What is DeMarks Indicator? - Definition of DeMarks Indicator

DeMarks FX indicator - DeMarks indicators is a popular forex indicator that can be found on the - Indicators List on this site. DeMarks forex indicator is used by the traders to forecast price movement depending on the chart price analysis done using this DeMarks indicator. Traders can use the DeMarks buy and Sell Signals explained below to determine when to open a buy or sell trade when using this DeMarks indicator. By using DeMarks and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What is DeMarks Indicator? DeMarks Indicator

How Do You Combine Forex Indicators with DeMarks? - Adding DeMarks Indicator on the MT4 Software

Which Indicator is the Best to Combine with DeMarks?

Which is the best DeMarks Forex indicator combination for trading?

The most popular indicators combined with DeMarks are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Oscillator Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best DeMarks indicator combination for Forex trading? - DeMarks MT4 indicators

What Indicators to Combine with DeMarks?

Find additional indicators in addition to DeMarks indicator that will determine the trend of the forex market & also others that confirm the trend. By combining forex indicators which determine trend and others that confirm the trend and combining these technical indicators with Forex DeMarks indicator a trader will come up with a DeMarks based system that they can test using a forex demo account on the MetaTrader 4 platform.

This DeMarks based system will also help traders to determine when there is a market reversal based on the indicators signals generated & hence trades can know when to exit the market if they have open trades.

What is DeMarks Indicator Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best DeMarks Strategy?

How to Choose & Select the Best DeMarks Strategy

For traders researching on What is the best DeMarks forex strategy - the following learn fx tutorials will help traders on the steps required to course them with coming up with the best strategy for forex market based on the DeMarks indicator system.

How to Create DeMarks Forex Systems Strategies

- What is DeMarks Indicator Strategy

- Creating DeMarks Strategy Template

- Writing DeMarks Strategy Trade Rules

- Generating DeMarks Buy and DeMarks Sell Signals

- Creating DeMarks Indicator System Tips

About DeMarks Indicator Example Explained

DeMarks Analysis & Range Extension Index Signals

Developed by Tom DeMark.

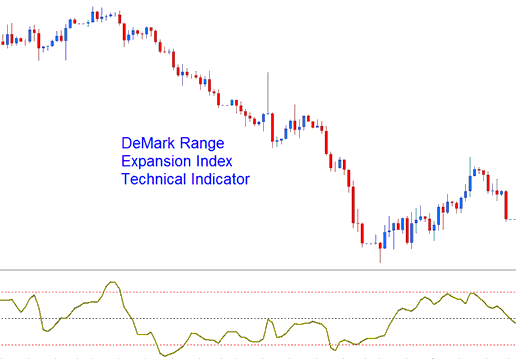

DeMarks used the Range Extension Index to trade options, in his strategy. This indicator is an oscillator indicator.

DeMark Range Extension Index

This Oscillator is used as a market timing oscillator technical indicator which attempts to overcome problems of exponentially calculated oscillators indicators, which are calculated arithmetically & these trading indicators tend to lag the market.

Technical Analysis and How to Generate Signals

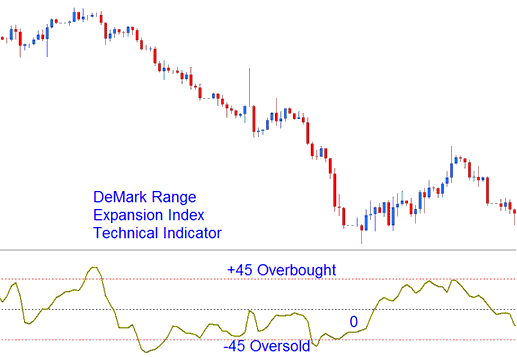

This Oscillator Indicator typically oscillates between the values of -100 to +100.

Overbought Levels -Readings of +45 or higher indicates overbought conditions.

Oversold Levels -Readings of -45 or lower indicates over-sold conditions.

Overbought & Over-sold Levels on Indicator

Exit Signals - DeMark advises against trading in extreme overbought conditions indicated by six or more bars above +45, exit for buy signals gets derived/generated six bars after the price touches/tests +45.

Exit Signals - extreme oversold conditions indicated by six or more bars below the -45 thresholds will generate exit trading signal for short trade transactions.

Learn More Lessons and Tutorials & Topics:

- What is Margin Requirement for 1 Lot of GER30 Index?

- IBEX 35 Indicator MetaTrader 4 Technical Indicators

- Forex Chandes Dynamic Momentum Index Expert Advisor(EA) Setup

- When Does WallStreet 30 Index Market Open?

- Daily Chart Time Frame Strategies

- DeMarks Range Projection Indices Technical Indicator Settings on MetaTrader 4 Platform Software

- William % R Indicator Settings on MetaTrader 4 Platform

- Stochastic MACD RSI Index Trading Strategy

- Gann Swing MT4 Technical Indicator on Trading

- Definition of Mini Lot in Trading