What is NIKKEI 225 Strategy? – A course on trading the NIKKEI 225 index.

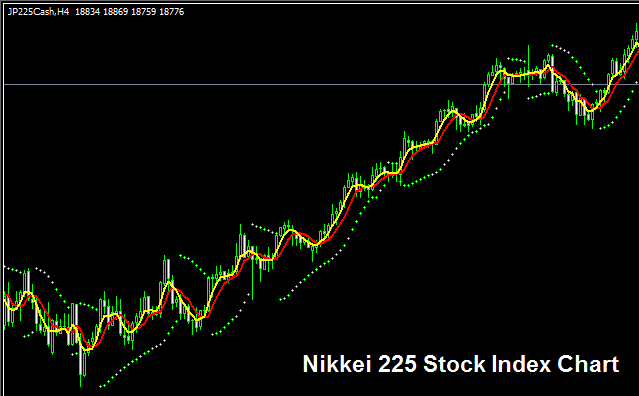

NIKKEI 225 Trading Chart

NIKKEI 225 chart is illustrated above. On the example above the index is named JP225CASH. The Indices example shown above is of NIKKEI 225 Indices on MT4 FX and Index Software Platform.

Strategy to NIKKEI 225 Index

NIKKEI 225 Index represents the relative trend movement of top 225 stocks/shares in Japan. Because this index monitors 225 corporations it will be more volatile when compared to an index like Germany DAX 30 that only monitors 30 firms.

If you are a trader interested in this stock index, be aware that it tends to be more volatile. While the general trend is upward over the long run, it experiences more fluctuations compared to other stock indices. Your trading approach should take this volatility into account.

Japan's economy often performs well, so an uptrend likely dominates. For this stock index, buy steadily and grab dips with a solid strategy.

During Economic Slow-Down and Recession

During periods of economic downturn and recession, companies typically begin reporting diminished earnings, reduced profits, and less favorable growth prospects. As a result, traders often start selling shares of companies that have announced these lower profits. Consequently, the indices that track these stocks also tend to decline.

In such times, market trends head down more often. Traders must shift strategies to match the dropping index trends they follow.

Contracts & Specs

Margin Requirement for 1 Lot - JPY 90

Value per Pips - JPY 0.1

While the overall trend tends to move upward, traders must account for daily market price fluctuations. On certain days, indices may trade within a range or experience a retracement. These corrections can occasionally be significant, making it essential to time trade entries with precision using a reliable trading strategy. Additionally, implementing proper money management techniques is crucial to mitigate risks and manage potential unexpected market volatility effectively. About indices equity management rules courses: What's Stock equity money management principles and guidelines & Stock Index equity management plan.

Get More Lessons: