MA Analysis & Moving Average Signals

An analytical tool that computes the arithmetic mean value of prices (or any designated series of data points) across a pre-established time frame.

The only big thing that makes the different kinds of MAs different is how much weight they give to the newest price info. Simple MAs give all prices the same weight. Exponential and weighted averages give more weight to recent prices.

Interpretation

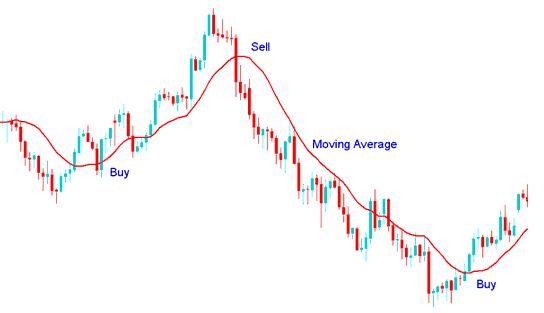

The main way to study moving averages is by checking how the average price relates to the actual price. You get a buy signal when the price moves above its moving average. A sell signal appears when the price falls below the moving average.

Moving Average Indicator

Buy & Sell generated by Moving Average crossing above or below the price action.

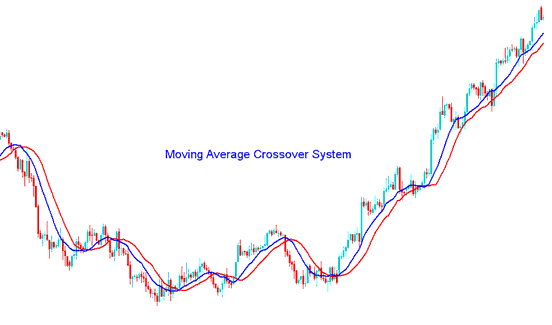

Moving Average Crossover Method

MA crossover strategies pull in many fans. They feature two or more MAs crossing up or down. Traders might mix in extra indicators for buy or sell cues. Setup rules offer near-limitless mixes.

Moving Average Crossover Method

Learn More Guides and Lessons:

- Forex Chandes Momentum Oscillator Expert Advisor Setup

- Ways to Trade US30 Stock Indexes

- Instructions for Implementing the MT4 T3 Moving Average Indicator in MT4 Software

- Gold Indicators for Stop Loss Placement on XAU USD Charts

- Utilizing the Strategy Tester Feature within MetaTrader 4 for Simulation Testing

- Understanding the Roles of Base Currency and Quote Currency in Foreign Exchange (FX)

- Stochastic Momentum Indicator on the MT4 Platform

- Guidelines for Trading Gold

- Gann Swing Oscillator Trading Indicator for MetaTrader 4

- Developing an Index Trading Plan