Swing Pivot Points Technical Analysis Signals

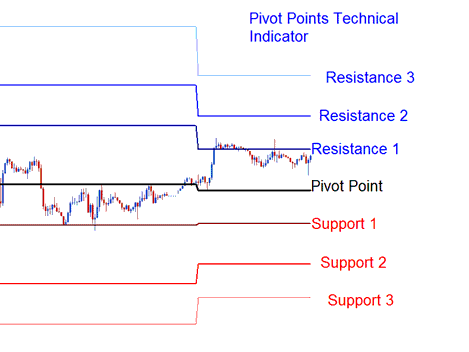

Pivot Point Indicator consists of a central pivot which is surrounded by 3 resistance levels above and Three support levels below the center pivot.

Pivot Point Indicator is regarded to be leading trading indicator.

Pivot Point Indicator provides a quick method for traders to analyze & interpret the general market trend and analyze how the market is going to be moving during the day. A few calculations are used to plot the resistance and support zones for the pivot point.

To calculate these support & resistance levels for coming day - the previous day's

- high,

- low, and

- closing prices are used

The trading day closes at 5:00PM EST and this daily closing time is when Pivot Points is updated.

The 24 hour cycle for this Pivot Points are calculated using a complex formula - the central pivot is then used to calculate the support & resistance levels as follows:

Resistance 3

Resistance 2

Resistance 1

Swing Pivot Points Analysis

Support 1

Support 2

Support 3

Pivot Point Indicator - Analysis

Pivot Point Indicator can be used in different strategies to generate signals. Following strategies are the most oftenly used analysis strategies:

Pivot Points Trend Identification

The center pivot point is used by the FX traders to identify the trend direction. The trades opened by traders will be only in the direction signal of the trend.

- Buy signal - bullish market trend - price is above the center pivot point

- Sell signal - bearish market trend - price is below the center pivot point

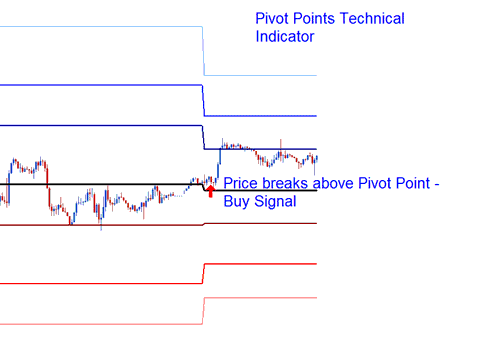

Pivot Point Indicator Price Breakout Signals

Price breakout signals are derived/generated as follows

- Buy signal gets generated/derived when the price breaks upward through the center pivot point.

- Sell signal gets generated/derived when the price breaks-out down-ward through the central pivot point.

Pivot Points Price Break-out

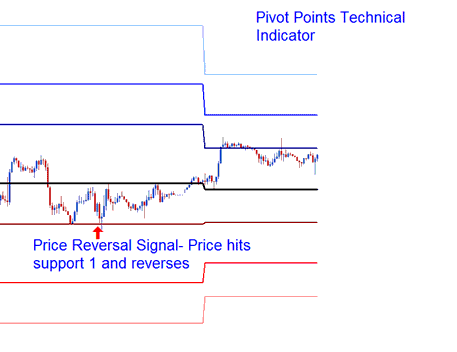

Pivot Point Indicator Price Reversal Signal

Pivot Point Indicator Price reversal setups are derived/generated as follows

Buy signal - when the price moves downwards towards one of the pivot point levels indicator support level, then touches the support zones or moves slightly through this support area then quickly reverses and heads & moves upward.

Sell trade signal - when the price moving up towards one of the pivot point resistance level, then touches resistance level or moves slightly through this resistance area then quickly reverses and moves downward.

Pivot Points Price Reversal Signal

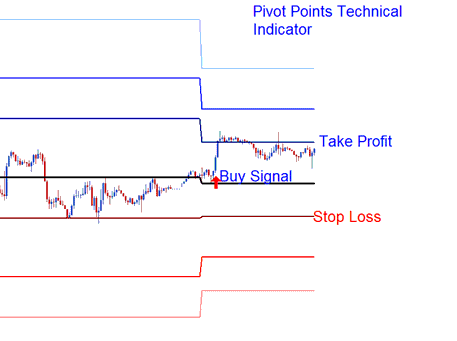

Placing Stoploss and Take Profit Levels

The central pivot-point and the other support levels & resistance levels of this pivot points indicator are used by the FX traders to identify suitable stop loss setting levels and take profit areas.

Setting StopLoss Levels and Setting Take-Profit Levels

If a buy order is placed above the central pivot point the Resistance 1 or Resistance 2 can be used to set the take profit level, and the Support 1 can be used to set the Stop Loss Level for the position.

To download Swing Trading Pivot Points Indicator: https://c.mql5.com/21/9/pro4x_pivot_lines.mq4 Once you as a trader download the Pivot Point Indicator - open the technical indicator with MQL4 Language Editor, Then Compile Pivot Points by pressing Compile Button & Pivot Points will be added to your MT4 software. NB: Once you as a trader add Pivot Point Indicator to your MT4, the technical indicator has additional lines marked MidPoints, to remove these additional Pivot Point Indicator lines open MQL4 Language Editor(short cut key board key - press F4), & change line No. 16 from: extern bool mid pivots = true: to extern bool mid pivots = false: Then Press Compile again, & Pivot Points will then be shown as precisely displayed on this website.

Get More Topics and Tutorials:

- What is William Percent R Indicator?

- Morning Star Candlestick, Evening Star Candlestick and Engulfing Pattern Candlestick

- Fundamental Analysis for Trading Forex Tutorial

- How to Add Ehlers Fisher Transform Technical Indicator in Chart

- MACD Fast Line Crossover and Center Line Crossover XAUUSD Signals

- How to Trade DAX 30 Index for Beginner Stock Index Traders

- Inverted Hammer and Shooting Star Candles

- Chande Momentum Oscillator Technical Indicator

- How to Analyze/Interpret Trend Reversal Technical Analysis

- Indices Trade Strategy using RSI Index Trading Indicator