S & P 500 Index - Standard and Poor's 500 Index

The Standard and Poor's 500 Index serves as a benchmark stock index reflecting the total market value of the five hundred stocks representing key sectors within the United States economy. The constituent list of these 500 companies includes equities listed on both the NYSE and NASDAQ exchanges.

Similar to the Dow Jones Industrial Average Index, the S&P 500 exhibits greater volatility than the majority of other Top Indices. The S&P 500 index is projected to trend upward in the long term, yet it will experience more price pullbacks and periods of consolidation than other indices. Traders who are more comfortable with trading the more dynamic and robust trends found in other leading indices may opt for those alternatives.

One reason this stock index changes more than others is that it includes more individual stocks than other indexes do. Also, the way this index is calculated involves a weighting factor, which also makes the index change more frequently.

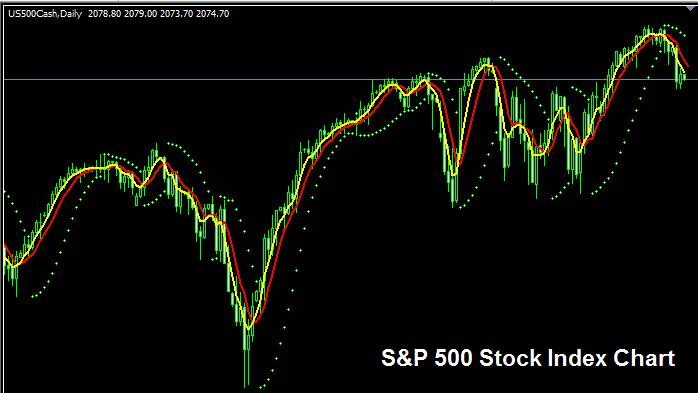

The S & P 500 Index Chart

The S&P 500 Index chart is shown above. On the illustration shown above this trading instrument is named as US500CASH . As a fx trader you want to look for & find a broker who offers the this The S&P 500 Index chart so that you can start to trade it. The example above is of S&P 500 Index on the MT4 FX and Indices Software .

Other Info about S & P 500 Index

Official Symbol - SPX:IND

The 500 component/constituent stocks which make up the S&P 500 Index are picked from the major industries in the American economy. The calculation of this index is however different compared to the other Indices: the price component of the 500 shares also has got a weighting factor that makes this index more volatile than others.

Strategy for Trading S & P 500 Index

The calculation method of the S&P 500 Index contributes to its increased volatility, resulting in more significant fluctuations in its price movements. Despite this, the index tends to rise over the long term, reflecting the robust growth of the US economy, which is the largest economy globally.

As a forex trader interested in this index, you should be ready for larger price fluctuations and greater volatility.

As a participant trading stock indices, your strategic bias should favor buying as the index advances upwards. When the US economic and business landscape is robust and performing well (which is often the case), this prevailing uptrend is highly likely to maintain its dominance. A sound strategy in this scenario involves capitalizing on pullbacks by purchasing them.

Contracts and Specifications

Margin Required for 1 Lot/Contract - $ 12

Value per 1 Pip(Point) - $ 0.1

Note: Even though the general and overall trend is in general upwards, as a forex trader you have got to factor in the daily market volatility, on some of the days the shares & stocks may oscillate or even retrace, the retracement may also be substantial sometimes & hence as a forex trader you need to time your trade entry precisely using this strategy: Stock indices strategy and at the same time use the suitable and proper and suitable money management rules & guidelines just in case of more unexpected market trend volatility. About equity management guidelines & strategies lessons: What's money management and money management methods.

More Lessons:

- EURRUB Opening and Closing Hours Explained

- How Can I Set USDPLN Chart to MT4 Software Platform?

- Learn Trading Basics of Forex Strategies

- Analyzing XAUUSD Parabolic and Momentum Trends

- Stochastic Overbought and Oversold Levels Used for Generating XAUUSD Signals

- MetaTrader FTSE MIB Indices FTSE MIB 40 MT4 FX Trade Platform

- Configuring the Acceleration/Deceleration Indicator in MetaTrader 5

- How do you use the Relative Vigor Index (RVI) indicator in MetaTrader 5?

- Defined Trading Strategies for the US TEC 100 Index

- Status Bar Information for Gold Connection in MT4