Where to Buy

You should know the right time to start a buy order: just because the btcusd trading market is going up and bitcoin prices are rising doesn't mean you should buy at any random time. You need to learn the skill of knowing when to buy.

Imagine the btcusd market is going up. You choose to buy right when Bitcoin prices are highest, which seems very good and makes it look like it will keep going up forever. You buy because you do not want to miss out. But, very quickly, the btcusd market suddenly goes down by 200 pips. This is not the right way to buy. Even if the btcusd market goes up & the btcusd market price goes back to where you bought, you still have not made any money: you have done nothing and wasted your time. You have to know the best time and price to buy Bitcoin so that the btcusd market does not go down right after you buy.

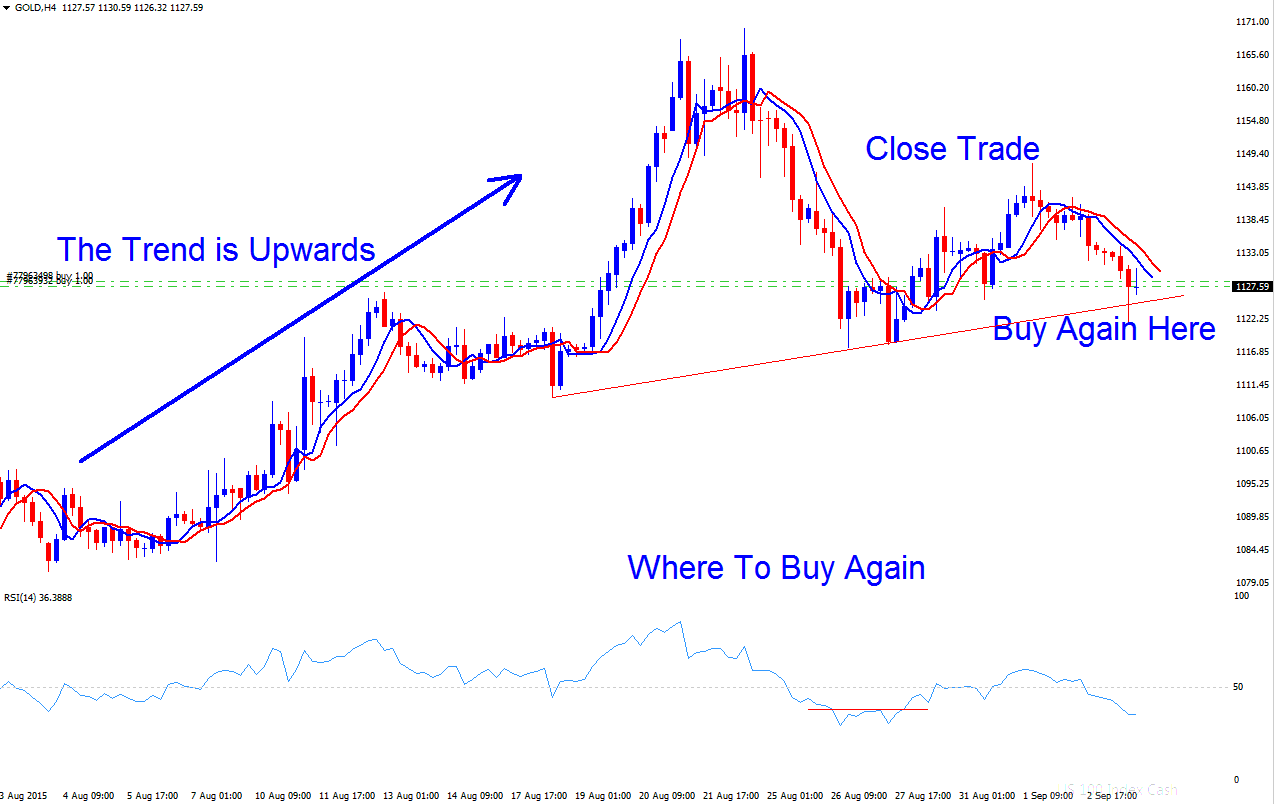

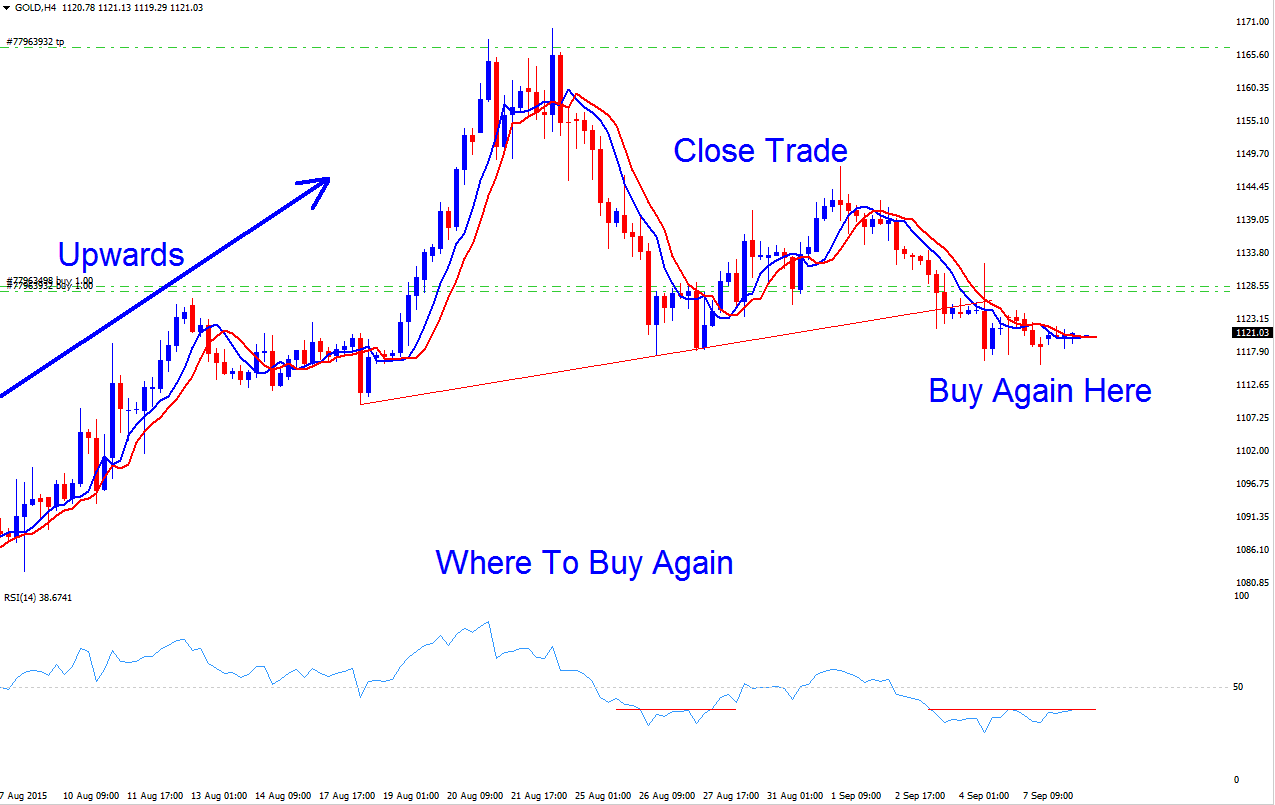

The chart below marks an uptrend in BTCUSD. It shows where most traders buy. They enter when the rise seems plain. Skip that. Buy on pullbacks when the trend dips. The example highlights such a buy.

The trick to this kind of buying is that you buy after a pullback, so even if the bitcoin price doesn't go up right away, the market pullback will already be partly or mostly done, so instead of you starting a buy order that pulls back 200 pips like if you bought at the peak, you buy after a pullback, so even if the bitcoin price were to pull back on you, it will only pull back a little, and once the bitcoin trend starts up again, you'll earn money much faster.

For instance, if you buy after the price of bitcoin has fallen back 150 points when the total fall is 200 points, your buy position will only fall back on you by 50 points instead of 200 pips. By the time the bitcoin price begins to rise again and moves up 200 points to overcome the market fallback, you'll already be 150 points in profit, saving time and earning money on the market fallback by entering at the best moment. This is how to buy if you want to earn money trading in a rising market.

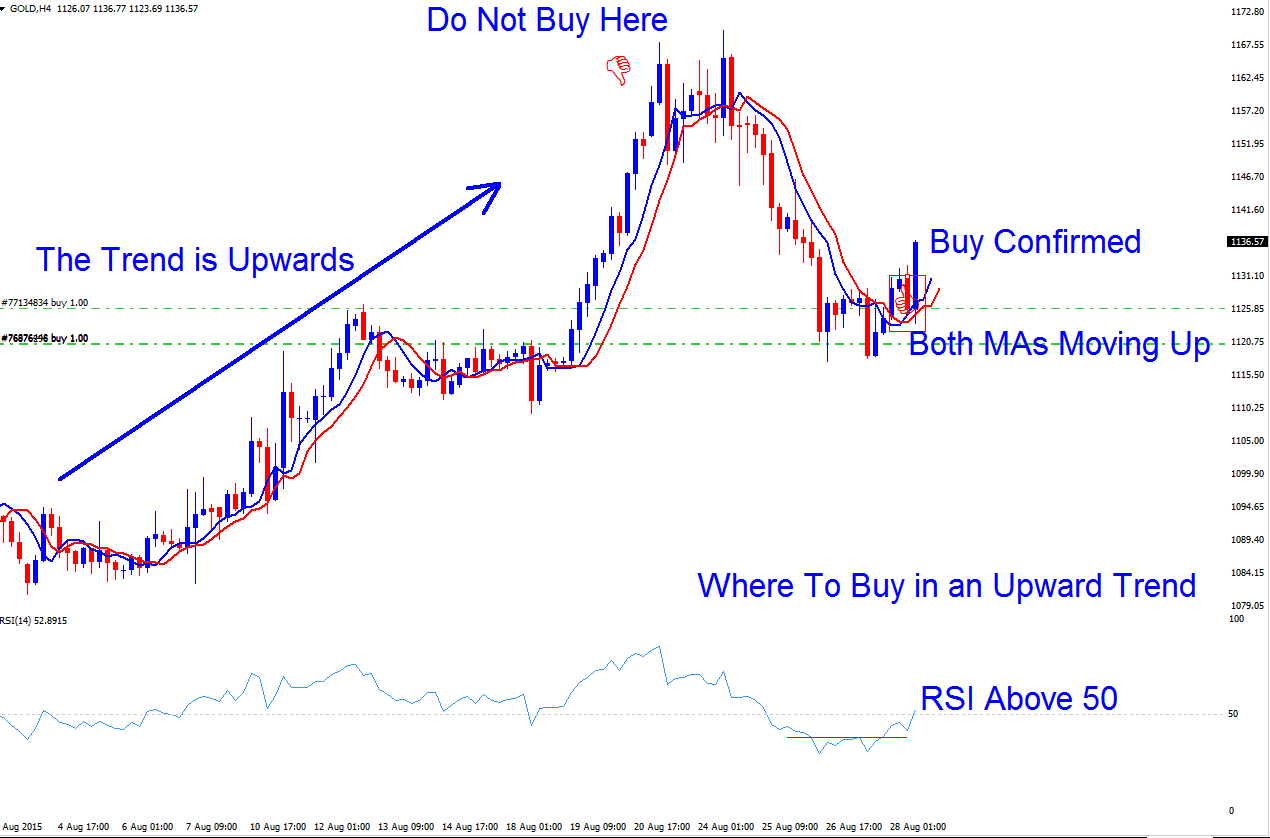

The example illustrated below shows where to not to buy and where to buy after a retracement, the buy was quickly confirmed by the moving average which started to move up & RSI went to above the 50 center line mark. Buying here after the price retracement shows as a bitcoin trader your position did not have a lot of draw-down and you begun to make money immediately henceforth making this a low risk trade.

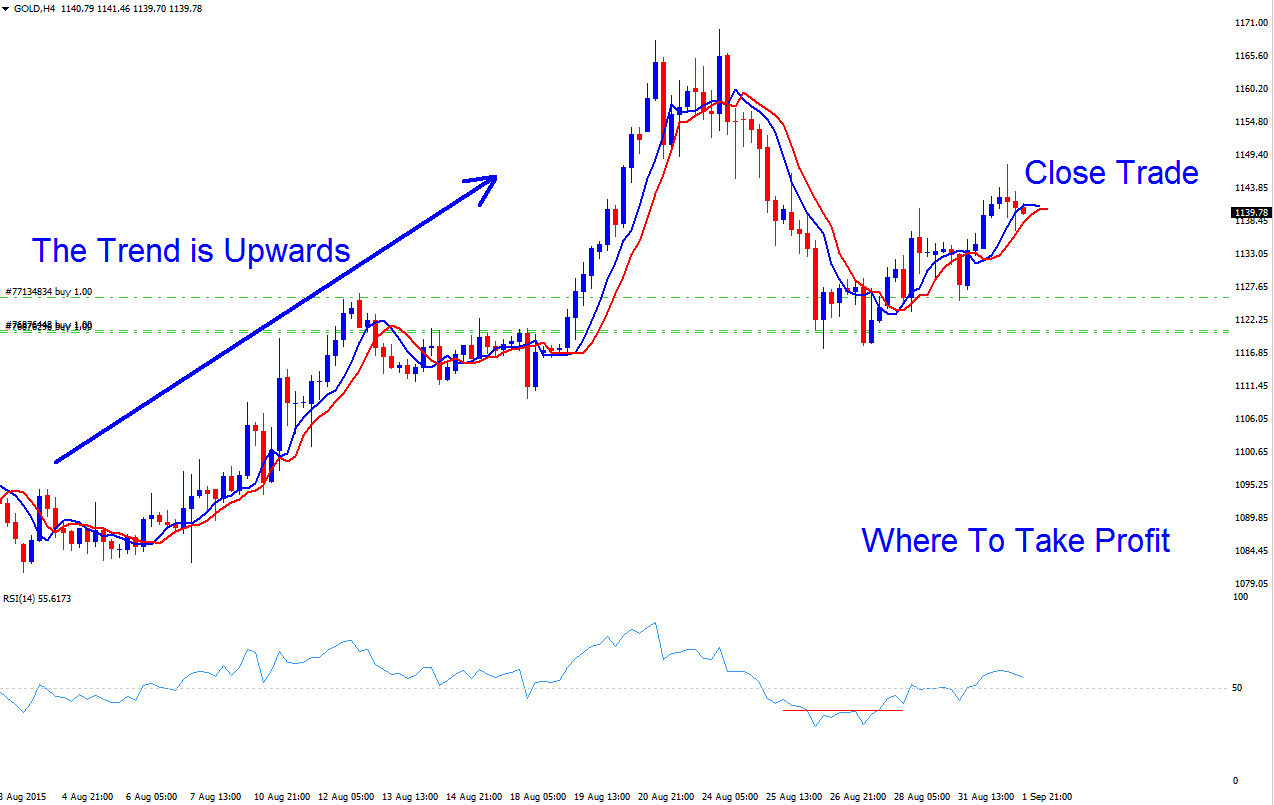

Where to close-out buy orders

Knowing buy spots also means knowing where to exit and lock profits.

For the configuration established above, we will utilize the overbought condition signaled by the RSI. If the RSI surpasses the 70 level and subsequently closes below this technical threshold, this will be interpreted as a sell signal for the cryptocurrency, prompting us to liquidate all open purchase orders.

Wait for the next pullback. Then open another buy trade after it, and repeat the plan.

We will take a screenshot of this trade to demonstrate where to close the orders once the btcusd market rises, as this trade occurs in real-time when this article is being written.

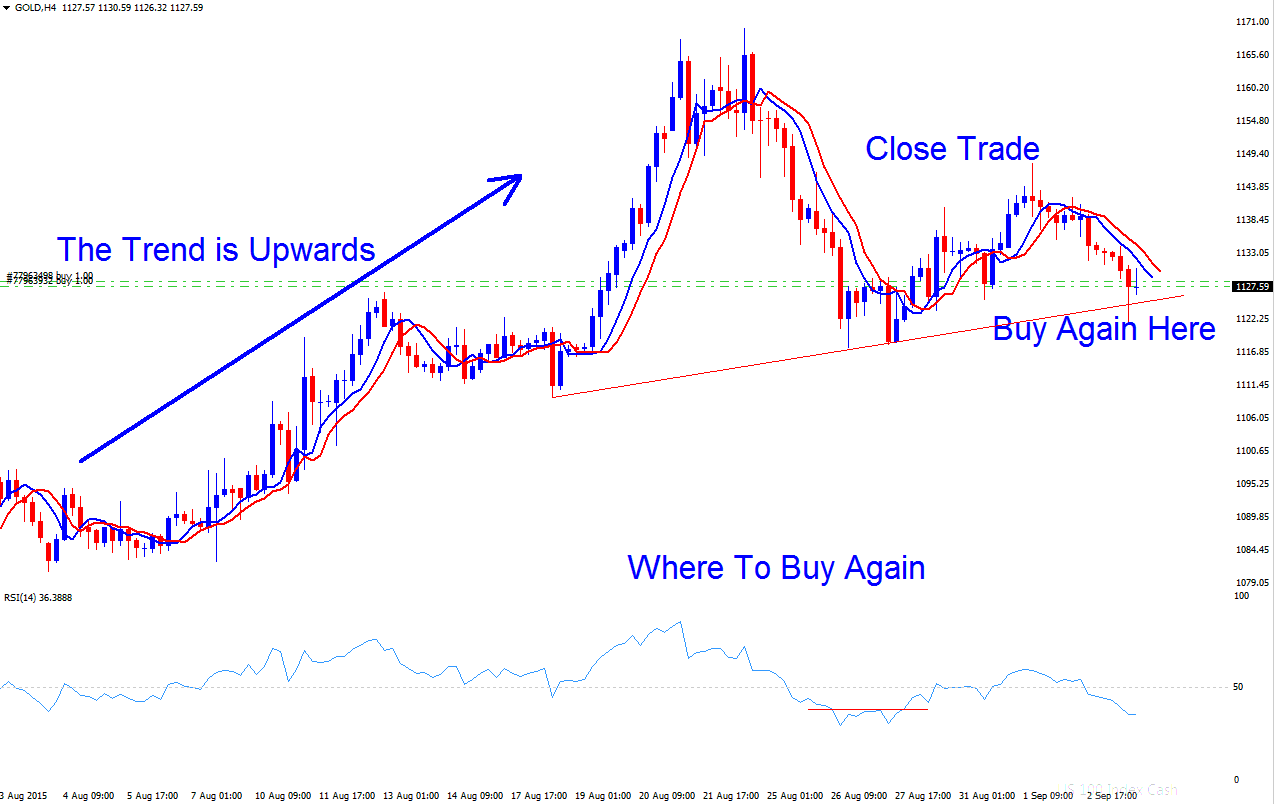

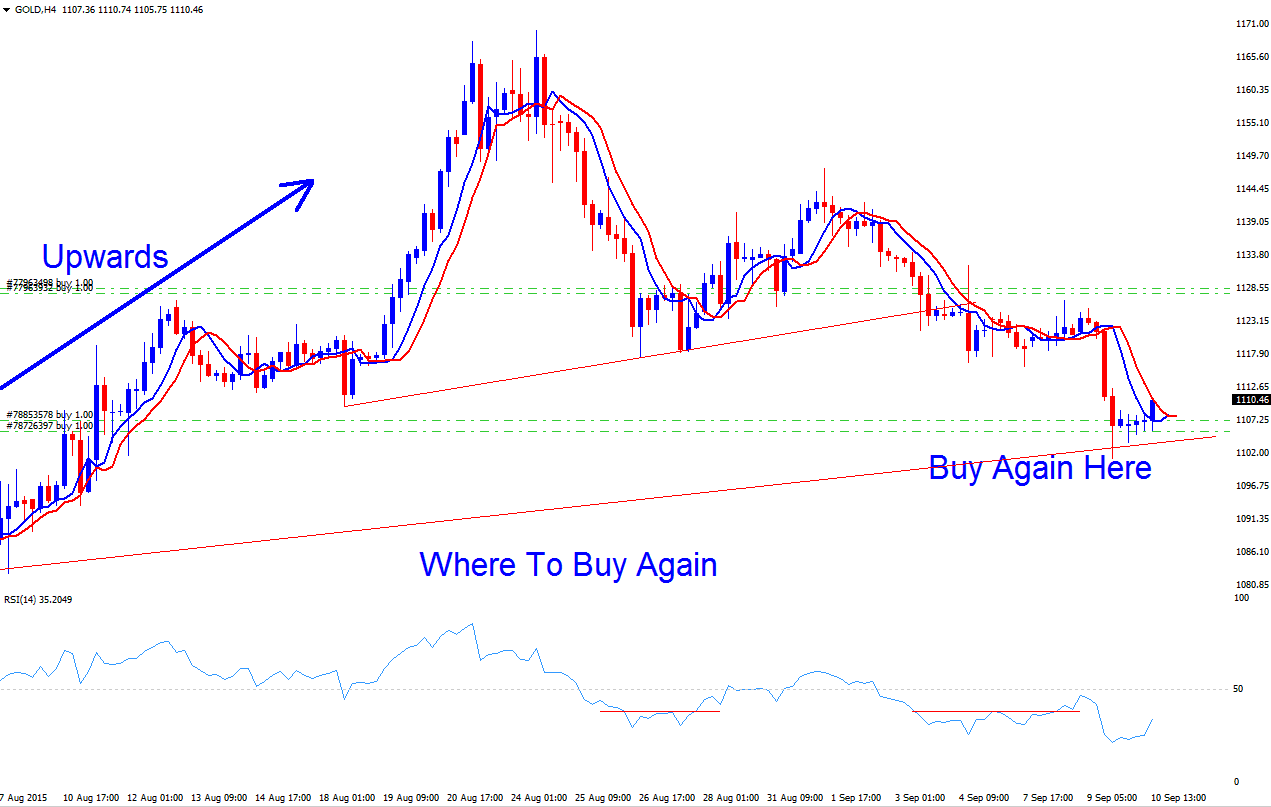

Where to buy again

Bitcoin trends up, so buyers wait for pullbacks to enter. They buy again after the price dips.

This would have been the best place to buy, as this is the level where the prevailing market is oversold.

You also can wait for confirmation of the above signal like is shown:

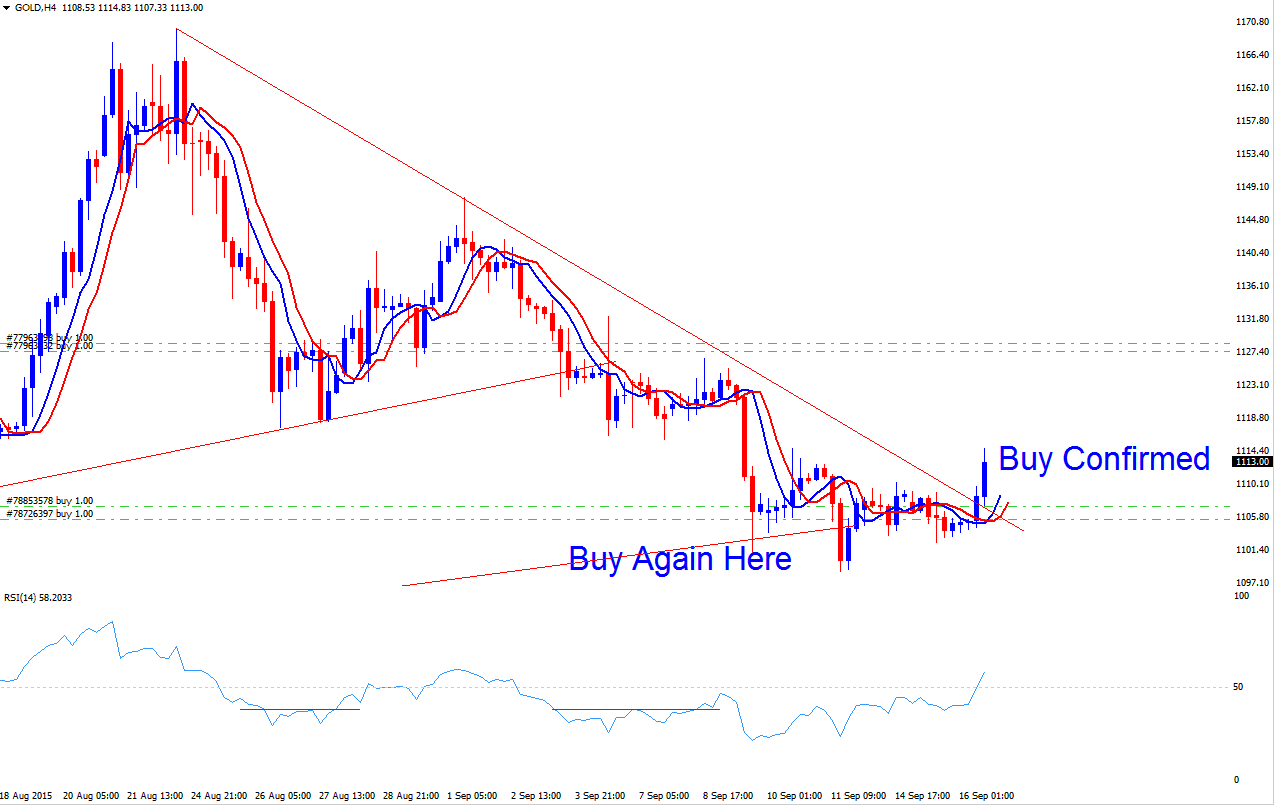

Buy trade set-up confirmed

What happens when a trader buys and the retracement continues downward?

This is a good point: what happens if the place you buy is not where the market stops falling, and the price keeps dropping?

This trade did exactly that, retracing 200 points down from our buy point, as illustrated below.

So the first thing to know is that this is an upward bitcoin trend & the price retracement has moved 671 pips from the top but using our strategy we've been caught by only 200 pips(points) instead of the 671 pips. This is the first reason why you should not buy at the top & instead wait for a retracement then buy. That way you'll only be caught by a fraction of the market retracement & not the whole retracement, therefore saving you from a lot of drawdown on the position.

The subsequent phase ensures you maintain adequate capital reserves to withstand potential drawdowns because you are consciously avoiding excessive leverage in your positions. Following this, you will proceed to open a fresh trading position once this retracement phase reverses and begins ascending, mirroring the illustration above.

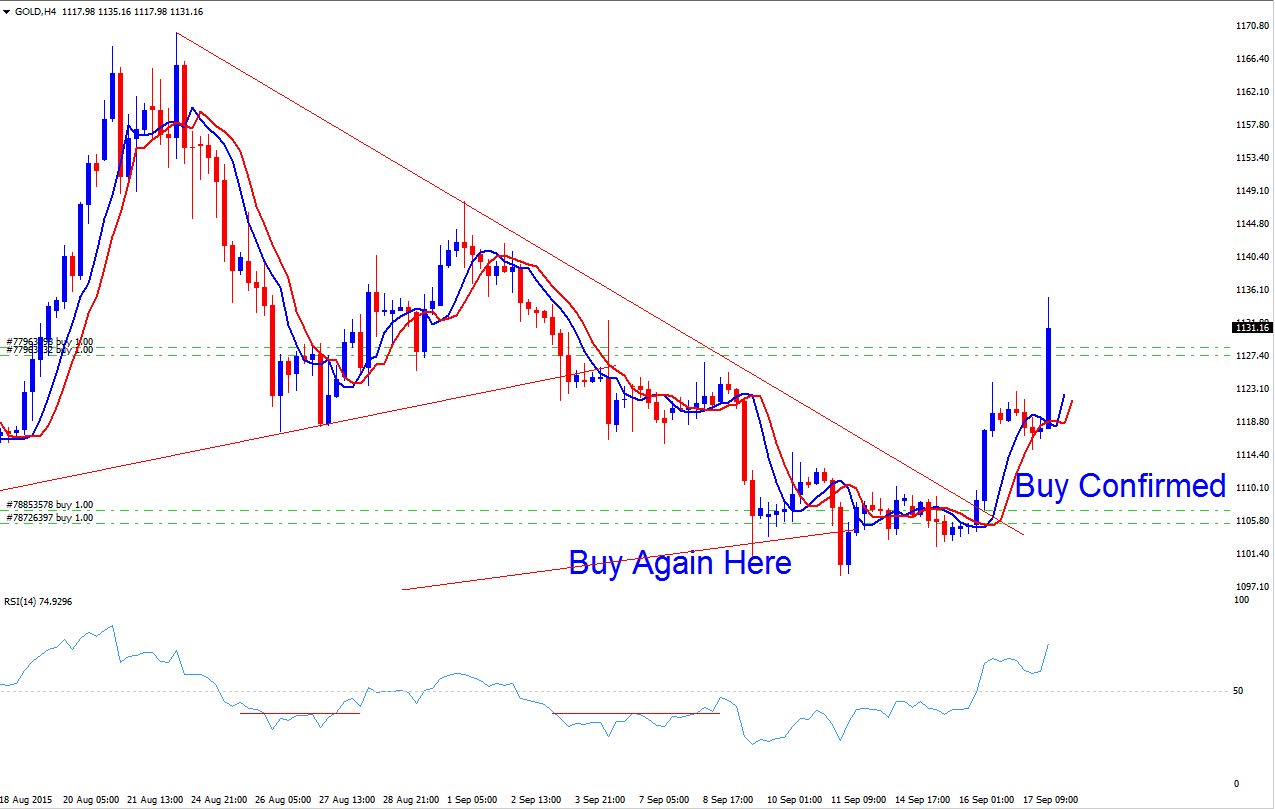

In the trade example above, our new trade went up by 70 points right after we started it. As a trader, you should quickly close these new trades to lower your risk and take some profit while the price is still changing back and forth.

For this trade, set take profit at 1144. Or watch the Bitcoin chart and exit if momentum fades.

We shall take a screen shot of this trade after the btcusd trading market bitcoin trend has developed.

The buy signal for bitcoin came after consolidation. Both moving averages point up now. RSI sits above 50. A short downtrend line broke, confirming the move.

As a trader, you can observe that by employing our strategy, we have successfully minimized our drawdown, even in the face of the short-term downward trend of btcusd. If the btcusd trading market rises to the level of our initial trade transaction, we will have increased our account's profit. The reason for this added profit will not stem from our ability to perfectly time the btcusd market, but rather from our entry into the btcusd market at a time when the likelihood of drawdown is significantly low. This indicates that our risk-reward ratio is sufficiently high to allow us to derive a profit from the bitcoin market utilizing this trading strategy.

The area here is where you end your trade: always stop while you're winning and wait to buy after a small pullback.

Close the trade now. The BTCUSD market looks overbought. Set a buy limit and wait for tomorrow.

According to our chosen trading approach, the optimal placement for a buy limit order would be at 1123, 1122, or 1121, just above the 1120 mark.

Just in case there's a continuation of this bullish upwards market, we also set buy stop pending order at 1136 just above most recent high that way our buy bitcoin trade will still be opened either way.

It's important to remember to pull back before buying - the goal is to first lower any losses before beginning to aim for profits.

An essential component of this strategy involves ensuring that Bitcoin's long-term trend is upward. By aligning trades with this trend, BTCUSD traders can effectively use the Moving Average Crossover method on weekly charts to confirm these patterns.

Traders can apply the same retracement idea before buys. Use it to start sell trades in a down bearish market for crypto.

Review Further Directions and Programs:

- Choosing User-Friendly Automated Cryptocurrency Trade Robots

- How Do You Add Trading Linear Regression Indicator on Chart?

- How Do I Analyze Chart Price Upward Trend?

- BTC USD Mini Account

- BTC/USD Tools for Trading Strategies

- How Do I Register a MT4 BTCUSD Account?

- Interpreting sell stop and sell limit BTC USD orders effectively.

- Parabolic SAR Combination of BTC/USD Indicators

- BTC USD MetaTrader 4 Chart Templates Different BTC USD Strategies Templates Examples

- Acceleration/Deceleration AC BTC/USD Indicator