What is Coppock Curve Indicator? - Definition of Coppock Curve Indicator

Coppock Curve - Coppock Curve technical indicators is a popular indicator which can be found on the - FX Indicators List on this site. Coppock Curve is used by the traders to forecast price movement based on the chart price analysis done using this Coppock Curve indicator. Traders can use the Coppock Curve buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Coppock Curve indicator. By using Coppock Curve and other forex indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Coppock Curve Indicator? Coppock Curve Indicator

How Do You Combine Indicators with Coppock Curve Indicator?

Which Indicator is the Best to Combine with Coppock Curve?

Which is the best Coppock Curve combination for trading?

The most popular indicators combined with Coppock Curve are:

- RSI

- MAs Moving Averages Trading Indicator

- MACD

- Bollinger Band

- Stochastic Oscillator Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best Coppock Curve combination for trading? - Coppock Curve MT4 indicators

What Indicators to Combine with Coppock Curve?

Get additional indicators in addition to Coppock Curve that will determine the trend of the market price and also others that confirm the market trend. By combining indicators that determine trend and others that confirm the trend & combining these indicators with Coppock Curve a trader will come up with a Coppock Curve based system that they can test using a practice trading demo account on the MT4 software.

This Coppock Curve based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is Coppock Curve Indicator Based Trading? Indicator based system to interpret and analyze price and provide trade signals.

What is the Best Coppock Curve Strategy?

How to Choose & Select the Best Coppock Curve Strategy

For traders researching on What is the best Coppock Curve strategy - the following learn tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the Coppock Curve system.

How to Create Coppock Curve Strategies

- What is Coppock Curve System

- Creating Coppock Curve System Template

- Writing Coppock Curve System Rules

- Generating Coppock Curve Buy and Coppock Curve Sell Signals

- Creating Coppock Curve Trading Indicator System Tips

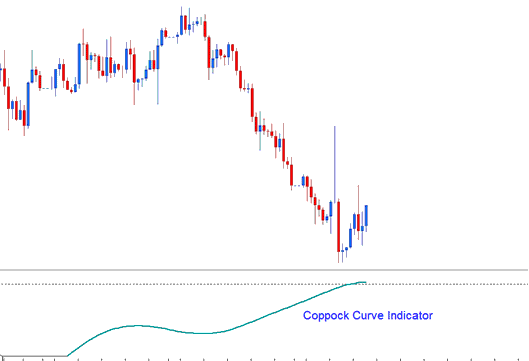

About Coppock Curve Example Explained

Coppock Curve Analysis & Coppock Curve Signals

Developed by Edwin Sedgwick Coppock

This indicator was used for technical analysis of Stocks & Commodities in the beginning but was later used to trade Forex.

The principle behind this is the psychology of trading, based on the theory that human habit-is predictable. And the price movement always moves in a zigzag format.

The principle of adaptation levels applies to how price reacts at certain levels, stock & currency prices will react in the same way or pattern as those observed historically.

Forex Analysis and How to Generate Signals

In trading, The Moving Average is the simplest form of an adaptation-levels, the price will oscillate around the Moving Average. This forms the basis of this indicator, which is a longer-term oscillator technical indicator based on this adaptation levels(moving average), but in a different way.

Oscillators usually and generally start by calculating a % change of the prevailing price from some previous price point, where the previous price level is the reference point (adaptation-levels).

Edwin Coppock argued & reasoned that the trading participants' emotional state when trading could be quantified & estimated by summing & adding up the % changes over the recent past to get a general sense of the market's longer term trend momentum.

For example, If we compare prices relative to a year ago and we see and observe this month the market is up 20 percent compared & analyzed to a year ago, last month it was up 15 % over a year ago, then we may as well determine that the market price is gaining momentum in its movement.

Basic signals can also be derived and generated using the Coppock Curve to trade market price reversals from extreme price levels. Looking for divergence & trendline breaks might also be combined together to confirm the signal.

Implementation

The input levels of this indicator might need to be adjusted to better fit the dynamic nature of the forex currency markets trading.

Coppock Curve has got a zero line reference point, but this does not represent the adaptation levels but it's only a visual reference point only.

Study More Courses & Guides:

- What is FX MT4 Trading Charts Tabs?

- What is XAUUSD Gold Margin Account?

- AUD NZD Spreads

- Forex Transactions

- What is Bollinger Percent B Indicator?

- DeMarks Projected Range MT4 Technical Indicator

- How to Set RVI Indicator in XAU/USD Chart RVI XAU/USD Indicator Example Explained

- How to Trade RSI Swing Failure In an Upwards Stock Index Trend and Swing Failure In a Downwards Index Trend

- What's FX Ehlers Laguerre RSI Indicator?

- Live Copying Trade XAU USD Signals Online