What is FTSE MIB 40 Strategy? - Tutorial Guide to FTSE MIB 40 Stock Index

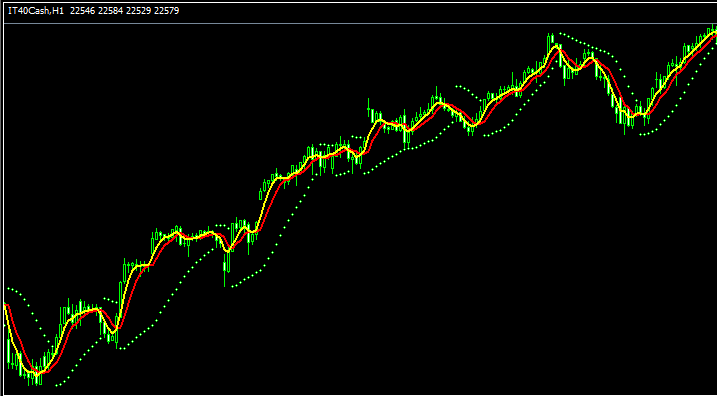

The FTSE MIB 40 Index Trade Chart

The FTSEMIB40 Index chart is displayed & portrayed above. On the above illustration this financial instrument is named IT 40CASH. You want to search and find a broker who offers FTSE MIB 40 Stock Index chart so that as you can start to trade it. Example displayed and shown above is of FTSEMIB 40 Stock Index on the MT4 Forex Platform Software.

Strategy of Trading FTSE MIB 40 Index

The FTSE MIB 40 Index usually goes up over a long time because the stocks picked are from the best parts of the Italian economy, so this index will likely keep rising over time because these economic areas will be successful.

As someone wanting to trade this stock index, you should lean towards the price of the market going upwards for this index.

Buy as the index climbs. Italy's economy does well most times, so uptrends dominate. A smart plan is to buy on pullbacks.

During Economic SlowDown and Recession

During periods of economic contraction and recession, corporations tend to report diminished revenues and earnings, slower profit generation, and reduced growth forecasts. For this precise reason, traders will typically divest shares in companies reporting weaker profits, causing the indices that track these specific stocks to decline in value.

During downward-trending markets, traders should align their strategies to reflect these broader trends. Identifying and adapting to prevailing conditions can significantly improve trading outcomes.

Contracts and Specifications

Margin Required for 1 Lot - € 250

Value per Pips - € 1

The IT40CASH pip is worth €1 per lot. Compare that to DAX or EUROSTOXX 50 at €0.1 each. But this index moves fewer pips on average than those others.

NB: Even though general trend is in general moves upward, as a trader you've got to consider and factor in the daily market price volatility, on some of the days the Indices may oscillate or even retrace and pull back, market retracement move may also be a large one at times & hence as a trader you need to time your entry strictly using this strategy: Index strategy and at the same time use proper & appropriate money management strategies & guidelines just in case there's unexpected market volatility. About money management guidelines/strategies in indices trading lessons: What is Index money management techniques & guidelines and equity management system.

Explore Further Instruction Sets & Programs: