How to Trade XAUUSD Using Classic Bullish and Bearish Divergence

In XAUUSD, classic divergence hints at trend flips. Traders watch for reversal spots. Prices may turn the other way. This setup offers low-risk entries and solid exits.

This low-risk method sells high or buys low. Risks stay small next to gains. But it has lots of fake outs. Few traders pick it.

Divergence in Trading is also used to predict the optimum ideal point/level at which to exit an opened/executed trade position. If you already have an opened/executed position that's already profitable, a good way to identify a profit taking and booking level would be the point where you identify this xauusd setup.

There are 2 types, based on the direction of the trend:

- Classic Bullish divergence

- Classic Bearish divergence

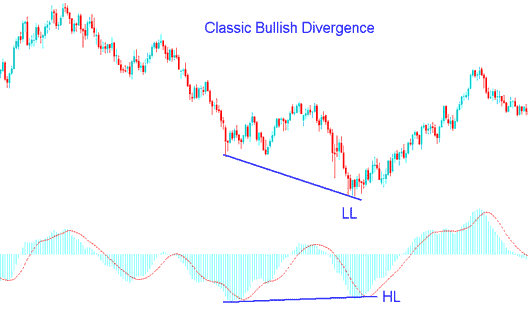

XAUUSD Classic Bullish Divergence

Standard bullish difference happens when price makes lower bottoms ( LL ), but oscillator tool makes higher bottoms (HL). The example shown and described below shows an example of this xauusd setup.

Gold Classic Bullish Divergence Setup

This example uses MACD as a XAUUSD Trading divergence indicator.

From the example above, you can see that the price made a lower low, but the indicator made a higher low. That's a clear divergence, which signals a possible trend reversal.

A classic bullish divergence trade signal serves as a caution of a potential trend reversal from a downward to an upward movement. This occurs because, although prices have increased, the impetus from sellers pushing prices lower has diminished, which is illustrated by the MACD technical indicator. This reflects a fundamental weakness in the downward trend.

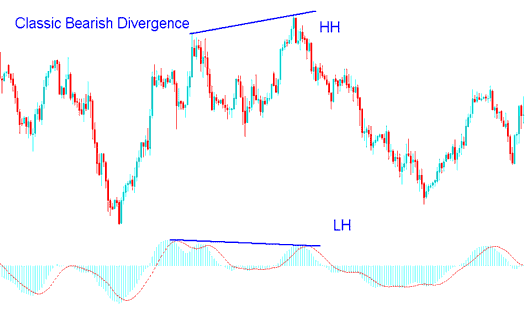

Classic bearish Divergence Setup

A classic bearish divergence trading setup arises when the price action records a higher high (HH), yet the corresponding oscillator indicates a lower high (LH). The diagram below offers a visual demonstration of this specific setup.

XAUUSD Classic Bearish Divergence

MACD indicator is also used in this example.

In the chart above, price hits a higher high (HH), but the indicator forms a lower high (LH). This gap shows divergence between price and the indicator. It hints at a trend shift.

Classic bearish diverging signal warns of a possible change in the market trend from up to down. This is because even though price headed higher higher the volume of buyers who moved price higher was less just as is displayed and illustrated by the MACD. This demonstrates underlying weakness of the upwards trend.

In the example chart shown above, a trader using divergence would spot strong signals to buy or sell at the right times. Still, these signals can lead to false moves, much like other tools. Always check them with extras like RSI, moving averages, and the stochastic indicator.

A great tool to use with normal diverging setups is the stochastic oscillator, and you should wait for the lines on the stochastic oscillator tool to move in the same direction as the divergence trading signal to make sure it's correct.

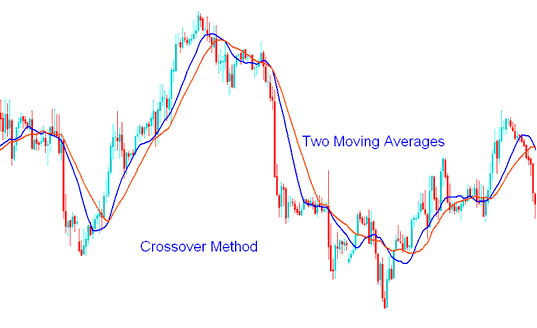

Another solid indicator to use with your strategy is the Moving Average (MA). Gold traders often combine this with the Moving Average Crossover System.

Examples of MA Cross-over Strategy Strategy

After you notice a divergence forming, wait for the Moving Average to cross over and signal the same direction. If you see a classic bullish setup, watch for the moving averages to cross upwards. For a bearish setup, wait for a downward crossover. Then, both signals agree before you trade.

By combining the classic divergence signals with other technical indicators this way, one will be able to avoid fake outs when it comes to trading the classic divergence signals, because the trader will wait til the market has actually reversed & is already moving towards this direction, hence the trader will not fall into the trap of picking the market tops & bottoms.

Explore more subjects, including how-to guides and learning resources.

- How Do You Count DJI 30 Index Pips?

- How Do You Calculate CAC40 Index Pips?

- How to Calculate Forex Leverage for 1:200 and 1:100 Ratios

- How to Calculate Leverage in Forex 1 25 and 1 100

- EUR/USD Spreads Explained

- Inverted Hammer and Shooting Star Candles

- What You Should Know About Forex: Advantages and Disadvantages

- How to Find MetaTrader 4 EURUSD Chart