Market Consequences Following the Formation of a Falling Wedge Pattern on a Bitcoin Chart

Falling Triangle Crypto Pattern

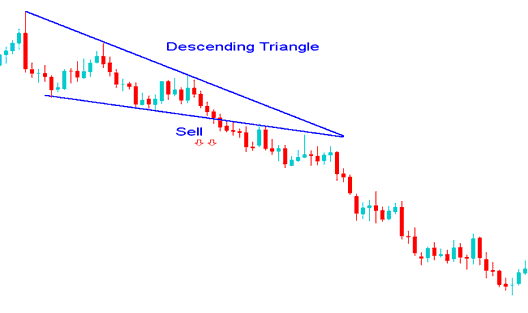

The descending triangle pattern forms during a bitcoin downtrend. It signals that the downward movement will probably keep going.

The falling triangle setup in cryptocurrency trading is recognized as a continuation pattern that suggests the ongoing downward trend in the market is likely to persist.

Falling triangle cryptocurrency pattern is also known as falling wedge bitcoin chart pattern.

The falling triangle chart pattern suggests a support level where sellers continually push prices lower. Once this support level breaks, the BTCUSD market often continues its downward movement.

A break below the lower line of a descending triangle pattern signals a sell in crypto. It means the market heads down from the triangle. This shows sellers will take control.

Crypto Price Breakout after Falling Triangle Pattern

The market exhibited a descending triangle pattern in cryptocurrency during its downward trend in Bitcoin, which resulted in increased selling and a continuation of the bearish trend.

A technical sell signal in cryptocurrency trading occurs when bitcoin prices break below the lower horizontal line of a descending triangle pattern. This breakout is typically followed by further selling pressure, continuing the downward trend in BTC/USD.

Get More Lessons and Tutorials:

- Trade BTC USD Modify Take-Profit BTC USD Order on MT4 Platform Software

- Standard BTCUSD Trade Lot vs Mini Bitcoin Lot Described

- How to Open Demo MT4 Bitcoin Trade Account in MetaTrader 4 Platform

- How Do You Add MT5 Trading BTC USD Expert Advisor EA Expert Advisor Robots on the MT5 Platform?

- How to Trade Open a Trading Order in Trade Software/Platform

- What Does the Quote Mean on the MetaTrader 5 Program