RSI Swing Failure Setup

RSI swing failure works well for short-term index trades. It suits reversal traders best, though it can apply to longer trends too.

RSI swing failure swing trading setup is a confirmation of a pending market price reversal. This swing failure setups a leading break out signal, it warns that a support or resistance level in the market is going to be penetrated. This setup should occur at readings above 70 for an upward trend & readings below 30 in a downwards trend.

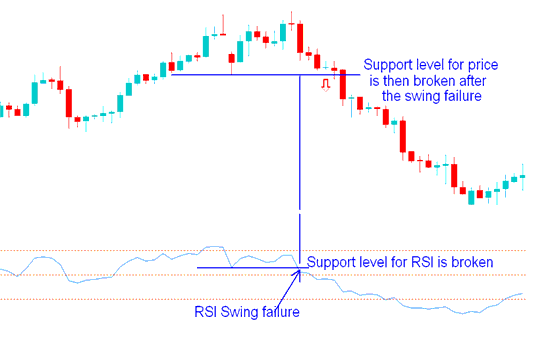

Swing Failure In an Upward Trend

When the RSI indicator for indices reaches 79 and then retreats to 72, followed by a rise to 76 before dropping below 72, this pattern represents a failure swing RSI setup. The 72 level, previously acting as RSI support, has been breached, indicating that the price is likely to follow suit and break its own support level.

In the illustration put on display below, Indices RSI indicator touches 73 then pulls back/retraces to 56, this is a support level. The indicator then rises to 68 & then drops to below 56, thus breaking the support level. The price then follows afterwards breaking its support level. The RSI swing failure is a leading trading signal and it's confirmed when price also breaks it support level. Some traders open trades once the swing failure is complete while other Indices traders wait for price confirmation, either way it's for a trader to decide what method works best for them.

Index RSI Swing Failure in an Upward Trend

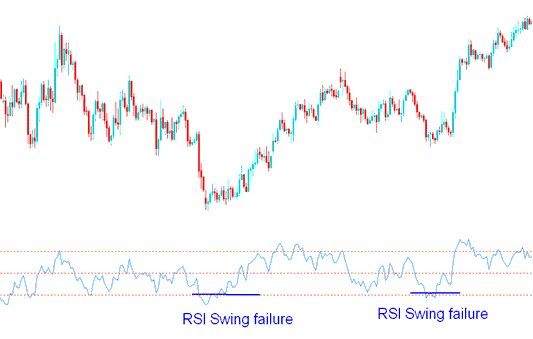

Swing Failure Setup In a Downwards Trend

If the Indices RSI Trading Technical Indicator touches 20 then pulls back/retraces to 28, then falls to 24 & finally penetrates above 28, this is considered a failure swing setup. Since the 28 level is an RSI resistance level and it has been penetrated it means price will and follow & it'll penetrate its resistance level.

Indices RSI Swing Failure Setup in a Downward Trend

Discover More Directions & Instructional Material:

- How to Add US 500 in the MT4 App?

- How to Analyze MT4 Trend Lines Indicator and Channels Indicator on MetaTrader 4 Charts

- DeMark Technical Indicator

- USDJPY System USDJPY Trade Strategy

- How Do I Trade Index in MetaTrader 4 Platform?

- Forex FTSE 100 Index FTSE 100 Quote in FX

- How is Nasdaq 100 Stock Index Calculated?

- Index Bollinger Bands Strategy

- How to Start FX Trade for Beginner Traders Guide Lesson

- McClellan Oscillator MT5 Technical Analysis in FX