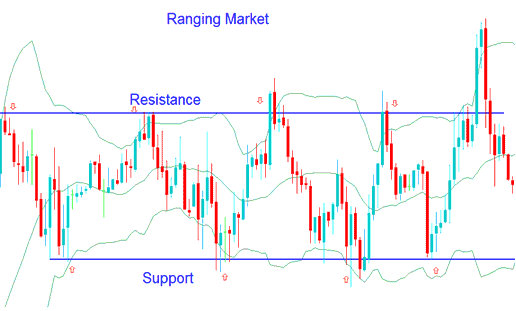

Bollinger Bands in Bitcoin Ranges: Price Action

Bollinger Bands spot when trends stretch too far. Use these steps for flat markets with this tool.

The Bollinger Band indicator for BTC/USD is crucial because it provides actionable bitcoin trading signals suggesting an imminent bitcoin price breakout may occur.

These methods don't work when bitcoin is trending: they only work if Bollinger Bands are moving sideways.

- If the btcusd trading market bitcoin price touches/tests the upper band it can be considered overextended on the upside - over-bought.

- If the btcusd trading market bitcoin price touches the lower band the bitcoin price can be considered overextended on the bottom side - over-sold.

One application of the Bitcoin Bollinger Band indicator involves utilizing the aforementioned overbought and oversold trading guidelines to set buy and sell targets in a sideways-moving bitcoin market.

- If bitcoin price has bounced off the lower band crossed the centerline moving average then the upper band can be used a sell level.

- If bitcoin price bounces downwards off the upper band crosses below center MA the lower band can be used as a buy level.

Utilizing Bollinger Bands for trading Bitcoin when the market lacks a clear trend - A Bollinger Band Strategy.

In the cryptocurrency market mentioned above, when the bitcoin price touches the upper or lower bands, it can be used as a goal for making money on bitcoin trades.

Positions may be initiated once the price action in the Bitcoin market reaches the ceiling of the resistance zone or the floor of the support level. It is prudent to establish a stop-loss order for Bitcoin a short distance above or below the entry, contingent upon the direction of the trade, anticipating a potential breakout beyond the prevailing range defined by the Bollinger Bands.

More How-To Guides and Subjects:

- How to Sign Up MT4 Real BTC/USD Account

- How to Open Standard Bitcoin Trade Account

- What's the Difference between Sell Stop BTC USD Order & Buy Limit BTC USD Order?

- Learn Bitcoin Trade for Beginner Traders

- How to Load Profile of MT5 Charts in MT5 Platform Explained

- How Do You Trade BTC USD in MT4 Bitcoin Charts?

- How Do I Go Live in MT5 Platform?