Morning Star, Evening Star, and Engulfing Patterns on XAUUSD Charts

Morning Star Candlestick

Trading Analysis of the Morning Star Candlestick Pattern

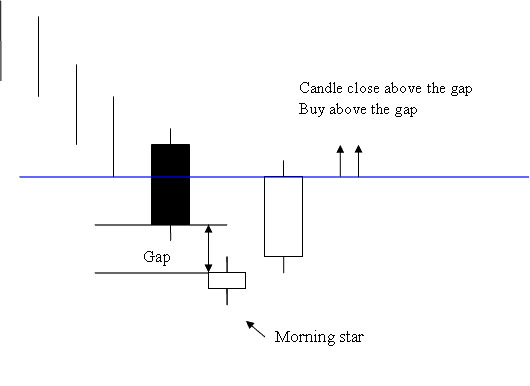

Morning star pattern is a three day bullish price reversal candlestick pattern.

The first day is a long black candle.

The second day is a morning star that gaps away from the long black candle.

Third day is a long white candlestick that fills the gap.

The successful filling of this price gap, coupled with the subsequent closure of a white candlestick above the gap area, strongly signals bullish momentum.

Investors and traders should initiate a buy position once the market closes above the gap setup of the morning star candle pattern. This serves as the confirmation signal for the buy signal generated by this morning star candle pattern.

Evening Star Candlestick

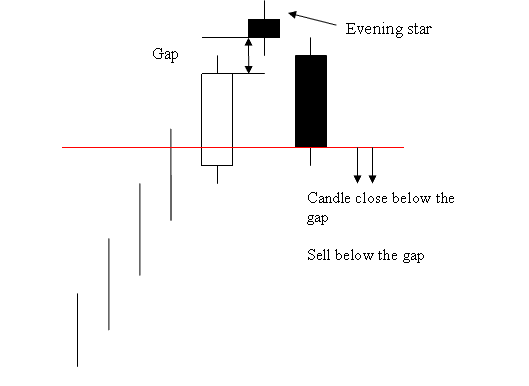

The evening star candle represents a market trend that is contrary to that of the morning star candlestick.

Technical Analysis of Evening Star Candlestick Pattern

Evening star pattern is a three day bearish price reversal candlestick pattern.

The first day is a long white candlestick.

The second day is represented by the evening star, which gaps away from the long white candlestick.

Third day is a long black candlestick that fills the gap.

The filling of the gap and remaining of the black candlestick underneath the space is a sturdy bearish.

Investors & Traders should start a sell trade when market prices go below the gap created by the evening star candle pattern. This confirms the sell signal that comes from the evening star candle pattern.

Engulfing Pattern

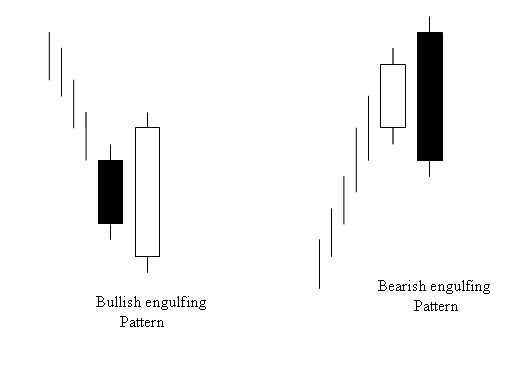

The engulfing pattern is a reversal candle formation that can indicate either a bullish or bearish trend, depending on whether it appears at the conclusion of a market downtrend or at the end of a market uptrend.<

Technical Analysis of Bullish and Bearish Engulfing Patterns

The color of the first candle indicates the trend of the day.

The second candlestick should completely cover the first one and should be the opposite color of the market trend.

For a Bullish Engulfing pattern, the candlestick should be blue. For a Bearish Engulfing, it needs to be red.

Get More Tutorials and Lessons:

.