Balance of Power Analysis & Balance of Power Signals

Created by Igor Livshin

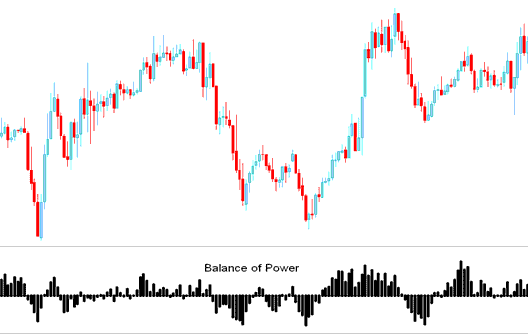

Balance of Power looks at how strong buyers are compared to sellers by checking how well each group can push prices very high or low.

XAU/USD Analysis and How to Generate Trading Signals

In utilizing this technical indicator, the zero line crossings are pivotal in generating trading signals.

Center is labeled and marked as the Zero mark, levels oscillating above/below are used to generate trading signals.

Buy - The scale ranges from Zero to +100, indicating bullish market movements.

Sell - The scale for this reading is graduated and labeled spanning from Zero down to -100 to indicate downward market momentum.

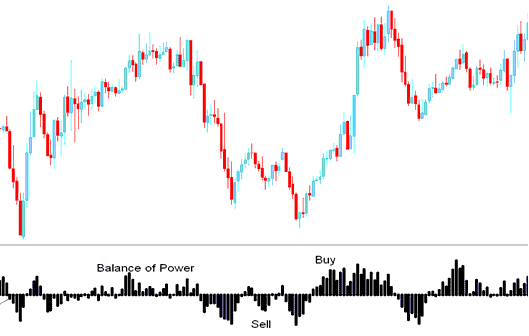

How to Generate Buy & Sell Trading Signals

Buy Signal

When Balance of Power (BOP) crosses above zero mark a buy signal is given/generated.

Also when the BOP is rising, the market is in an upwards trend, some traders use this as a buy signal but it's best to wait out for the confirmation by the technical indicator moving above the zero line. As this will be a buy signal in a bearish territory & this type of trading signal is more likely to be a whip-saw.

Sell Trading Signal

When BOP crosses below zero mark a sell signal is given/generated.

When the Balance of Power indicator drops, the market's trending down. Some traders see that as a signal to sell, but honestly, it's better to wait for confirmation. If it crosses below the zero line, that's a stronger sell signal - otherwise, you're more likely to get caught in a whipsaw.

Sell and Buy Trading Signals

Divergence Gold

In trading, differences between the BOP and price can be really helpful to find possible spots where the market might change direction or keep going the same way. There are several kinds of these difference setups.

Classic Divergence - XAU/USD Trend reversal signal

Hidden Divergence - XAU/USD Trend continuation

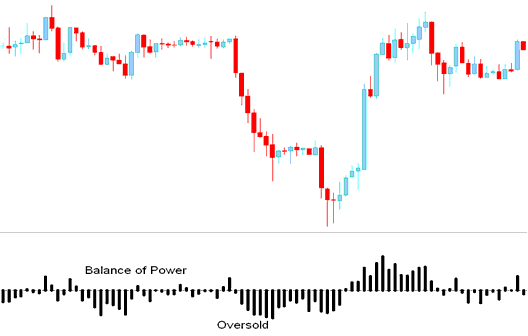

Gold Overbought/Oversold Conditions

Balance of Power spots overbought or oversold spots in price action.

- Over-bought Oversold levels can be used to provide and give an early warning for potential market trend reversals.

- These levels are generated when technical indicator clusters its tops and bottoms thus setting up the over-bought and oversold levels around those values.

However, price may also stay at these overbought & oversold levels & continue heading in that given direction for some period of time & thus it's always good to wait until the Balance of Power BOP crosses over Zero mark.

In the example shown here, even though the BOP showed the price was being sold too much, the price kept going down until the technical indicator went above the zero line.

Analysis in XAU/USD Trading

Get More Topics and Tutorials:

- Using DeMark Projected Range Indicator on MT4 Charts

- Trading Session Times for CHFJPY: Market Opening and Closing

- How Do I Count Pips in MetaTrader 4 for Nano Account Nano Lots?

- Combining Bollinger Bands for Top Trading Indicators

- Nasdaq100 Signals Trading System

- Forex Parabolic Stop and Reverse Expert Advisor Configuration

- Introduction To XAUUSD Online

- How to Find GER 30 in MetaTrader 4 PC

- FX S&PASX 200 in MT4 Index S&PASX 200 Symbol in MetaTrader 4 Software

- Fibonacci Extensions and Pullback Levels Trading Tutorials