Stochastic Oscillator Trade Signals

Created by George C. Lane

Stochastic Trading is a technical tool that measures momentum, showing how the current closing price relates to the highest and lowest prices over a specific number of periods. The Oscillator Technical Indicator uses a scale from 0 to 100 to display the indicator's values.

This Oscillator works based on the idea that in a market where prices are rising, the price usually ends near the highest point, and in a market where prices are falling, it will end near the lowest.

The Stochastic Lines are drawn as 2 lines- %K & %D.

- Fast line %K is the main

- Slow line %D is the trade signal

The Three Variations of the Stochastic Oscillator: Fast, Slow, and Full Configurations

Three Stochastic types exist: fast, slow, and full. Each checks a set period, like 14 days. It compares today's close to the period's high-low range.

This oscillator technical works on the principle that:

- In an upwards trend, price oftenly will tend to close at the high of candlestick.

- In a downward trend, price will tend to close at the low of candle.

This particular indicator serves to gauge the directional force behind trends and pinpoint market conditions characterized by over-buying or over-selling.

Technical Analysis and How to Generate Trading Signals

Common ways to read stochastic oscillators include crossover signals, divergence, and overbought or oversold spots. Here are those methods for signals.

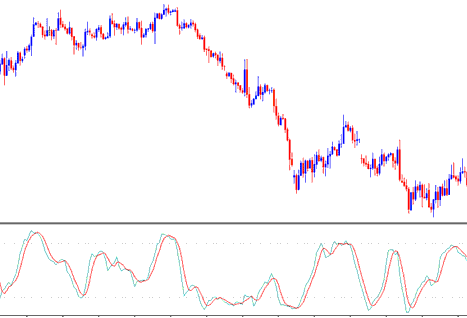

XAUUSD Cross-Over Signals

Buy signal - %K line crosses above the %D line (both lines heading upward)

Sell trade signal - %K line crosses below the %D line (both lines moving down)

50-level Cross over:

Buy signal generation occurs when the lines comprising the stochastics indicator intersect and move above the 50 level.

Sell signal - when stochastic lines cross below 50 a sell signal is generated.

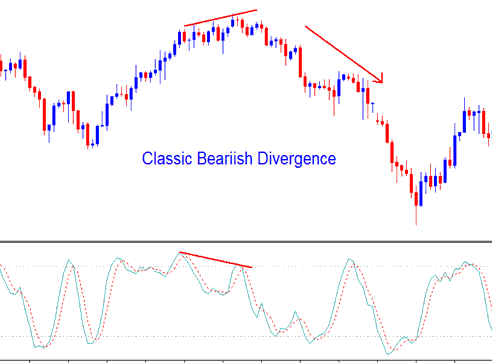

Divergence XAUUSD

Stochastic is likewise used to look for divergences among this technical indicator and the charge.

This is used to figure out potential market trend reversal signal setup.

Upwards/rising trend reversal - identified by a classic bearish divergence setup

Trend reversal - identified by a classic bearish divergence setup

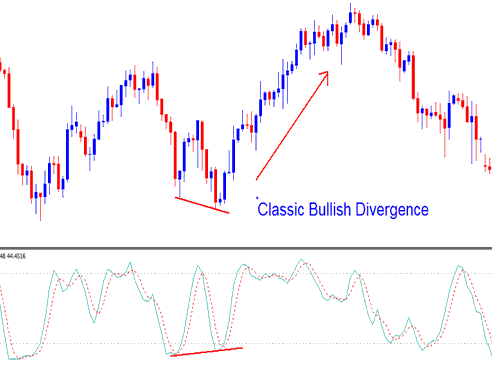

Bullish divergence signals a shift from a falling to a rising price trajectory.

Trend reversal - identified by a classic bullish divergence setup

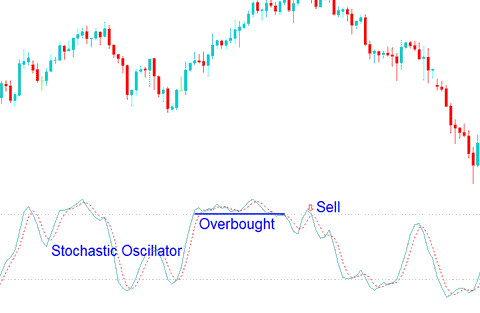

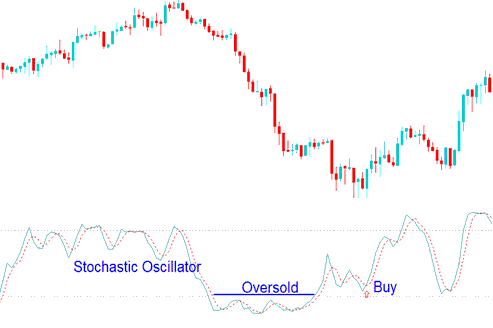

Over-sold/Overbought Levels in Indicator

Traders use Stochastic to spot overbought or oversold spots. These show up in price action.

- Over-bought values greater than 70 level - A sell signal occurs when the oscillator rises above 70% & then falls below this technical level.

Over-bought - Values Greater 70

- Over-sold values less than 30 level - a buy signal is generated/derived when oscillator moving below 30% and then rises above this technical level.

Over-sold - Values Less Than 30

Signals come up when Stochastic crosses certain technical levels. But watch out - overbought or oversold readings can whip-saw you, especially in a strong trend.

Get More Topics & Courses:

- Explanation of FX Leverage and Margin with Examples

- Equity Management Systems for Index Trading

- How is IBEX35 Stock Index Traded on the MT4 and MetaTrader 5 Platform?

- USD/CAD Spread Overview

- The ultimate MetaTrader 4 indicator for forex.

- FRA 40 Index Strategy Example

- Developing a Profitable Trading System for EUR AUD

- How to Trade the FX Bollinger Bands Squeeze Pattern Effectively

- Looking at Commodities Channel Index Indicator

- Determining Margin Requirements for 1 US500 Contract