MACD Technical Analysis Buy and Sell Trading Signals

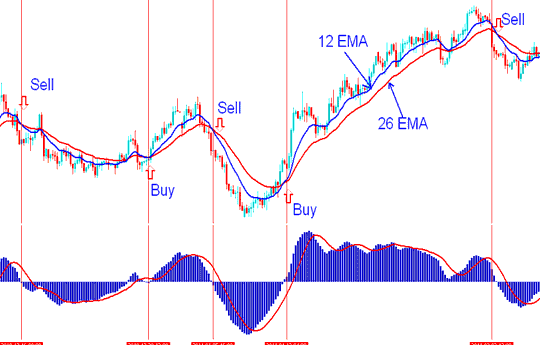

The MACD draws from 26-period and 12-period EMAs, so we compare those to see how it creates buy and sell signals.

MACD Gold Indicator - Explanation of MACD Technical Indicator

The MACD is a leading indicator, meaning it gives signals before price changes, unlike lagging indicators which follow behind the price.

Buy Trade

A buy trade happens when a MACD fast line goes above the signal line. However, like any early technical indicator, these signals can have sudden, sharp changes or false signals.

To avoid being tricked, it's a good idea to wait until you are sure about the buy or sell signals. A confirmed signal is when the two lines go above the zero line, and when this happens, the buy signal is usually correct.

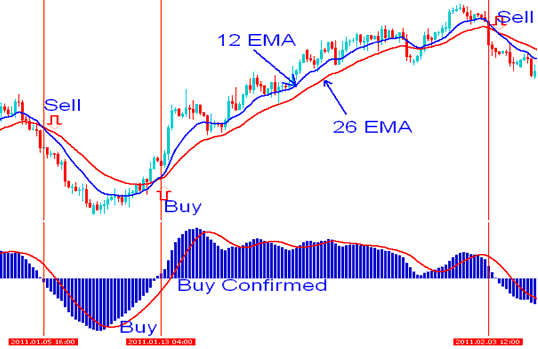

In the example below, the MAs tool gave a signal to buy before the price started to climb. But the buy signal wasn't sure until the MACD went above zero, and the MAs also showed a switch. I've learned it's best to buy after both MACD lines are above the zero middle line.

Where to Buy using MACD Gold Indicator - Buy Trading Signal

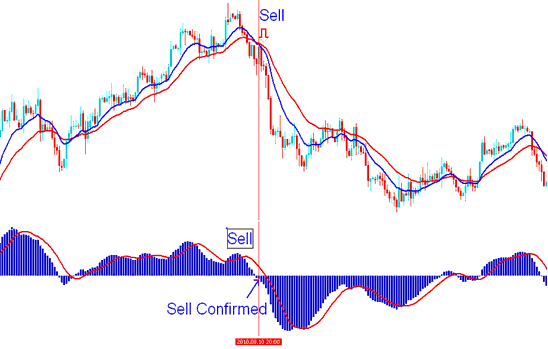

Sell Trade

A sell signal pops up when the MACD fast line drops below the signal line. But just like buy signals, these can trigger false alarms or whipsaws, so stay alert.

To avoid false signals, it's wise to wait for the sell trade signal to be confirmed. This happens when the two lines cross below the zero line: if this occurs, the sell trade signal is then considered reliable.

In the examples, MAs gave a sell signal. MACD confirmed it by dropping below zero during the crossover.

Where to Sell using MACD Gold Indicator - Sell Signal

Study More Topics and Lessons:

- How to Use MT5 ATR Indicator

- Advantages of MQL5 FX Signals to MQ5 Forex Signal Sellers and Forex Signal Providers

- GER30 Trading Strategies How to Develop Strategy for GER30 Lesson Download

- Steps to Input the Choppiness Index Indicator onto a Trading Chart

- Mastering Day Trading with an Index Trading System

- XAUUSD Leverage & Margin Tutorial Guide

- XAUUSD Islamic Accounts: Swap-Free and Interest-Free Options

- What Does a Demo Account in Trading Mean?

- Determining the Optimal Trading Times for the GBPUSD FX Pair