What's Ehler Laguerre RSI Indicator? - Definition of Ehlers Laguerre RSI Indicator

Ehler Laguerre RSI - Ehlers Laguerre RSI indicators is a popular technical indicator which can be found in the - Indicators Listing on this website. Ehlers Laguerre RSI is used by the traders to forecast price movement depending on the chart price analysis done using this Ehler Laguerre RSI indicator. Traders can use the Ehler Laguerre RSI buy & Sell Trading Signals explained below to identify when to open a buy or sell trade when using this Ehler Laguerre RSI indicator. By using Ehler Laguerre RSI and other forex indicators combinations traders can learn how to make decisions about market entry and market exit.

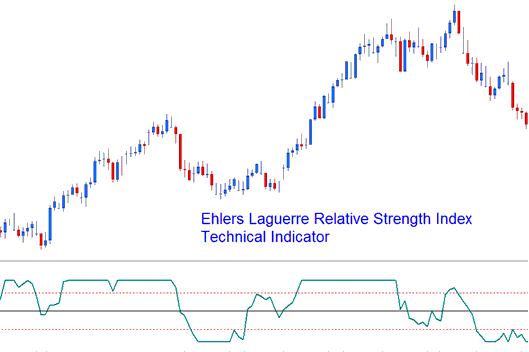

What's Ehler Laguerre RSI Indicator? Ehlers Laguerre RSI Indicator

How Do You Combine Forex Indicators with Ehlers Laguerre RSI? - Adding Ehler Laguerre RSI in MT4 Platform

Which Indicator is the Best to Combine with Ehlers Laguerre RSI?

Which is the best Ehlers Laguerre RSI combination for trading?

The most popular indicators combined with Ehler Laguerre RSI are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Technical Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best Ehlers Laguerre RSI combination for trading? - Ehlers Laguerre RSI MT4 indicators

What Indicators to Combine with Ehlers Laguerre RSI?

Get additional indicators in addition to Ehler Laguerre RSI that will determine the trend of the forex market & also others that confirm the market trend. By combining forex indicators that determine trend and others that confirm the trend and combining these technical indicators with FX Ehler Laguerre RSI a trader will come up with a Ehler Laguerre RSI based system that they can test using a demo account on the MT4 software.

This Ehler Laguerre RSI based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Ehler Laguerre RSI Based Trading? Indicator based system to analyze and interpret price and provide trade signals.

What's the Best Ehlers Laguerre RSI Strategy?

How to Select and Choose the Best Ehlers Laguerre RSI Strategy

For traders researching on What is the best Ehlers Laguerre RSI strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for forex market based on the Ehler Laguerre RSI system.

How to Develop Ehler Laguerre RSI Systems

- What is Ehler Laguerre RSI Strategy

- Creating Ehler Laguerre RSI Trading Strategy Template

- Writing Ehler Laguerre RSI Strategy Trading Rules

- Generating Ehler Laguerre RSI Buy and Ehlers Laguerre RSI Sell Trading Signals

- Creating Ehler Laguerre RSI Trading System Tips

About Ehlers Laguerre RSI Described

Ehler Laguerre RSI Analysis and Ehlers RSI Signals

Created and Developed by John Ehler.

Originally used to trade stocks and commodities.

Ehlers RSI uses a 4-Element Ehler Laguerre filter to provide a "time distort" such that low frequency constituents/price spikes get delayed much more than the higher frequency constituents. This indicator enables more smoother filters to be developed using short amounts of data.

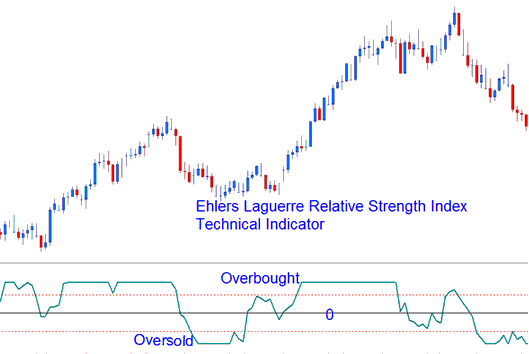

The Ehler RSI uses a scale of 0- 100, the center line is used to generate FX signals and the 80/20 levels represents overbought-over-sold areas.

The only parameter which can be optimized for this indicator is damping gamma factor, normally 0.5 to 0.85, to best suit your trading method.

Ehler Laguerre RSI

FX Analysis and Generating Signals

This implementation of the Laguerre RSI uses scale of 0 - 100.

Forex Crossover Signals

Buy Signal- A buy signal is derived & generated when the Ehler RSI crosses above the 50 level and center Mark.

Sell Trade Signal- A sell signal is derived and generated when Ehlers RSI crosses below 50 level and center Mark.

Oversold/Over-bought Levels in Trading Indicator

Over-sold/Overbought Levels in Technical Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20 % level & sell after it crosses back below the 80 % level.

Get More Tutorials and Lessons:

- How Can I Use MetaTrader 5 Aroon Oscillator on MT5 Platform?

- Buy Stop Order and Sell Stop Order

- How Can I Read Support Resistance Levels using Support Resistance Indicator?

- How is FTSE100 Index Traded on the MetaTrader 4 and MT5 Platform?

- What is NZDUSD Spreads?

- Bollinger Band MT4 Trading Indicator

- Two XAU USD Methods That are Most Commonly Used

- How to Set Accelerator Oscillator on Forex Chart on MT4 Software

- Starting Forex with MT4 FX Brokers and Learning Their Platform Softwares

- Fib Pullback Levels on Upward XAU USD Trend and Fibo Pullback Levels on Downwards XAUUSD Gold Trend