Bollinger Band Indicator Bulge and Squeeze Analysis

BTCUSD Bollinger Bands adjust automatically. They expand or contract with price swings.

Standard Deviation serves as the statistical metric for measuring bitcoin price volatility, which is instrumental in determining the expanding or contracting nature of the Bollinger Bands. When bitcoin prices fluctuate significantly, the standard deviation value will be elevated: conversely, it will be lower during periods of market calm in the btcusd segment.

- When bitcoin price volatility is high the Bollinger Band widen.

- When bitcoin price volatility is low the Bollinger Band narrows.

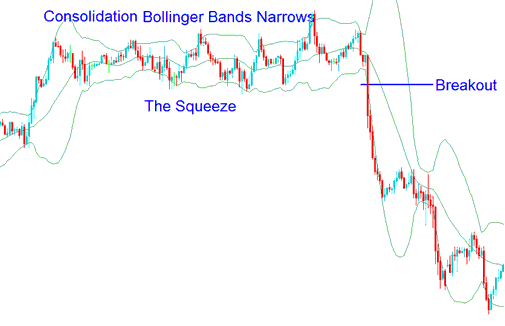

The Bollinger Bands Squeeze

When a bitcoin Bollinger Band gets tighter, it means the bitcoin price is staying steady: this is a Bollinger band squeeze.

When the Bollinger Band indicator on a cryptocurrency chart shows narrow standard deviations, this typically signals a period of consolidation for Bitcoin price action. This narrowing is a precursor to an anticipated breakout, indicating that Bitcoin traders are positioning themselves for a significant new move. Furthermore, the longer the price remains confined within these tight bands, the higher the probability that the subsequent breakout will be substantial.

Bollinger Squeeze Explained - Understanding the Bollinger Band Squeeze for Cryptocurrency Trading

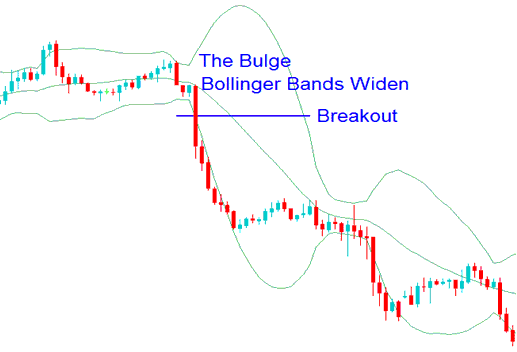

The Bollinger Bulge

Bollinger Bands spreading wide signals a bitcoin breakout. It's called the Bollinger Band squeeze.

Wide Bollinger Bands signal a bitcoin turn ahead. In the example below, bands spread out from wild price swings on the drop. The btcusd trend flips as prices hit outer edges. Stats and normal curves back this. The fat squeeze foretells a shift to down moves in crypto.

Understanding the Bollinger Bulge - Tactics for Cryptocurrency Trading Using Bollinger Bands Expansion

Explore Additional Topics & Courses:

- How to Set Take Profit BTC USD Order on MT4 iPhone Trade App

- BTC USD What's Straight Through Processing BTC/USD Account Meaning?

- How Does Online BTC USD Trade Work?

- STP BTC/USD Trade Brokers

- Strategy Guide for Using Short-Term and General Moving Averages (MAs) as BTC USD Trading Indicators

- Set Up Fibonacci Pullback Levels for Bitcoin on MT4

- Placing Channels on BTC USD Charts in MT4 Platform

- How to Add Bulls Power Bitcoin Indicator to MT4 Charts

- What's an Engulfing Candles Candlestick in Trade?

- What are the Top Ten BTC USD Trade Strategies?