RSI Hidden Bullish Divergence & Hidden Bearish Divergence Setups

Hidden divergence setup is used as a possible signal for a market trend continuation. Hidden divergence set up occurs when the price retraces to retest a previous high or low.

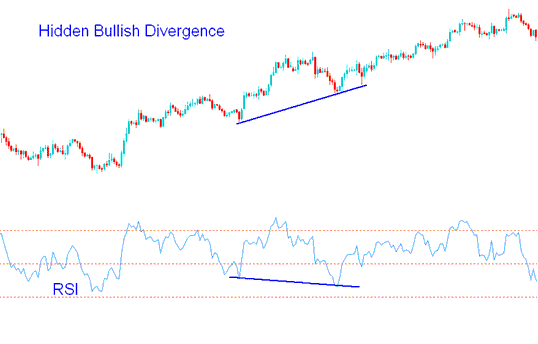

Hidden RSI Bullish Divergence

Hidden RSI bullish divergence setup forms when price is making a higher low (HL), but the oscillator trading is showing a lower low (LL).

Hidden bullish divergence occurs when there is a retracement in a uptrend.

RSI Hidden Bullish Divergence - Hidden Divergence Trading Setup

This hidden divergence set up confirms that a retracement move is exhausted. This hidden divergence indicates underlying strength of an upwards trend.

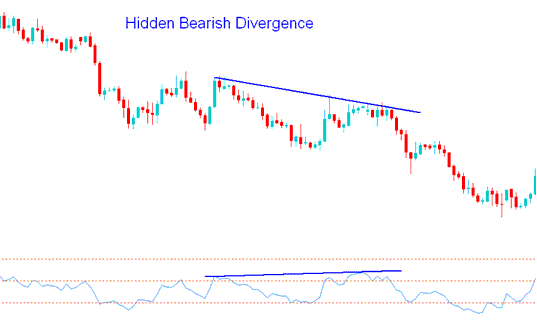

Hidden RSI Bearish Divergence

Hidden RSI bearish divergence setups forms when price is making a lower high ( LH ), but the oscillator technical indicator is displaying a higher high ( HH ).

Hidden bearish divergence occurs when there is a retracement in a down-trend.

Hidden Bearish Divergence - Hidden Bearish Divergence Setup

This hidden bearish RSI setup confirms that a retracement move is exhausted. This divergence indicates underlying momentum of a downwards trend.

Learn More Courses & Tutorials:

- How Can I Calculate Pip on MetaTrader 4 Platform?

- Buy Long Trade - What's Opening Long?

- Example of Used Gold Margin and Free XAU/USD Margin in MetaTrader 4 Platform

- How to Set Forex Trading Buy Orders in MetaTrader 4 FX Charts

- Calculate Value of 1 Pips for What is 1 Pips Equal to for DowJones30 Stock Indices Pips

- How Can I Download MT5 Trade XAU/USD Platform for iPad?

- How to Calculate Leverage in 1:200 & 1:100 FX Leverage

- How to Use MetaTrader 4 DeMarks Projected Range Indicator on MetaTrader 4 Platform

- How Can I Analyze Instant Market Execution Order?

- How to Use MetaTrader 5 Bollinger Band-width Trading Indicator