Bollinger Band Bitcoin Trend Reversals

Wait for Bitcoin price to bounce back after hitting a Bollinger band. That could signal a real reversal in your trade.

Furthermore, a bitcoin trader should observe the bitcoin price crossing over the moving average.

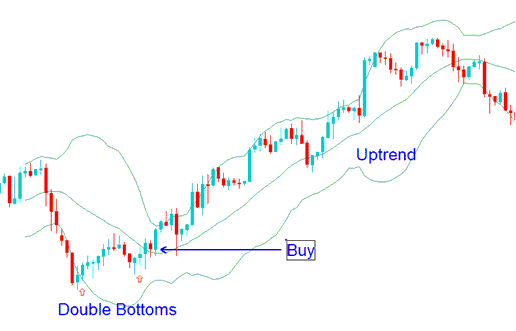

Double Bottom Bitcoin Trend Reversals

A double bottom signals a buy in crypto. It forms when Bitcoin price dips below the lower Bollinger Band, then bounces to a first low. Later, it hits another low, but this one stays above the band.

The second bitcoin low should not drop below the first. It also must avoid the lower band. This bull signal confirms when price closes above the middle band, a simple moving average.

Double Bottom - Bollinger Bands Bitcoin Trend Reversal Plan Using Double Bottom Patterns on Bitcoin Charts

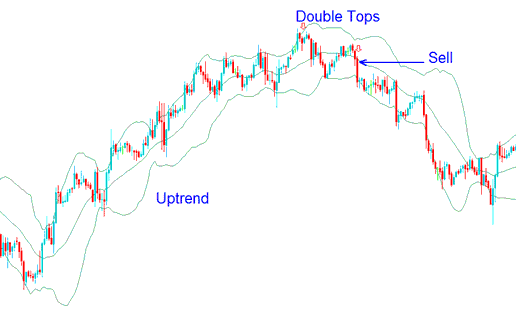

Double Top Bitcoin Trend Reversals

A double top signals a sell in crypto. It forms when Bitcoin price breaks above the upper Bollinger band and falls back to make the first high. Later, another high forms below that band.

The second peak achieved by the Bitcoin price must not surpass the initial recorded peak, and it is vital that this second Bitcoin price high does not make contact with or breach the upper boundary band. This specific bearish cryptocurrency trading configuration is definitively confirmed when the Bitcoin price movement successfully closes beneath the central band (which represents the simple moving average).

Double Top Pattern - A Bollinger Bands Strategy for Trend Reversals Using Double Top Chart Formations.

Get More Lessons and Tutorials & Topics:

- Defining BTC USD Trading Through the Lens of BTCUSD Chart Analysis

- Educational Tutorial Covering the Piercing Line Candlestick Pattern in BTCUSD

- Using MT4 Momentum Indicator for Trading BTC/USD

- BTCUSD Trade Account Minimum Amount

- Drawing an Upward Channel on MT4 Charts Explained

- A Sequential Course Tutorial Covering the Entire Procedure for Opening a Live Trading Account

- A Tutorial Guide on Deploying Fibonacci Pullback Levels on BTCUSD Charts

- BTCUSD Open a Demo MT4 BTCUSD Account in MT4 Software Platform

- Calculating Stop Loss Placement for Accurate Trade Management

- How do you draw Fibonacci extensions on MetaTrader 5 BTCUSD charts?