Bitcoin Market Hours and The 3 Major Bitcoin Sessions

Tokyo Close Charts

If you want to find as many chances to trade as possible during Bitcoin's active times, you need to know when the bitcoin market has the most activity. This is when there's the most trading happening with bitcoin.

While there are no official opening and closing hours during the week, Bitcoin trading can be categorized into three main sessions: Tokyo, London, and New York markets.

Timing matters - a lot. It might not seem crucial at first, but knowing when to trade is one of the keys to success.

The ideal time to engage in trading is when the BTCUSD market experiences high activity, leading to higher transaction volumes. A bustling market presents better opportunities for profit, whereas a slow and inactive one is essentially unproductive - it's advisable to turn off your desktop and refrain from trading Bitcoin during these times.

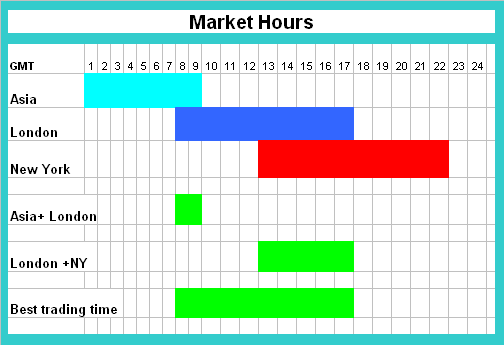

Not all the times are suitable, that is because the volatility keeps changing. Below is a table explaining the schedule of Bitcoin Currency Sessions. The time used is GMT 0

The 3 major sessions are:

- Asian Session Hours( Tokyo ): 00:00 to 9:00 GMT

- European Session Hours( London ): 7:00 - 17:00 GMT

- U.S. Session Hours( New York ): 13:00 to 22:00 GMT

Bitcoin Sessions Overlaps

There are hours when 2 market sessions are overlapped:

London + Tokyo overlap - 7:00 - 9:00 GMT

New York + London over-lap - 13:00 to 17:00 GMT

You'll see the most bitcoin being traded during these hours, meaning you have better odds of winning in these specific hours.

This implies that the bulk of Bitcoin transactional volume transpires during the overlap between the London and US market sessions. Consequently, this period naturally presents the optimal window for profit generation.

Because multinational corporations, hedge funds, managed funds, and banks are open for trading during the New York and London Market Sessions, the price of bitcoin fluctuates significantly.

Companies from different countries will use bitcoin at this time to make doing international business and trade easier, investment groups will trade bitcoin to make money, and banks will exchange a lot of money for their customers, like people traveling or anyone who wants to exchange money to buy things in other countries or do business.

This situation makes the btcusd market highly liquid, and the large volume of trades results in significant price fluctuations. Typically, the charts will trend in a specific direction, establishing a short-term trend during this period.

Join crypto trades when activity peaks. That's when liquidity flows and chances to profit rise. High volume makes bitcoin prices more steady. Low liquidity leads to wild swings and range-bound moves with no clear path.

After trading Bitcoin for some time, you'll notice it's typically easier to profit in a trending BTC/USD market - whether moving up or down - compared to a range-bound market.

Asian Session Characteristics:

- Least volatile of the 3 sessions

- Account for 15 % of daily trade transaction turnover

- Typical 20 -30 pip(point) moves

European Session Characteristics:

- Most volatile of the 3 market sessions

- 35 % of daily trade volume

- Typical 90 -150 pip moves

USA Session Characteristics:

- 2nd most volatile of the 3 sessions

- Accounts for 25% of daily trade turnover

- Focuses on AUS economic news

US and Europe Session Overlaps Characteristics:

- Combines the 2 most volatile sessions

- Accounts for 60 % of total daily trade transaction turnover

- Focuses on USA and European economic news

- Fast moving bitcoin prices and cryptocurrency trends in a particular direction

Discover Extra Subjects & Instructions:

- What are the Different & Various Types of BTC USD Traders?

- Candlesticks Chart BTC USD Crypto, Line Chart & Bar Chart Types

- How Do You Add Heikin Ashi Bitcoin Trading Indicator in Chart in MT4 Platform/Software?

- How Much Capital Does it Cost to Open a Mini BTCUSD Trade Account?

- Learn Bitcoin Setups Defined with Examples

- MetaTrader 4 Momentum BTCUSD Trading Indicator for BTCUSD Trade

- BTC USD Equity Management in BTC USD Trade

- Types of Oscillator Indicators for BTCUSD

- No Deposit Bonus No Deposit Bonus BTC USD Account

- How to Open MT4 Practice BTC USD Trade Account