How Do I Interpret Bitcoin System Bitcoin Signals?

How Do I Interpret Bitcoin System Bitcoin Signals?

Back Testing Bitcoin System Bitcoin Signals

Using a system to generate Bitcoin signals is one way to trade bitcoin. It helps beginners get a handle on where the bitcoin trend is headed, and with a bit of practice and backtesting on a demo account, you can keep improving your accuracy. The more you practice BTCUSD trading with the system, the better you get at spotting the right moves.

Best method of how to backtest a bitcoin strategy is by following these two steps:

- Bitcoin Paper Method

- CryptoCurrency Demo Trade Technique

When it comes to Bitcoin paper trading, this method involves testing your trading system on a historical chart. You can take the chart back to a specific date, such as three months ago, and analyze the historical price data to identify potential buy signals, sell signals, and exit points according to your system. Write down these points on a bitcoin journal and also write the profit per bitcoin trade or loss per bitcoin trade and then calculate the total profit of loss after you have recorded a good number of trades generated by the bitcoin system like 20 paper trades and determine if your system is overall profitable or not, the win ratio of bitcoin system, the loss ratio of your system & the risk:reward ratio of your system.

An old-fashioned method of testing trading strategies, predating online platforms and desktop computers, involved manually charting data on graph paper such as A3 or A2. Imagine hand-drawing cryptocurrency charts for bitcoin every hour - something modern traders would likely be hesitant to do. These traditional investors demonstrated remarkable diligence. In our example of this paper-based technique, a sample dataset of just 20 cryptocurrency trades is sufficient for illustration purposes.

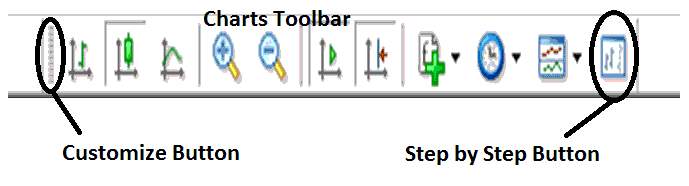

A good bitcoin tool to use to backtest your system is the MT4 BTC USD CryptoCurrency Trade Step by Step Tool. Found on the MetaTrader 4 charts tool-bar of MT4 software platform - If you want to find the charts toolbar on the MT4 software it is at the top of MetaTrader 4 software. If the charts tool-bar is not there: Press View (next to file, tops left corner of MT4 software)>>> Tool Bar >>> Charts. Then click Customize button >>> Choose Bitcoin Trade Step by Step >>> Press on Insert >>> Close.

How Do I Interpret Bitcoin System Bitcoin Signals

Crypto Trade with Crypto System Crypto Signals? - How Do You Read Crypto System Crypto Currency Signals?

Once you get this MetaTrader 4 tool you can move your chart backwards, & use this MT4 tool - bitcoin trading step by step bitcoin tool - to move the crypto charts step by step while at the same time testing when your bitcoin system would have generated either a buy cryptocurrency signal or a sell bitcoin signal, & where you'd have exited the BTCUSD trade, then writedown on a bitcoin journal the amount of profit/loss per bitcoin trade and out of a sample number of trades you would then calculate the over-all profits/losses generated by the bitcoin system.

If your trading system is profitable on the paper trade method then, it's time to open a demo practice account - demo bitcoin crypto trade & test if your system is profitable on the real market as it is on the paper method. This is known as the process of testing a trade system or backtesting a trade system.

Writing a BTC/USD Crypto Trade Journal

Write a Bitcoin Journal to keep track of the profitable trades and use the bitcoin journal to figure out why these trade transactions were profitable. Also keep a log of all losing cryptocurrency trades & use the bitcoin journal to figure out why these trades made losses so as to avoid making these same mistakes the next time that you're trading using your system.

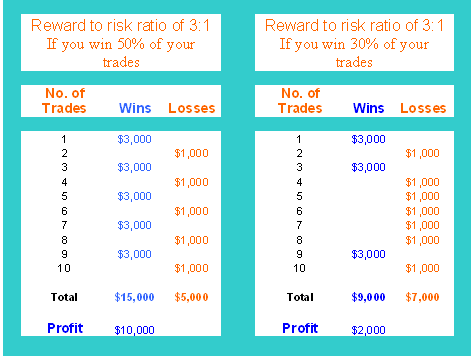

Tweak your bitcoin system until your bitcoin system gets a good risk: reward ratio - with the bitcoin signals that you generate with it. Aim to get a good risk: reward ration of 3:1 & a win ratio of above 70 % for your system is a good ratio, with proper bitcoin money management guide-lines even a bitcoin system with a win ratio of even 30% than is less than half of your trades make profit you can still make a profit using the proper bitcoin money management rules. You might want to learn the topic bitcoin money management to know what the illustration below is all about: Risk Reward Ratio.

Crypto Trade with CryptoCurrency System Crypto Signals? - How Do You Read Crypto System Crypto Currency Signals?

Learn Money Management Methods Lesson Guide

A manual system is still the best way to generate bitcoin signals compared to automated systems, a manual trading system is a better technique & is also much simpler to implement.

However, other bitcoin traders prefer automated bitcoin systems & for those bitcoin traders - they can check the automated bitcoin information on this learn bitcoin webpage MQL5 EAs and Automated Bitcoin Systems.

You can also learn other bitcoin strategies to use in your bitcoin system from our list of bitcoin trade strategies topics that provides you with various methods of how to generate buy bitcoin signals & sell bitcoin signals using various analysis methods - Bitcoin Strategies List.

Crypto Trade with Crypto System Crypto Currency Signals? - How Do You Read Crypto System Crypto Currency Signals?

Discover Additional Classes and Courses:

- How Do You Trade Fibo Pullback Indicator?

- How Do You Place Trend line in Trade Software Platform?

- Technical Analysis of BTC USD Trading Indicators to Use in BTC/USD Trade

- BTC USD Guide of How to Draw BTC USD Trend Lines in BTC USD Trade

- BTC USD 15 Minutes Chart Strategy

- Interpreting Signals from BTC USD Trading Indicators

- How to Interpret and Analyze Setups for Beginner Traders