Defining Buy and Sell Trading Signals Generated by the Ehler MESA Adaptive MA Moving Average

Ehler MESA Adaptive Moving Average Buy Signal

How to get buy signals from Ehler MESA Adaptive Moving Average.

Steps to produce buy signals using the Ehler MESA Adaptive Moving Average (MA) indicator:

This Ehler MESA Adaptive MA Moving Average buy signal guide explains how to generate buy signals using the Ehler MESA Adaptive MA Moving Average like shown below:

How to Generate Buy Trading Signals Using the Ehler MESA Adaptive Moving Average (MA) Indicator

Ehler MESA Adaptive Moving Average Sell Signal

How to get sell signals from Ehler MESA adaptive moving average

Steps for generating sell trade signals using the Ehler MESA Adaptive Moving Average (MA) indicator:

This tutorial on generating sell signals with the Ehler MESA Adaptive Moving Average explains the technique for producing sell signals by utilizing the Ehlers MESA Adaptive Moving Average (MA), as depicted below:

Generating Sell Trade Signals Using the Ehler MESA Adaptive Moving Average (MA) Indicator

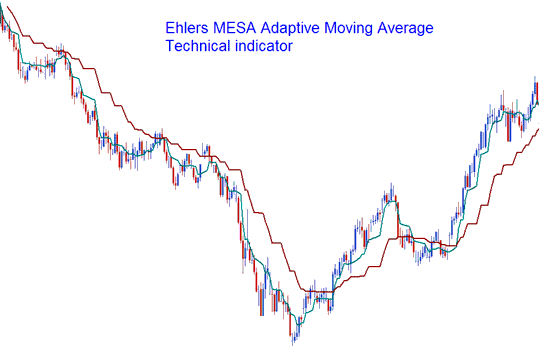

MESA Adaptive average looks like 2 MAs. The difference is the MESA heads in a staircase manner & not in a curved line such as the MA. The illustration put on display below shows this trading indicator drawn on a price chart.

Ehler MESA Adaptive MA Moving Average

The MESA Adaptive MA(Moving Average) is a market trend following indicator that changes with the price movement based on the speed of change of price as determined by the Hilbert Transform Discriminator. The instrument will produce an example when the two crossing one another span. The market MESA average directions are the positions to be taken.

This particular methodology employs both a fast and a slow Moving Average, enabling the composite average to track price fluctuations closely while maintaining its calculated value until the subsequent candle concludes. This indicator is characterized by a lower susceptibility to false breakouts compared to the standard Moving Averages. This resilience stems from the specific mathematical formula used to compute the rate of change relative to the ongoing price action.

Learn More Courses & Guides:

- How the Bulls Power indicator works on MT4 with examples.

- Forex Stop Loss Setting Things to Think About When Setting Stop Loss Orders

- Gann Swing Oscillator Automated Trading Expert Advisor(EA)

- Ehler MESA Adaptive Moving Average: Buy/Sell Signals

- Information on Regulated Brokers

- Analysis of the Keltner Bands Indicator Applied to XAUUSD Charts

- Exploring CAD/JPY Market Open and Close Times

- Introductory Lesson for Beginner Traders on Using the ADX XAU USD Indicator in MetaTrader 4

- What amount of money does one Pip represent in a Micro Account?

- How do you get started with DAX stock index trading? Here's a strategy course you can download.