What's Swap in XAUUSD?

In XAUUSD, there's the payment of swap every day: this is the interest rate of a xauusd that the instrument earns per day. This interest for a xauusd instrument like the Australian Dollar is 5 %, this means that every day a fraction of this five % is paid to anybody holding this Australian Dollar.

This situation introduces the religious consideration within Islam pertaining to the exchange and receipt of interest payments. As the Islamic faith prohibits both the payment and receipt of interest, a specialized account tailored to align with these ethical guidelines is provided for Islamic XAUUSD traders, known as a Swap Free account.

With this account, a trader skips overnight rollover fees on gold. They also skip any interest payments. This fits Shariah rules with no RIBA or interest. It's called an Islamic trading account.

To secure a swap-free account as a gold trader, a XAUUSD/Gold trader must navigate to a designated Islamic Gold Broker specializing in XAUUSD and select the "Islamic Trade Account" setting. This specific option is typically available within the broker's 'Accounts' section, outlining the requirements for establishing one of these compliant accounts.

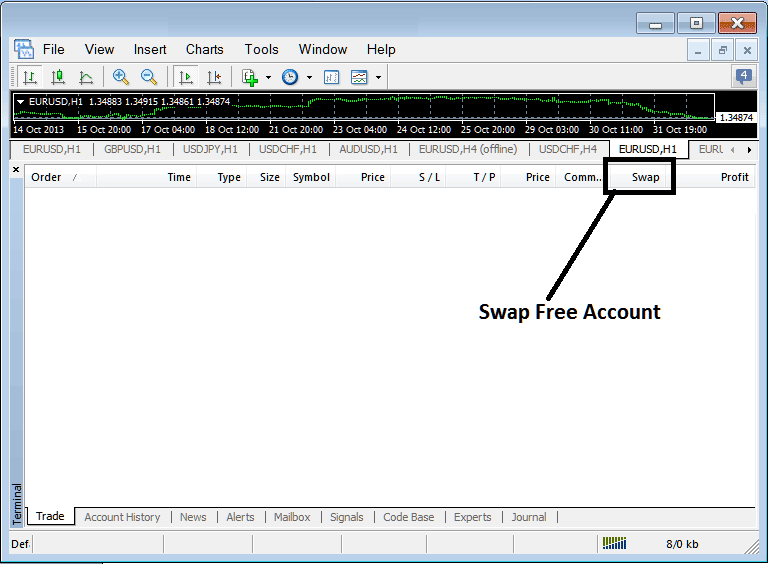

Open a trading account, and rollover interest stops. Set no interest pay or receive. On MT4, the rollover fee shows as zero.

The rollover fee is assessed daily at the conclusion of the trading day for those holding a specific xauusd instrument subject to a swap. As a trader, if you wish to avoid incurring this rollover fee, you should close your trade prior to the end of the trading day: this way, you will not be liable for the rollover fee since you will no longer be maintaining an open trade position. Given that the market is closed on Saturday and Sunday, the rollover interest for these two days will be charged on Wednesdays. Consequently, on Wednesday, a trader will incur the rollover fee for Wednesday, Saturday, and Sunday, resulting in the payment of this rollover interest three times on Wednesdays.

Traders often call these positions that earn swap interest as Positions Held Overnight. Day Traders usually do not keep their trades open overnight and close all of them before the trading day ends. Swing Traders, however, might open trades and keep them open for several days, leaving these trades open overnight to take advantage of more price movement in the trend.

When a trader picks a swap-free broker and sets up an Islamic account, conditions match those of regular traders. The difference is no rollover fees. A gold trader uses MetaTrader 4 just like others. They can access all currencies, indices, CFDs, metals, and other tools from the broker.

However, be careful in choosing a swap free broker, some brokers will add a commission or add a-few pips to the spread you trade with to cover the swap(Swap Fee Online Broker). This isn't supposed to happen as a gold trader will still be paying and charged for the interest even though it is disguised as another charge, good Brokers do not add any commission nor do they add any charge onto the spreads.

Furthermore, some brokers impose a rollover fee (also known as a swap fee) if a XAUUSD/Gold trader maintains an open trade position for more than five or seven days. This practice should ideally not occur, as the broker should refrain from charging any carry-over interest even if open trades remain active beyond the five or seven-day threshold. Traders aiming to set up such a swap-free account with an Islamic Gold broker catering to XAUUSD should meticulously examine any supplementary terms and conditions associated with the Islamic Account to ensure the chosen broker truly operates as a no-swap provider.

Islamic XAUUSD Account

Brokers created swap-free accounts due to demand from Islamic XAUUSD traders. Standard accounts charge rollover interest. This fits their rules against interest. Now they can trade without paying or earning it.

Find more tutorials and topics.