How To Trade Gold

Within the sphere of online gold trading, a participant has the choice to either purchase or liquidate gold contracts to realize profits.

A trader will purchase gold if they anticipate that the value of xauusd will increase against the US dollar, or they may sell gold if they expect the price of xauusd to decrease against the dollar.

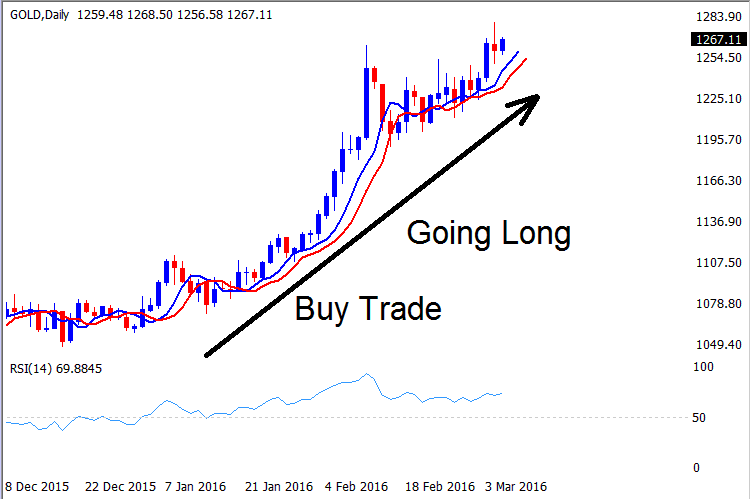

Buy Trade - Going Long

If the cost of gold is increasing, then those who trade will purchase gold. This action can also be known as taking a long position. Taking a long position simply means that you are buying.

In the preceding trade illustration, when gold prices were ascending, a trader would initiate a buy position, as depicted. This action is termed 'going long,' and the gold trader would maintain this open buy position for as long as the upward trajectory of prices persists.

The price direction for gold will maintain an upward trajectory as long as both moving averages trend higher. The purpose of using two distinct moving averages is to illustrate the prevailing price direction, commonly termed the trend. The technique involving dual moving averages is referred to as the moving average crossover strategy. A faster (shorter period) moving average and a slower (longer period) moving average - for instance, a 5-period MA and a 7-period MA - are combined to form this system for determining the overall inclination of gold prices. At any specific moment, these moving averages will either be ascending or descending: conversely, during periods of market consolidation, the moving averages will move laterally, signaling that prices are neither advancing nor retreating.

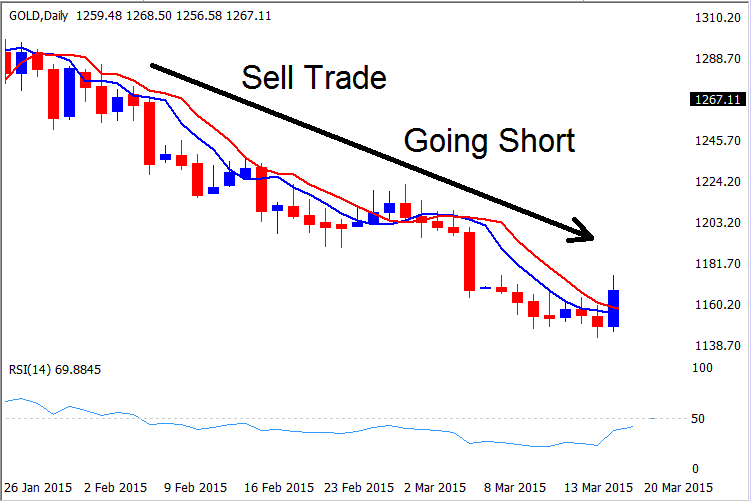

Sell Trade - Go Short

When the xauusd prices are going in a downward direction, then traders will make a move to sell gold. This also is known as going short. Going short is just selling.

In the preceding trade illustration, the XAU/USD prices are observed to be descending, which is confirmed by both moving averages trending lower. A trader would initiate a sell transaction: this action is termed "going short." The trader would maintain this short position open for as long as the price trajectory continues downward.

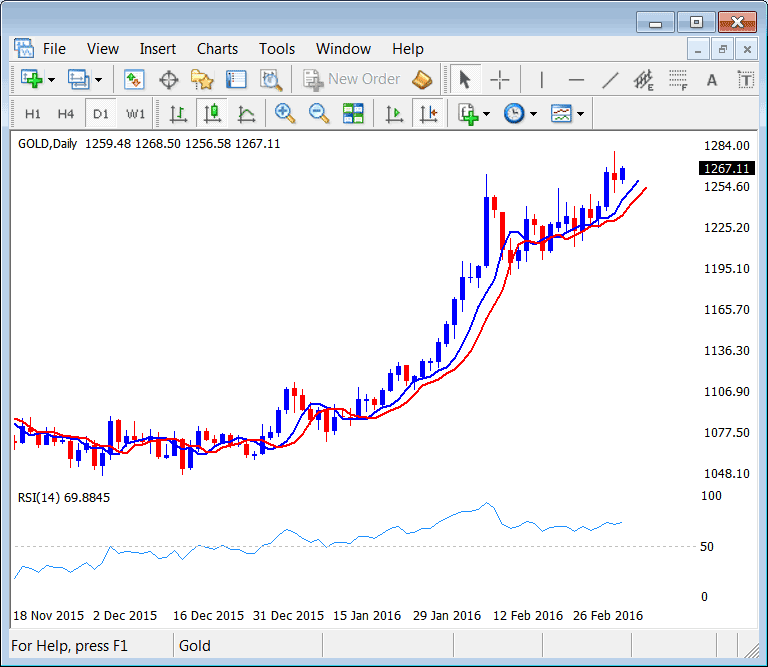

Gold Charts

Now that as trader you know when to buy and when to sell gold, the question is how to sell or where to place the buy or sell trade.To do this a trader will use the gold charts provided. A xauusd chart will represent the movement of gold prices & draw this using a graphical format which can be used by technical traders to analyze the xau/usd price movement.

The xauusd/gold chart presented above, which is the daily trading chart, illustrates the rising trajectory of gold prices from $1048 per ounce to $1267 per ounce between November 2015 and February 2016.

The vertical axis marks prices. The horizontal axis marks dates and times. A chart shows the XAUUSD price and how it moves. This chart points to rising prices. Traders study such movements to pick trade directions. In the sample chart, rising prices mean a gold trader buys XAUUSD and holds a long position.

You can start a trade to buy or sell directly from this chart. If you right-click anywhere on the chart, a menu will show up, and the online trader can pick the option to start a new order and begin a trade.

Calculating Profit

When trading gold, profit is determined by the price change: the difference between the price when a gold trader starts a trade and when they finish it is used to calculate the profit.

In the example above where xauusd prices went from $1048 per ounce to $1267 dollars per ounce, if a trader bought at $1060 dollars per ounce and sold at $1260 per ounce, the difference would be $200.

Because gold is traded in lots of 100 ounces, then trading one contract/lot of xauusd will mean that for every one dollar move per ounce the trader makes $100 dollars because they will not be trading a single ounce but they will be trading 1 lot of xauusd which is equal to 1 hundred0 ounces of gold. Hence, it means the $1 dollar per ounce move will be multiplied by 100.

This means that is a trader had bought 1 lot of xauusd at $1060 per ounce and closed the trade at $1260 dollars per ounce, where the price difference would be $200 dollars. Then $200 dollars difference multiplied by $100 profit per $1 dollars move, then this would mean the online trader would have made $20,000 in profit from this trade position.

To acquire one standard lot of gold, which equals 100 ounces, at a price of $1,050 per ounce, a XAUUSD trader would theoretically require $105,000 in trading capital ($1,050 per ounce multiplied by 100 ounces). Since this capital level is inaccessible to most retail traders, gold brokers offer leverage, allowing traders to operate using borrowed funds. Standard leverage of 100:1 enables traders to borrow capital up to 100 times their own deposit. Consequently, to initiate a one-lot position in gold, a trader only needs to deposit $1,050 into their account. Employing the 100:1 leverage, this deposit grants control over capital valued at $105,000 (calculated as $1,050 multiplied by 100).

XAU/USD Platform Software

You can find gold price charts on the xauusd platform that gold trading brokers provide. This platform is what traders use to connect to their brokers and make trades in the online gold market.

The platform draws price charts for online traders and automatically calculates profits and losses on open trades. You don't have to crunch the numbers yourself - the platform takes care of it.

You can get the trading platform software from the xau/usd broker's site, and traders can find out how to work the software with a demo account.

Demo Demo Account

Demo practice trade account is a practice account which traders use to learn the trading platform & how to open and close trades without the need to of investing their own money. The money used on this account is virtual and traders can practice trading with the virtual funds until they learn enough about xauusd trading. Once traders gain enough knowledge and experience to help them make profits then the online traders then can decide to open a real gold account & begin trading xauusd online.

Live XAUUSD Account

The live gold trading account is the operational account market participants utilize for speculating on XAUUSD/gold within the digital trading environment. A gold trader executes transactions using actual capital within this account: they must first fund it with a deposit. Following this, online traders can establish gold trade positions in the market via this account, and any resultant profits or losses are reflected therein.

Study More Courses and Courses:

- What's GBP/SEK Spreads?

- The Forex Morning Trades are When Most Forex Trades Happen

- Head & Shoulders vs Reverse Head Shoulders Pattern

- Guide to Reading a Downward XAU/USD Channel on MT4 Charts Using MetaTrader 4

- Adding MACD Indicators to Forex Charts in MetaTrader 4

- Buy and Sell Signals Generated by the Commodity Channel Index (CCI)

- What Does FX Market Trading Involve?