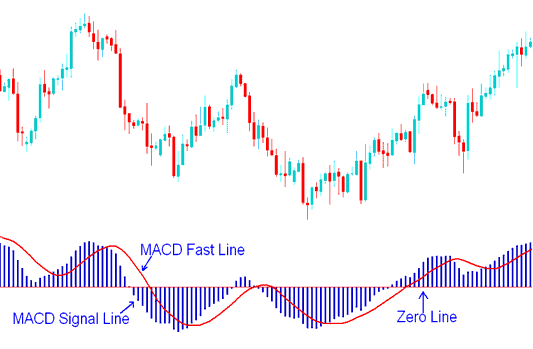

MACD for Bitcoin: Fast Line and Signal Line Analysis

MACD indicator is used in different ways to give analysis information.

- MACD centerline crosses reflect bullish or bearish markets: below zero is bearish, above zero is bullish.

- MACD Cross-overs indicate a buy or sell bitcoin trade signal.

- Oscillations can be used to indicate oversold and over-bought regions

- Used to look for divergence between bitcoin price & indicator.

Construction of MACD Crypto Indicator

The MACD indicator utilized in cryptocurrency analysis is constructed from two Exponential Moving Averages (EMAs), resulting in the plotting of two distinct lines. The standard configuration employs EMAs for periods of 12 and 26, with an additional smoothing factor of 9 applied when rendering the MACD indicator for btcusd.

Summary of how MACD cryptocurrency indicator is drawn

The MACD is computed using a combination of two Exponential Moving Averages (EMAs) set at 12 and 26 periods, smoothed further by a 9-period factor.

MACD cryptocurrency technical indicator only plots/draws 2 lines - the MACD fastline and the MACD signal line

MACD Lines - MACD Fast-Line & MACD SignalLines Trading Signals

- The FastLine is the difference between the 26 Exponential Moving Average and 12 EMA

- The Signal-line is the 9 period moving average of the MACD fastline.

Implementation of MACD Crypto Indicator

The MACD crypto tool shows the MACD line as a steady line. The signal line appears as bars. These two lines create trade alerts through crossover moves.

Furthermore, there exists the MACD centerline, often referred to as the zero level, which acts as a neutral demarcation separating buyers and sellers active in the bitcoin market.

Numbers above the middle point are seen as good signals for trading btcusd, while numbers below are bad signals for bitcoin trading.

The MACD cryptocurrency indicator functions as an oscillator, fluctuating above and below the center line.

Study More Lessons and Courses:

- MetaTrader 4 Indicators for Bitcoin Trade

- Pattern Analysis of BTCUSD Charts in the Bitcoin Market

- How Do You Add MT5 BTCUSD Relative Vigor Index, RVI BTC/USD Indicator in Chart RVI BTC/USD Indicator?

- BTC/USD Trade Buy Sell Technical Indicators & BTCUSD Exit Indicators

- Learn Bitcoin Equity Management Strategy Explained

- BTC USD Price Pullback Explained with BTCUSD Example

- Guide Trade Mobile MetaTrader 5 Mobile Trade iPhone Trade App Guide Tutorial

- Elliott Wave Pattern in BTC USD Chart Trend

- Setting Up the MetaTrader 5 Bitcoin Trading Platform Tutorial

- Analyzing and Understanding the Falling Wedge Chart Setup