How to Set McClellan on MetaTrader 4 Charts

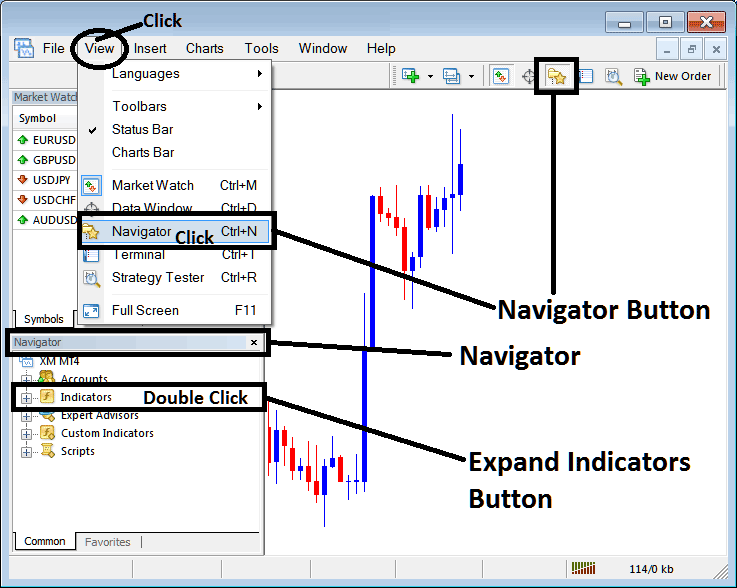

Step 1: Open the Navigator Panel on Trading Platform

Open Navigator panel like is shown below: Go to the 'View' menu (click on it), then select 'Navigator' panel window (click), or From Standard ToolBar click 'Navigator' button or press key board short cut keys 'Ctrl+N'

On Navigator window, choose & select 'Indicators', (Double Click)

How Do You Add McClellan in the MT4 Software - MT4 McClellan Indicator

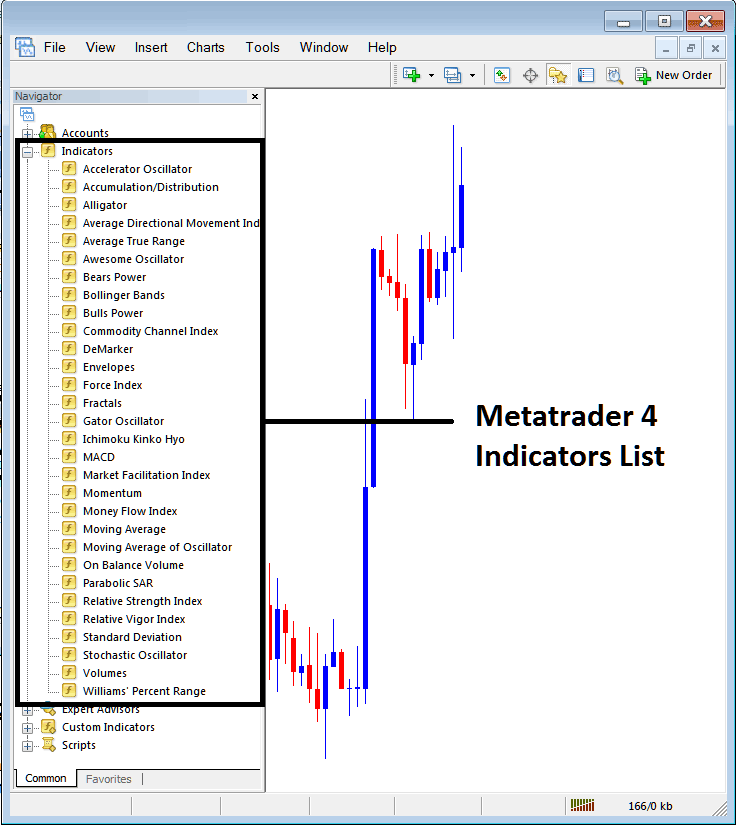

Step 2: Open the indicators menu in navigator - Adding McClellan Oscillator to MT4

Make this menu bigger by clicking the expand (+) tool/button sign ( + ) or double-clicking the 'indicators' menu: after that, this button will show up as (-) and will then show a list like the one below. Pick the McClellan Oscillator technical indicator from the list of indicators to put the McClellan Oscillator indicator on the chart.

How to Add the McClellan Indicator - From the window shown above, you can add the McClellan Oscillator indicator to the chart.

How to Set Custom McClellan to MT4

If the indicator is custom, like the McClellan Oscillator, add it to MT4 first. Then compile it. This makes the new McClellan Oscillator appear in the custom indicators list on the platform.

How to add a custom McClellan Oscillator indicator in the MT4, how to install McClellan Oscillator indicators on the MT4 platform, and how to add a McClellan Oscillator indicator panel to the MT4 are all topics covered in this course.

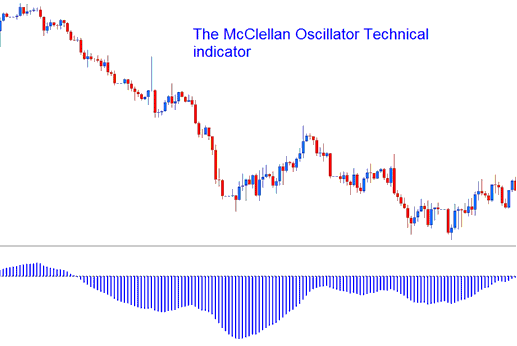

McClellan Oscillator Indicator - here's a quick example to show how it works.

Using McClellan Oscillator for Market Analysis and Trade Signals

Developed & Created by McClellan.

The McClellan Oscillator smooths the gap between up and down candles. It looks much like the standard MACD.

McClellan Oscillator Indicator

Technical Analysis and How to Generate Signals

The Oscillator is a momentum tool traded similarly to the MACD. The McClellan Oscillator offers three specific methods for generating trading signals.

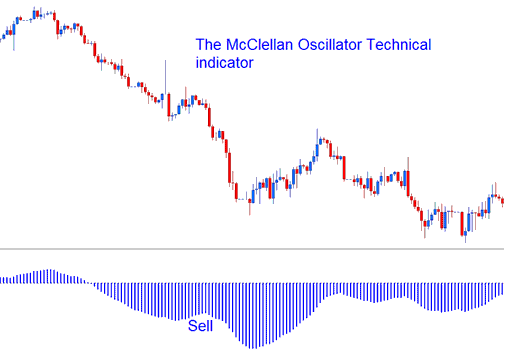

Zero Center-Line Crossover Signals:

Buy Signals - A buy signal happens when the tool crosses above the zero line on the chart.

Bearish Signals- When the oscillator technical indicator crosses below zero center line a sell trading signal is given/generated.

Technical Analysis in Forex Trading

FX Divergence Signals:

Looking for divergences between the McClellan Oscillator & price can prove to be very effective in spotting the potential reversal and/or trend continuation points in price movement.

There are several types of divergences:

Classic Divergence ( Regular Trade Divergence )

- Bullish Divergence: Lower lows in price action & higher lows on the McClellan Oscillator.

- Bearish Divergence: Higher highs in price & lower highs on the McClellan Oscillator Indicator.

Hidden Divergence Setup

- Bullish Divergence: Higher lows in price action and lower lows on the McClellan Oscillator.

- Bearish Divergence: Lower highs in price action & higher highs on the McClellan Oscillator Indicator.

Over-bought/Oversold Levels in Indicator

Traders use the McClellan Oscillator to spot overbought or oversold price levels. These states show up when the tool hits far extremes and begins to shift. In a strong trend, though, it can linger in those zones for a while. Avoid using overbought or oversold points for trade signals. Rely on centerline crossovers for better entry cues.

Study More Lessons and Tutorials & Topics:

- Best Times to Trade Currency Pairs

- Method for Setting Standard Deviation on the XAU/USD Chart for Gold Market Analysis

- How to Add MACD on a Chart in MetaTrader 4 Platform Software

- MACD XAU/USD Classic Bullish Divergence and Classic Bearish XAU USD Divergence

- FX Trading Signals Using MACD Analysis

- Identifying Continuation Patterns within XAUUSD Trades

- Determining the Margin Requirement for One Lot/Contract of the HSI50 Index

- USDX Chart: How to Trade with the US Dollar Index

- Ehler Laguerre RSI Indicator Overview