How to Set True Strength Index on MetaTrader 4 Charts - Adding MT4 TSI Indicator

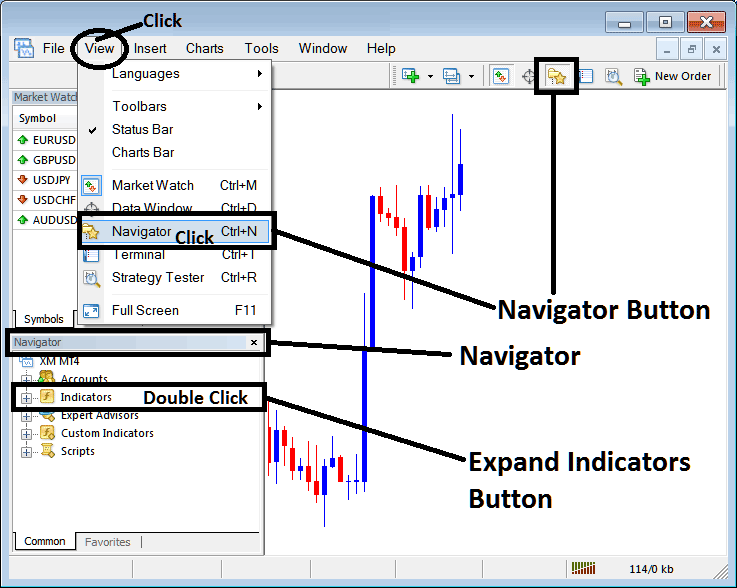

Step 1: Open the Navigator Panel on Trading Platform

Open Navigator panel as shown and illustrated below: Go to 'View' menu (click on it), then select 'Navigator' window panel (press), or From Standard Toolbar click 'Navigator' button or press key board short cut keys 'Ctrl+N'

On Navigator window, select and choose 'Technical Indicators', (Double-Click)

How Do I Add True Strength Index TSI on the MT4 - MT4 True Strength Index TSI Indicator

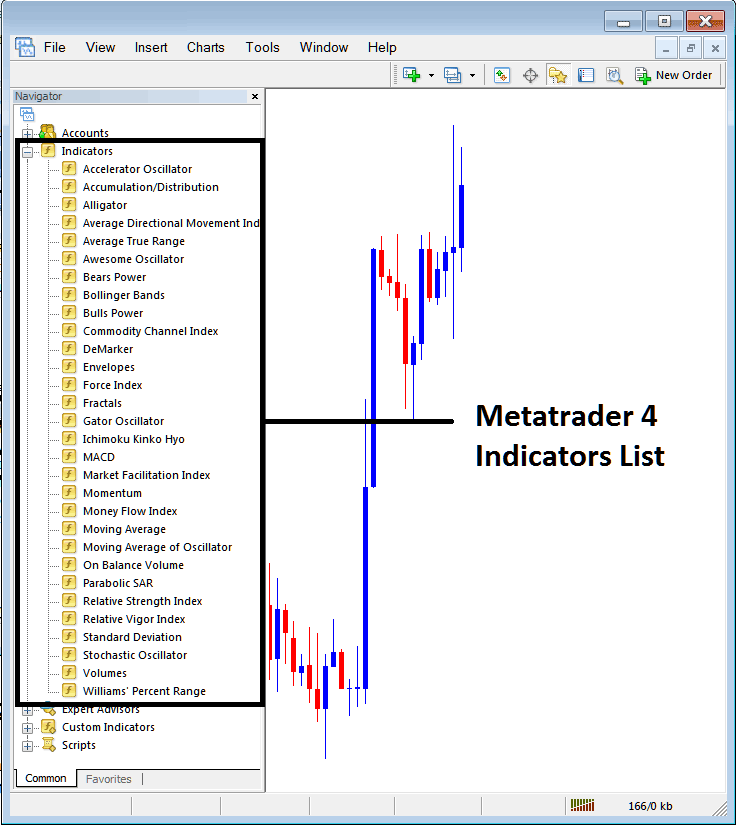

Step 2: Expand the Indicators Menu on the Navigator - Adding True Strength Index TSI MT4 Indicator

Expand this menu by clicking the enlarge tool/button sign mark '+' or doubleclick the 'indicators' menu, after which the button will appear and be shown as (-) & will now display a list just as shown below - select the True Strength Index TSI forex chart indicator from this list of indicators so that to add the True Strength Index TSI on the chart.

How Do You Add True Strength Index TSI - From the Above window you can then place True Strength Index TSI that you want on the chart

How to Set Custom True Strength Index TSI to MT4

If the indicator you want to add is a custom technical indicator - for example if the True Strength Index TSI you want to add is a custom indicator you'll need to first add this custom True Strength Index TSI on the MT4 software & then compile custom True Strength Index TSI so that as the newly added True Strength Index TSI custom technical indicator pops up on the list of custom technical indicators on MetaTrader 4 software.

To learn how to install True Strength Index TSI indicators in MT4 Platform, how to add True Strength Index TSI panel to MT4 and how to add True Strength Index TSI custom indicator in the MT4 Software - How to add a custom True Strength Index TSI in MT4 Platform.

About True Strength Index (TSI) Example Explained

True Strength Index (TSI) Analysis and TSI Signals

Developed & Created by William Blau

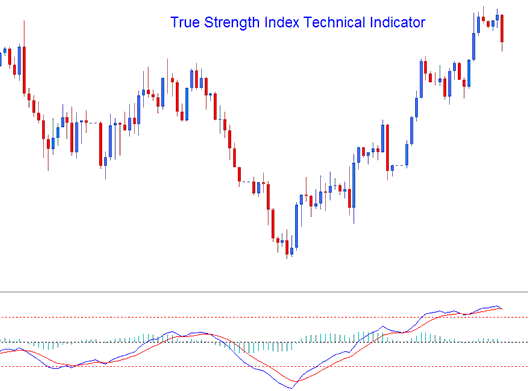

TSI is a momentum indicator. The TSI is plotted/drawn by using a momentum calculation which reacts faster & is more responsive to the price changes, making it a leading technical indicator that follows the price action direction closely in the market.

The TSI is drawn as a blue line, the indicator also draws a signalline which is plotted as a red line, & these 2 lines are used to generate crossover signals.

TSI also draws a histogram which illustrates and shows the difference between the TSI Line & the Signal line. This histogram crosses above/below the center-line, histogram levels above the center-line shows a bullish crossover signal, while center-line levels below the centerline shows a bearish crossover signal.

FX Analysis and How to Generate Signals

The TSI uses various different methods & techniques to generate trade signals. This indicator can be used just in the same way as the RSI to determine the general trend direction of the currency markets. Overbought and over-sold levels can also be shown using TSI. The most regular methods of generating trading signals are:

Zero line Crossover (Histogram crossover not Lines Trading cross over )

- Buy - when the histogram crosses above 0 a buy signal gets generated

- Sell - when the histogram crosses below 0 a sell signal is generated

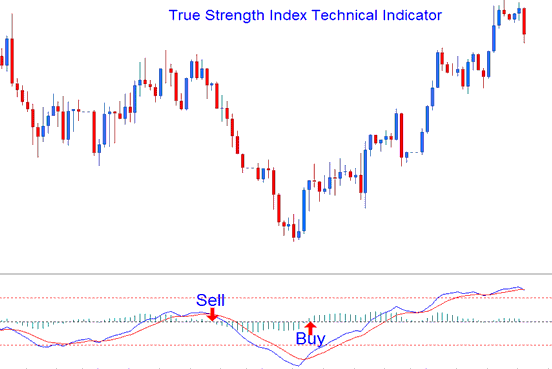

Signal line Crossover

- A buy gets generated/derived when the TSI line crosses above SignalLine

- A sell is generated/derived when the TSI Line crosses below the SignalLine

This signal is the same as the one above and the timing corresponds with the time when the histogram crossover happen.

Divergence Trading

Divergence is used to look for potential trend reversal point of a forex currency pair. The reversal divergence setups are:

Classic FX Divergence Trading Setup

Classic Bullish Divergence: Lower lows in price and higher lows in the indicator

Classic Bearish Divergence: Higher highs in price and lower highs in the indicator

Divergence trading also can be used in spotting potential trend continuation points in the price action direction. The continuation divergence trade setups are:

Hidden Divergence Trading Setup

Hidden Bullish Divergence: higher lows in price and lower lows in the indicator

Hidden Bearish Divergence: lower highs in price and higher highs in the indicator

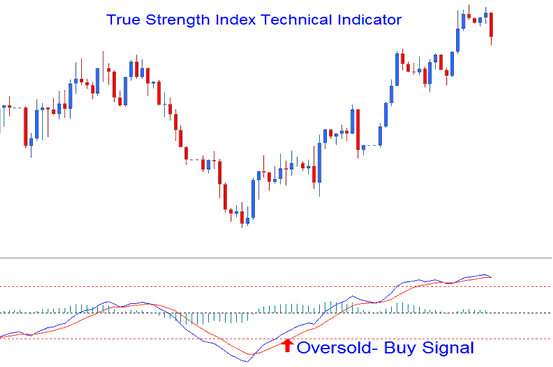

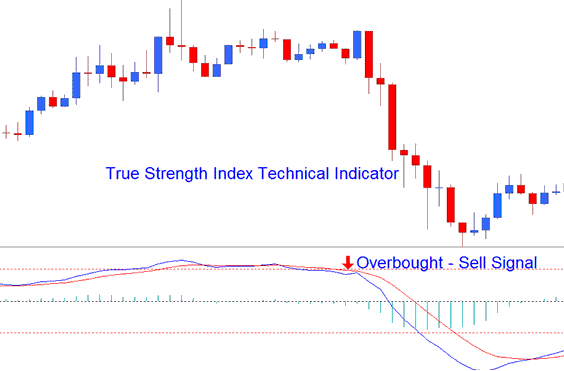

Over-bought/Oversold Levels in Trading Indicator

This can be used to identify overbought & oversold conditions in price action movements.

- Overbought condition - levels being higher than the +25 level

- Oversold condition - levels being lesser than the -25 level

Trades can be derived & generated when TSI crosses these levels.

Buy trade signal - when the levels cross above -25 level a buy gets generated.

Sell trade signal - when the levels cross below +25 level a sell signal is generated.

Oversold - Buy Trading Signal

Overbought - Sell Signal

The overbought/oversold levels are indicated using horizontal lines drawn/plotted at the +25 & -25 levels.

Learn More Courses & Guides:

- US 500 Index in MetaTrader 5 Software

- How to Add Awesome Oscillator Gold Indicator to MT4 Charts

- Decoding Support and Resistance Indicator Utilization

- Forums for Traders of XAUUSD Listed

- How to Trade RSI Swing Failure in Upward and Downward Stock Index Trends

- What is the Value of 20 Pips for Mini Trading Account?

- Understanding Consolidation Patterns and Symmetrical Triangles in XAUUSD Patterns

- How to Get MT4 FX Trading FX Pairs List

- Dow Jones 30 Index: Making Sense of the Trade Chart

- Insert Cycle Lines, XAUUSD Chart Text Label in XAUUSD Charts on MT4 Platform Software