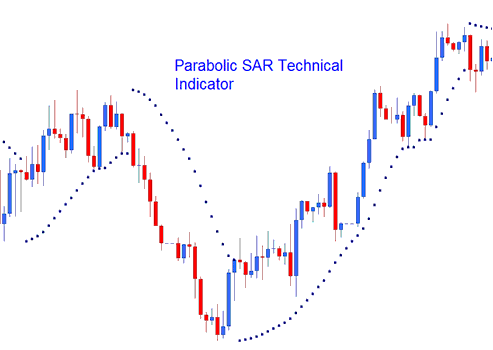

Parabolic SAR Technical Analysis & Parabolic SAR Signals

Created by J. Welles Wilder.

The Parabolic SAR helps set price limits that move with the price to protect profits. This indicator is generally called 'SAR' (stop and reversal) & it's used to closely watch the price changes.

- In an Uptrend, the stop and reversal will trail below the market price

- In a downwards trend, the stop and reversal will trail above market price

XAU USD Technical Analysis and Methods for Generating Trading Signals

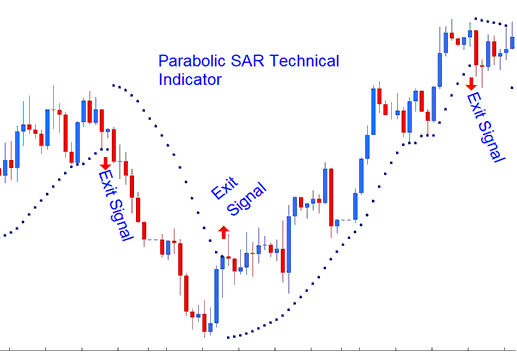

This indicator provides excellent exit levels.

Exit XAUUSD Signal for Buy trade positions

Traders and Investors should close long trade positions when the price falls and drops below the indicator.

If you're trading long, and the price is above the stop and reversal, the SAR indicator will go up every day, no matter which way the price is moving. How the technical indicator moves depends on how many pips the prices move. When the Parabolic SAR indicator changes direction, it means the market trend is also going down. This tells you to get out of your long trades.

Exit Signal for Sell trade positions

Traders should close short trades when price rises above the indicator.

If you're short - The price is below the stop and reversal, the SAR will move down every day, regardless of direction that price action is going. The movement of technical indicator depends on number of pips that prices move. When Parabolic SAR indicator changes the direction then the market trend also changes into up. This generates the exit signal for the short trade positions.

Exit Trade Signal for Buy and Sell trades

Get More Topics:

- Kauffman Efficiency Ratio Gold Indicator Technical Analysis

- Fundamental Economic Data Reports in Gold Trading

- Where Can You Get DJI30 in MT4?

- Keltner Bands FX Indicators Guide Tutorial

- How to Place Accumulation Distribution Indicator in Forex Chart

- Moving Average MA on MT5

- Momentum Market Trends Trade Parabolic Gold Price Trends

- Analyze and Use MetaTrader 5 Platform Full User Tutorial