What is Bears Power Indicator? - Definition of Bears Power Indicator

Bears Power - Bears Power indicators is a popular technical indicator that can be found on the - Forex Indicators List on this site. Bears Power is used by the traders to forecast price movement depending on the chart price analysis done using this Bears Power indicator. Traders can use the Bears Power buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Bears Power indicator. By using Bears Power and other indicators combinations traders can learn how to make decisions about market entry & market exit.

What's Bears Power Indicator? Bears Power Indicator

How Do You Combine Indicators with Bears Power Indicator?

Which Indicator is the Best to Combine with Bears Power?

Which is the best Bears Power combination for trading?

The most popular indicators combined with Bears Power are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Band

- Stochastic Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best Bears Power combination for trading? - Bears Power MT4 indicators

What Indicators to Combine with Bears Power?

Get additional indicators in addition to Bears Power that will determine the trend of the market price and also others that confirm the market trend. By combining indicators which determine trend & others that confirm the trend & combining these indicators with Bears Power a trader will come up with a Bears Power based trading system that they can test using a practice trading demo account on the MT4 platform.

This Bears Power based system will also help traders to determine when there is a market reversal based on the indicators signals generated & hence trades can know when to exit the market if they have open trades.

What is Bears Power Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best Bears Power Strategy?

How to Choose & Select the Best Bears Power Strategy

For traders researching on What is the best Bears Power strategy - the following learn trading courses will help traders on the steps required to course them with coming up with the best strategy for trading market based on the Bears Power trading strategy.

How to Create Bears Power Systems

- What is Bears Power Strategy

- Creating Bears Power Strategy Template

- Writing Bears Power Strategy Trade Rules

- Generating Bears Power Buy and Bears Power Sell Signals

- Creating Bears Power Trading System Tips

About Bears Power Example Explained

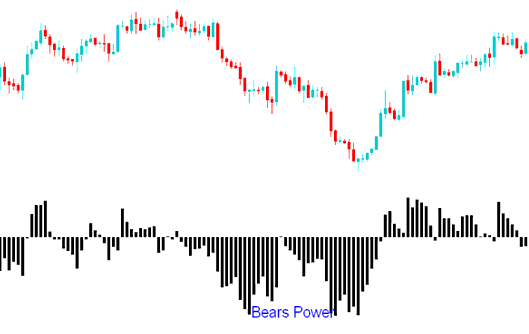

Bears Power Analysis & Bears Power Signals

Created and Developed by Alexander Elder

Bears Power is used to estimate power of the Bears (Sellers). Bears Power estimates the balance of power between the bulls & bears.

This indicator tries to spotting if a bearish trend will continue or if the trading price has reached a point where it might reverse.

Calculation

A Currency Price bar has four parameters: the Opening, Closing, High & Low of the price bar.

Every price bar either closes higher or closes lower than the previous and prior price bar.

The highest price will mark and show the maximum power of the Bulls within a trading period.

The lowest price will mark and show the maximum power of the Bears(Sellers) within a trading period.

This indicator uses the Low of the price and a Moving Average MA (Exponential Moving Average)

The moving average(MA) illustrates the middle ground between sellers & buyers for a certain price period.

Therefore:

Bears Power = Low Price - Exponential Moving Average

FX Analysis and How to Generate Signals

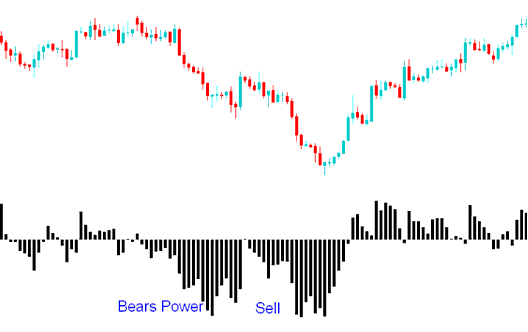

Sell Trade Signal

A sell trading signal gets generated/derived when the oscillator trading goes below Zero.

In a downtrend, the LOW is lower than EMA, so the technical indicator is below zero and Histogram Oscillator is located below zero line.

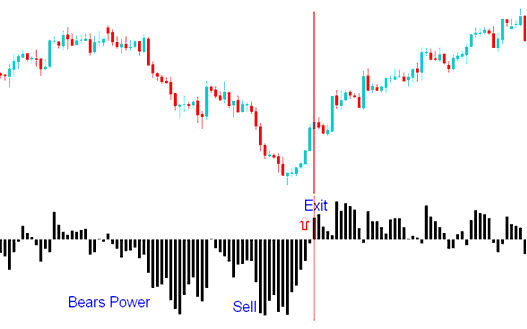

Exit Signal

If the LOW goes above EMA it then means that prices are beginning to rise, the histogram rises above zero line.

The Triple Screen method for this indicator suggests that spotting the price trend on a higher chart time frame interval (like daily timeframe) & applying the bears power signals on a lower chart time frame interval (like hourly timeframe). Signals are traded and transacted according to the lower timeframe but only in direction of the longterm trend in the higher chart time frame.

More Courses & Courses:

- NKY 225 Indices Strategy Example

- How Can I Analyze/Interpret Chart Analysis using Systems?

- How to Set Volumes Trading Indicator in Chart in MetaTrader 4 Platform Software

- Moving Average XAU/USD Indicator Analysis in XAUUSD

- FX Trading Bears Power MT4 Platform

- How Can I Find MetaTrader 4 SMI20 Index Trade Chart?

- Different Strategies for Forex Trading Risk Management

- Buy Limit Order and Sell Limit Order

- Course for Trading FTSEMIB 40 Index