What is the SMI20 Trading Method? - A Comprehensive Guide to Trading the SMI20 Index

The SMI20 Index Trade Chart

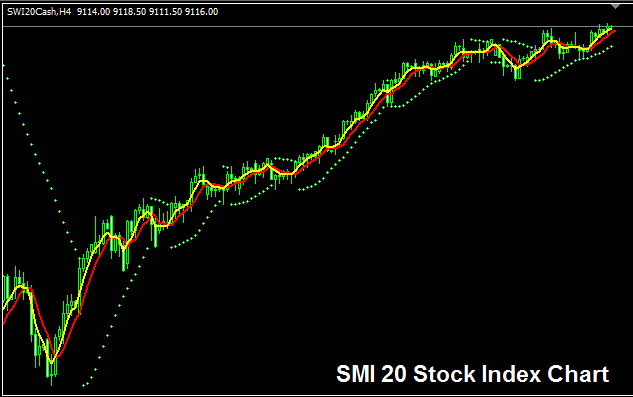

The chart for the SMI20 Stock Index is presented and viewable above. In this visual guide, the Index is labeled SWI20CASH. You should now search for a brokerage that offers the SMI 20 Stock Index chart to begin your trading activities. The preceding visual is of the SMI20 Stock Index presented on the MT4 Forex Platform Software.

Strategy for SMI20 Index

The SMI20 Index reflects the market valuation of Switzerland's top 20 corporations. Due to the consistent and strong growth of the Swiss economy, this Stock Index generally trends upward over the long term. Furthermore, Switzerland boasts one of the world's most resilient banking systems, underpinning its status as a highly dependable and stable economy.

As an index trader, you should usually buy because the index tends to rise. If the Swiss economy is doing well, most of the big stocks will likely keep increasing, so the index will also probably go up. A smart way to trade stock indexes is to buy when the price drops a little.

During Economic SlowDown and Recession

In slow economies and recessions, companies report less revenue and profit. Growth looks weaker too. Traders sell shares of firms with low profits. The index for those stocks drops as a result.

During these active times, market trends are more likely to experience downward movements, prompting traders to adjust their strategies to align with the prevailing negative trends of the index being traded.

Contracts & Specifications

Margin Required for 1 Contract - CHF 100

Value per Pips - CHF 0.5

Note: Although the overall trend generally favors an upward movement, as a trader, paying attention to daily price volatility is mandatory. On certain days, the Index might move sideways, pull back, or experience a retracement, which could be quite pronounced at times. Thus, you, the trader, must execute precise entry timing by employing this strategy: Index strategy, while concurrently applying suitable and proper money management rules and guidelines to handle any unanticipated market movement volatility. Regarding equity management strategies and guidelines within stock indices topics: Understand Index equity management and the money management system framework.

Explore More Lessons, Tutorials, and Courses:

- What is Margin Requirement for 1 Contract of CAC40 Indices?

- What is the FX Trend Lines Indicator on MT4 Platform?

- Understanding and Counting Pips in GBP/USD

- How Do You Trade Index with MACD Crossover Signal Strategies?

- Scalping, Day Trading, and Swing Trading XAU/USD Methods

- Piercing Line Candlestick & Dark Cloud Candlestick Patterns

- EURNOK Opening Time and EURNOK Closing Time

- TSI XAU/USD Indicator Analysis

- SPAIN35 System