Indicators for Setting Stop losses in XAUUSD

Some indicators help you set stop loss orders automatically, so you don't have to stress over complicated calculations.

A systems trader can also set a stoploss order based on these technical indicators. Some indicators use math to figure out where the trade order stop loss should be set to provide the best exit. These technical indicators can be used to set stoploss orders. These indicators watch how the price of something changes and mark the limits within which prices should move. When the price goes outside these limits, it's then best to close your open trades because the price is no longer moving in that direction.

Some of the Trading indicators that can be used to set stop losses are:

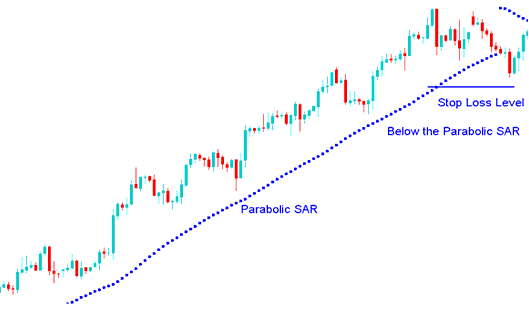

Parabolic SAR Indicator

The Parabolic SAR functions akin to an indicator for automatically setting both Stop Loss and Take Profit orders, employed to trail a price stop loss.

Parabolic SAR provides excellent exit points.

In an upwards trend, you should close long trade positions when the price falls below Parabolic SAR technical indicator

During a declining trend, short positions should be liquidated when the price ascends above the level indicated by the Parabolic SAR indicator.

When you hold a long position with price above the Parabolic SAR, this indicator climbs each day. It rises no matter the price direction. The climb size matches how much price shifts.

Parabolic SAR Indicator: An Indicator Capable of Automatically Setting Stop Loss and Take Profit Orders

Picture of parabolic SAR & how it's used

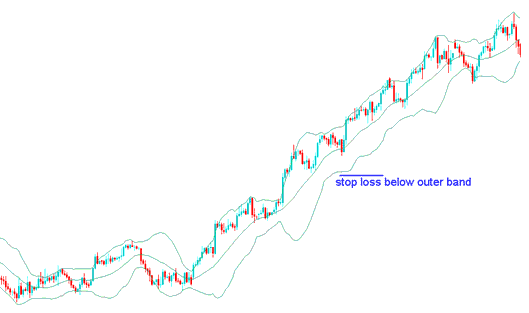

Bollinger Band

Bollinger Bands rely on standard deviations to gauge market ups and downs. This indicator measures volatility. The bands adjust on their own. They spread out when action heats up. They tighten when things calm down.

Bollinger Bands include three lines that cover most price moves. The middle line tracks the medium-term price trend. It often uses a 20-period simple moving average. This line forms the base for both the top and bottom lines. The space between the top line and middle, or bottom and middle, depends on how much the market swings.

As the price activity is covered by these Bollinger Bands, traders may utilize them to establish stop losses just outside of the band levels.

Setting the Stop Loss Order Level with Bollinger Bands - Technical Indicator Analysis

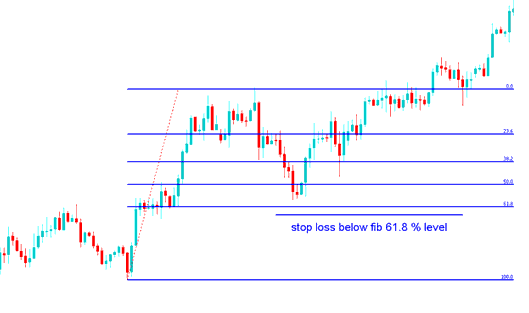

Fibonacci Retracement Levels Indicator

Fibonacci retracement levels indicate support and resistance areas that can be used for setting stop loss zones.

The Fibonacci Retracement level at 61.8 - The most popular level for placing stop losses is 80%. Place a stop-loss order just below 61. 80% Fibonacci retracement level

The 61.80% Fibo retracement level is utilized as a technical benchmark for setting these specific orders, owing to its infrequent attainment.

Fibo Indicator StopLoss Order Setting at 61.8% Retracement Level

Fib retracement level 61.8% - Fib Technical Indicator

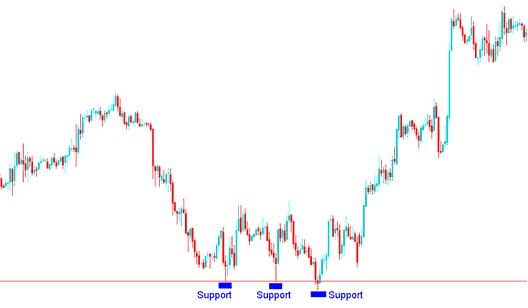

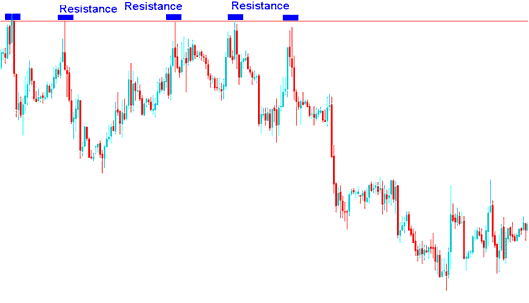

Support and Resistance Areas Lines

Support and resistance areas can be used to decide where to put stop-loss orders: the stop-loss orders are placed just above or below them.

- Buy Trade - Stop-Loss Order set just a few pips below the support

Buy Trade - StopLoss set few pips below the support

- Sell Trade - Stop Loss Order set a few pips above the resistance

Sell Trade - Stop-Loss Order set few pips above the resistance

Study More Guides & Lessons: