What are BTCUSD Trading Patterns?

Bitcoin trading chart patterns are how bitcoin prices are shown, displaying repeating formations that are commonly used when trading in the BTCUSD market.

Bitcoin Trading chart patterns is one of the studies used in analysis to help bitcoin traders learn how to identify these repeating chart patterns formations.

Crypto patterns play a key role in Bitcoin trading. When BTCUSD stalls, it builds chart patterns. Spotting them helps predict the next price shift.

Bitcoin price movements often form recognizable patterns that repeat over time. These BTC/USD chart patterns are widely used by technical cryptocurrency traders to anticipate future market movements with greater accuracy.

Traders study these Bitcoin chart patterns to figure out supply and demand - that's what really drives BTCUSD price swings.

These BTCUSD crypto patterns are classified in to 3 different categories:

1. Reversal BTCUSD Trade Setups

- Double Top BTC USD CryptoCurrency Chart Patterns

- Double Bottoms BTC/USD Crypto Currency Patterns

- Head and Shoulders BTCUSD Chart Patterns

- Reverse Head & Shoulders Bitcoin Chart Patterns

2. Continuation BTC USD Setups

- Rising Triangle BTCUSD Crypto Chart Patterns

- Falling Triangle BTCUSD Patterns

- Bull Pennant/Flag Bitcoin Chart Patterns

- Bear Flag/Pennant BTCUSD Crypto Currency Chart Patterns

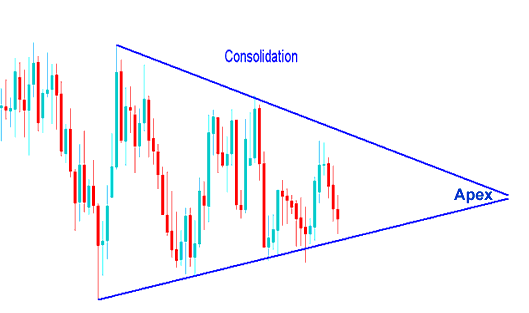

3. Bilateral BTCUSD Setups

- Symmetric Triangle - Consolidation BTCUSD Patterns

- Rectangle - Range Bitcoin Chart Patterns

Reversal patterns prove the Bitcoin market trend is turning. They appear after a long run up or down. These setups mean the BTCUSD trend is set to switch course.

Continuation BTC USD Crypto Patterns are formations which set up the btcusd market for a bitcoin trend continuation movement in the direction of previous Crypto trend. These continuation BTCUSD trading chart patterns are formed when the BTCUSD Trading market is taking a break prior to continuing in same direction of previous Crypto trend.

Consolidation BTCUSD Patterns form when the bitcoin crypto market is taking a pause/break before making a decision which is the next direction to move. When these consolidation BTCUSD chart patterns are formed the btcusd market is trying to figure out what direction to trade.

Bitcoin Setups Guides

BTCUSD Pattern Setups - An examination of candlestick patterns within bitcoin charts.

Crypto Pattern Setups - Patterns Strategy

Get More Courses and Topics:

- Bitcoin Triangle Break Out Tool MetaTrader 4 System

- Strategies for Trading Setups Indicated by the Bearish Bear Flag Chart Pattern.

- How to Tell if the Market is Trending

- MetaTrader 4 Trading Program Instructions Bitcoin Trading Chart Study Guide Instructions

- Adding RSI to Charts

- A Strategy for Day Trading Bitcoin Using Trendlines in BTC USD

- How to Install the BTC/USD MetaTrader 4 Platform

- How Can You Analyze/Interpret BTC USD Strategies Guide Lesson?

- How to Download Data for MT4 Trade System Tester

- Adjusting Chart Properties for Bitcoin Trading within the MT5 Platform's Chart Menu