Best Divergence Indicator - Divergence Indicators

Best divergence indicator is the RSI, traders can use this indicator to check divergence when trading forex currencies.

The 2 types of divergence -bullish & bearish divergence are explained below.

RSI Hidden Bullish and Bearish Divergence Trade Setups

Hidden divergence is used by the traders as a possible sign for a price trend continuation. Hidden divergence occurs when price retraces to retest the previous high or low.

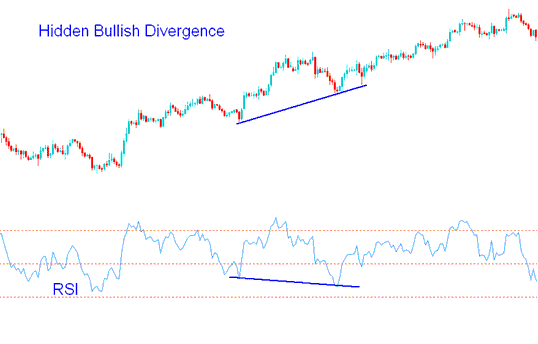

Hidden RSI Bullish Divergence Trading Setup

Forms when the price is making/forming a higher low (HL), but the oscillator technical indicator is displaying a lower low (LL).

Hidden bullish divergence in forex occurs when there is a retracement in an uptrend.

Hidden Bullish Divergence - best divergence trading indicator

This setup confirms that a retracement move is exhausted. This divergence indicates underlying strength of an uptrend.

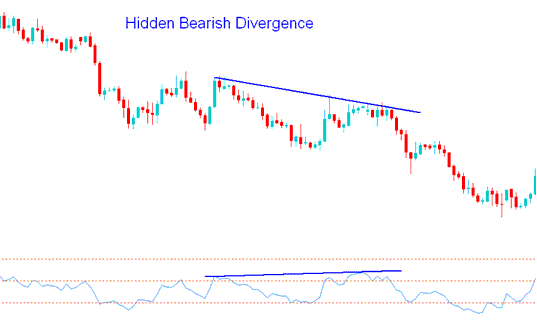

Hidden RSI Bearish Trading Divergence

Forms when price is making/forming a lower high ( LH ), but the RSI is displaying a higher high ( HH ).

Hidden bearish divergence in forex occurs when there is a retracement in a downtrend.

Hidden Bearish Divergence - best divergence technical indicator

This divergence trade setup confirms that a retracement move is exhausted. This divergence reflects the underlying strength of a down-trend.

Learn More Lessons and Tutorials and Courses:

- MetaTrader AS51 Index AS 51 MetaTrader 5 FX Software

- What's the Best XAUUSD Leverage to Use in XAUUSD for Beginner Traders?

- Hang Seng 50 MT4 Hang Seng Name on MT4 Platform

- Automated Parabolic SAR EA

- Stochastic Gold Analysis in XAUUSD

- Gold Market Session Overlaps and The Three Major Sessions

- How Can I Use Bears Power in Trading?

- How to Use MetaTrader 4 DeMarks Projected Range Indicator

- How Can I Use Linear Regression in?

- Inserting Line Studies Tools on the MT4 Trading