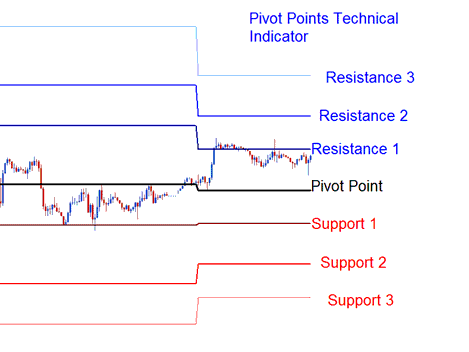

Pivot Points Technical Analysis & Pivot Points Signals

This xauusd/gold indicator has a main center point with 3 resistance points below it and 3 support points above it.

Traders originally used these points to analyze and trade equities and futures in the XAUUSD market. This indicator is seen as leading, not lagging.

Pivot points offer traders a rapid methodology for assessing and interpreting the general anticipated market flow throughout the trading session. A few straightforward calculations are employed to plot and delineate the zones of resistance and support.

To calculate these points for the coming day, the previous day's

- high,

- low, and

- closing prices are used

The trading day closes and this daily final time is whilst the technical indicator is up to date.

The 24-hour period for this trading indicator is figured out using a complicated calculation. The central pivot is then utilized to determine the support and resistance amounts in this way:

Resistance 3

Resistance 2

Resistance 1

Pivot Points

Support 1

Support 2

Support 3

XAU/USD Technical Analysis and How to Generate Trading Signals

This XAUUSD gold tool works in many ways for signals. These are the top trading checks.

XAU/USD Trend Identification Trading Signals

Online traders employ the central pivot point as a primary reference to gauge the primary market direction for xauusd: any subsequent trades initiated will strictly follow this identified trend.

- Buy signal - price is above the center pivot point

- Sell signal - price is below the central pivot point

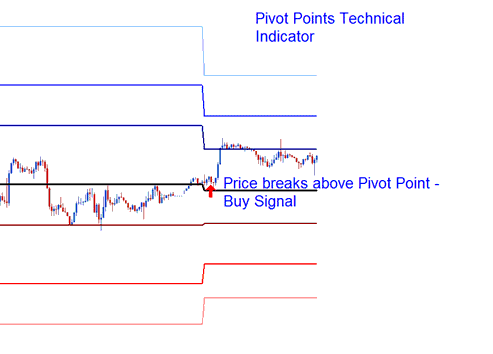

XAUUSD Price Break Out Signals

XAUUSD Price breakout signals are generated as follows

- Buy signal - is generated/derived when the price breaks out upward through the central point.

- Sell signal - is generated/derived when price breaks out down-ward through the central point.

XAUUSD Price Break out

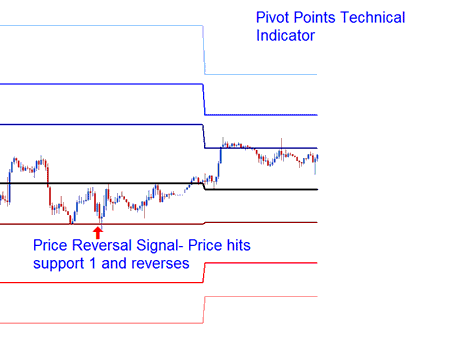

XAUUSD Price Reversal Signal

XAUUSD Price reversals are generated as follows

Buy Signal: when the price goes down towards a support level, then touches that level or goes a little past it, but then quickly changes direction and moves upwards again.

Here's a sell signal: price climbs up to a resistance area, touches it (or maybe pokes a bit above), then quickly reverses and drops.

XAUUSD Price Reversal Signal

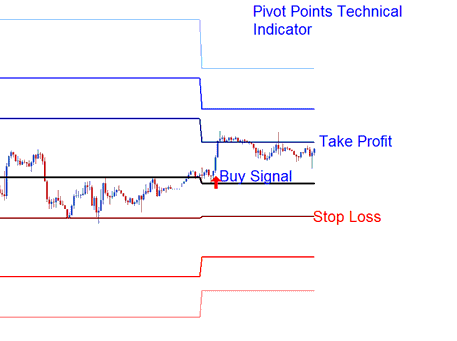

Placing Stop Loss and Limit Profit Values

Professional traders utilize the central pivot alongside other calculated support and resistance levels as benchmarks for determining appropriate placement for both stop loss orders and profit-taking limits.

Placing Stop Loss and Limit Profit

When a purchase is made above the midpoint, the Resistance 1 or Resistance 2 levels can be employed to establish the take profit target, while the Support 1 can serve as the Stop Loss Order Area for the trade.

To Download this Pivot Points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Download the indicator, then open in MQ4 editor. Compile it with the button, and add to MT4.

Note: Add it to MetaTrader 4, and the indicator shows extra mid-point lines. To remove them, open the MQ4 Meta Editor with F4 key. Edit line 16 from:

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Then Press Compile button again, and the technical indicator will then appear such as shown on this web site.

Learn More Lessons & Topics:

- Downloadable Course Detailing Nikkei225 Trading Strategies

- Rainbow Charts XAUUSD Indicator Analysis

- Wondering about market opening hours for indices? Here's the info.

- Trying to find the MetaTrader 4 SWI20 Index chart? Here's where to look.

- How Do You Generate FX Signals in Trading?

- AS51 Trading Framework

- How Do I Strategy Signals?

- What's the inverted hammer bullish pattern for XAUUSD?

- A list of XAU/USD broker reviews.

- McClellan MetaTrader 4 Indicator in FX