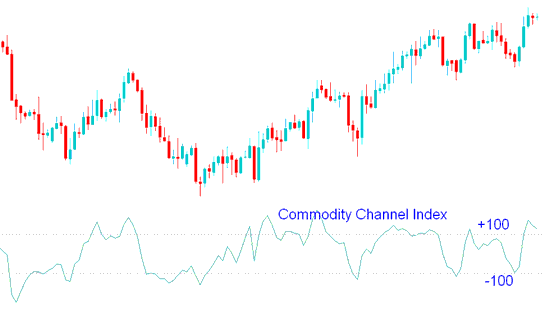

Commodity Channel Index, CCI Analysis and Commodity Channel Index Signals

Developed by Donald Lambert

The Commodity Channel Index measures the variation of a commodity price from its statistical mean/statistical average.

This indicator is an oscillator trading which oscillates between high levels and low levels

When the Commodity Channel Index is high it displays that the price is unusually high compared to the the average.

When the CCI is low it displays that the price is unusually low compared & analyzed to the the average.

Technical Analysis and Generating Signals

Overbought/ Over-sold Levels

The Commodity Channel Index typically oscillates between ±100.

Indicator values above +100 indicate an overbought conditions and an impending market correction.

Indicator values below -100 indicate an oversold conditions and an impending market correction

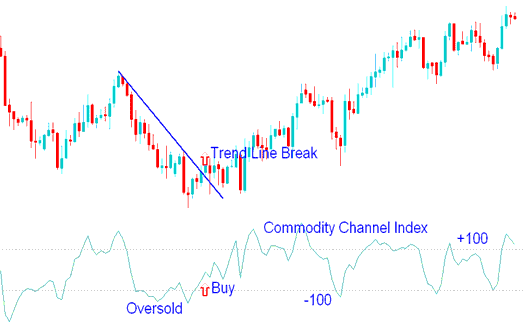

Buy Signal

If the Commodity Channel Index is oversold, levels below -100, then there is a pending market correction.

Oversold levels will remain intact until Commodity Channel Index starts to move above -100.

When price starts and begins moving above -100 then that is interpreted as a buy.

The Commodity Channel buy signal should be combined with a trendline break signal to confirm the buy.

Buy Trade

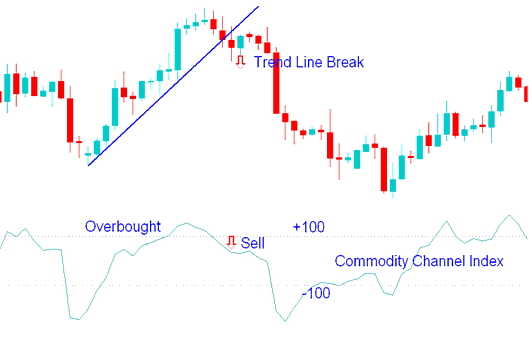

Sell Trade Signal

If the Commodity Channel Index is over bought, zones above +100, then there is a pending market correction.

Overbought levels will remain intact until Commodity Channel Index starts to move below +100.

When price begins moving below +100 then that is a interpreted as a sell.

This Commodity Channel sell trading signal should be combined with a trendline break signal to confirm the sell.

Sell Trade

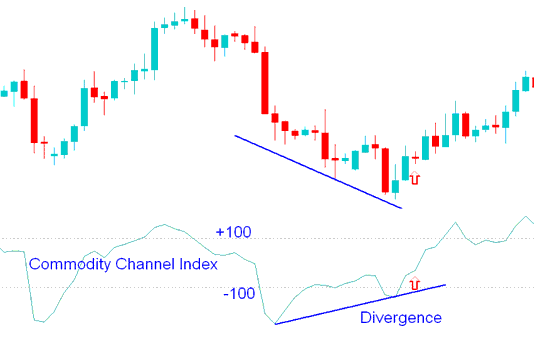

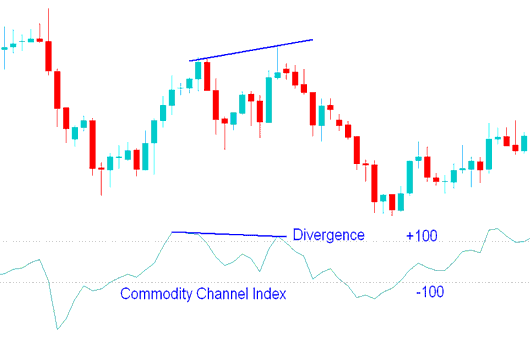

Divergence Trading

Bullish Trading Divergence

Bullish divergence setup forms when the price is making/forming new lows while the Commodity Channel Index is failing to surpass and move past its previous low.

This is a bullish signal because the divergence trading setup will be followed by an upward market correction.

Bearish Divergence Trade Setup

Bearish Divergence forms when price is making/forming new highs while the Commodity Channel Index is failing to surpass its previous high.

This is a bearish signal because the divergence will be followed by a downwards market correction.

Analysis in FX Trading

Learn More Topics and Tutorials:

- Tips on How to Write a Gold Journal with Gold Examples

- Entry Stop Forex Orders: Buy Stop Forex Order and Sell Stop Order

- How Can I Use Ichimoku Technical Indicator on Forex?

- How to Interpret/Analyze and Analyze FX Pips When Trade Cent Lots

- MACD MetaTrader 5 FX Chart Technical Indicator

- How Can I Trade US TEC 100 Lesson Guide Download?

- Aroon Oscillator Gold Indicator Analysis in XAU USD Charts

- How to Open a Live Index Trade Account

- Rainbow Charts Forex Trading Buy Sell Trade Signal