Bitcoin Trader Types: Scalpers, Day, Swing, Position Traders

Types of Bitcoin Traders

There exists a diversity among Bitcoin traders, with the specific classification of a trader being determined by the duration for which they choose to maintain their Bitcoin positions open.

Bitcoin traders of different kinds pick varied time frames for their trades.

The various types of Bitcoin traders are:

- Scalpers

- Day traders

- Swing traders

- Position BTCUSD traders

Each category of Bitcoin traders is tailored for different personalities and trading preferences. Beginner BTC/USD traders can explore these types and choose one based on their preferred chart timeframe and habits.

Types of Bitcoin Traders

Scalpers in bitcoin trading maintain their transactions for just a few minutes. Their aim is to secure a small profit, typically ranging from 5 to 20 pips.

Scalpers are Bitcoin traders who execute numerous transactions in a single day, often targeting the busiest hours of the BTC/USD trading market. These traders typically open between 30 to 50 trades daily.

Scalpers are Bitcoin traders who can make quick decisions.

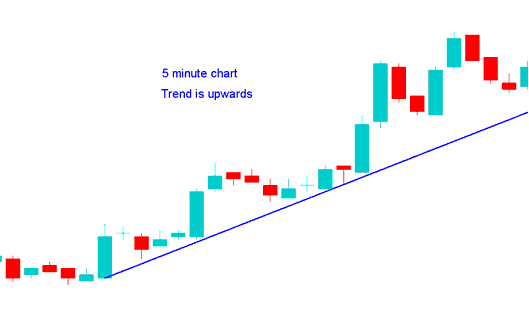

Scalpers use 1 min cryptocurrency charts to put their orders. They use 5 minutes Bitcoin chart timeframe to figure out the bitcoin trend, if the bitcoin trend is moving up or down and to decide their entry and exit.

Scalper 5 minutes bitcoin trading time-frame btcusd strategy

A Scalper who uses a 1-minute trading chart wants to start or do a long trade, so they check the 5-minute chart. If the cryptocurrency trading example looks like the one shown below, and it shows the bitcoin trend is going up, the scalper will then decide it is okay to buy bitcoin crypto.

Categories of Bitcoin Traders: Scalpers, Bitcoin Scalping Strategies, and the Scalper Bitcoin Trader Profile

Types of Bitcoin Traders

Bitcoin day traders hold deals for hours, under a day. They aim for 30 to 70 pips in gains.

A cryptocurrency day trader makes a couple of bitcoin trades in a single day, trading when the market is most active, and they do not keep their trades open overnight.

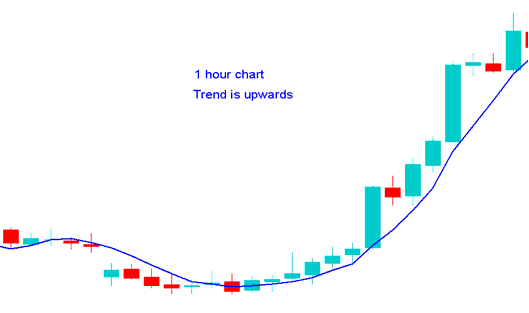

These BTCUSD traders check the 15-minute BTCUSD Crypto charts to place their orders. They check the 1-hour chart to see the btcusd cryptocurrency market trend, whether it's rising or falling, and to plan when to buy and sell.

A trading strategy for Bitcoin day traders using a one-hour time frame

A BTCUSD day trader analyzing a 15-minute crypto chart may consult the 1-hour timeframe for confirmation. If the trend indicates bullish movement, like in the example provided, the trader would proceed to buy Bitcoin.

Types of Bitcoin Market Traders - Bitcoin Day Traders - Crypto Currency Day Trade - Types of Bitcoin Traders

Types of Crypto Traders

Bitcoin Swing Traders - This category of bitcoin trader retains their Bitcoin positions for several days up to a week, aiming to achieve significant profit of 100 to 400 pips.

This kind of trader typically makes about 2 to 5 bitcoin trades each week, keeping their positions open overnight. The swing bitcoin trading method needs traders to have patience.

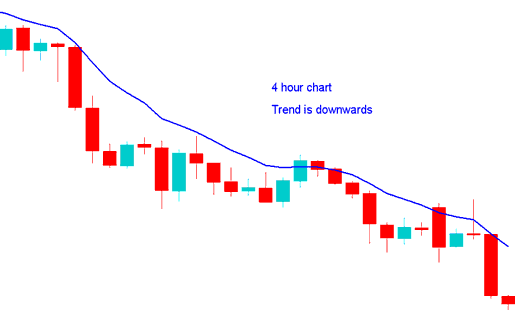

This bitcoin trader type uses 1-hour charts for orders. They check 4-hour charts for trend direction and entry-exit points.

Bitcoin Swing Trader H4 chart timeframe strategy

A Bitcoin swing trader utilizing 1-hour candlestick charts aims to initiate a short position. After inspecting the 4-hour candlestick chart, which, as depicted in the cryptocurrency example below, confirms a downward price trajectory, the swing Bitcoin trader will then decide it is appropriate to Sell or Go Short on the Bitcoin cryptocurrency.

Classifications of Bitcoin Traders: Specifically focusing on Swing Traders, Swing Bitcoin trading styles, and Swing Bitcoin Traders.

Types of Bitcoin Traders

Position Bitcoin Traders - These bitcoin traders keep their trades open for several weeks or months. They aim to make a large profit, around 300 to 1000 pips.

Position Bitcoin Traders place an average of 2 to 5 orders in a year, position bitcoin trading method requires those who are patient, experienced and have huge trading account balances that can withstand huge draw-downs.

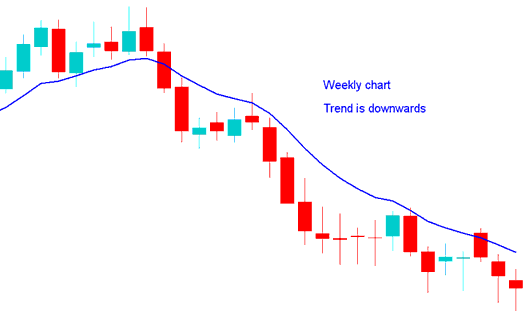

Position bitcoin traders check one-day or weekly crypto charts for orders. They look at the weekly chart to spot the bitcoin trend, up or down, and pick entry and exit points.

Types of BTCUSD Traders

A position trader in Bitcoin looks at daily candlestick charts. They want to go short. They check the weekly frame next. It matches the example shown below. The weekly view shows Bitcoin trending down. So the trader feels safe to sell and go short.

Types of Bitcoin Traders - Position Traders encompass long-term Bitcoin traders.

Types of Bitcoin Traders

When it comes to trading Bitcoin, most people gravitate towards day trading or scalping. Scalpers make super quick trades - you have to be sharp and make fast decisions. Day traders, on the other hand, hold their positions for a bit longer but still close everything out before the day's over. If you're just starting out, trying either scalping or day trading for BTCUSD makes sense. You won't leave trades open overnight, so you can keep an eye on things and react to the market as it moves. The main thing is to ride the trend as long as it's going your way, and get out as soon as the trend flips against you.

In the question about which type of bitcoin trading style is used by the best Bitcoin traders or by the top Bitcoin traders the two bitcoin trading methods above are the most commonly used bitcoin techniques. Traders can also automate these scalping or day trading styles by implementing their btcusd trade strategies using automated cryptocurrency bots.

For bitcoin swing traders, holding onto bitcoin trade positions for too long can use up your profit, and this bitcoin trading method takes a lot of skill, so beginner Bitcoin traders should stick to short term bitcoin trading methods.

Position trading in bitcoin is not advisable as it necessitates a substantial account balance and may lead to significant drawdowns.

Swing and position trading in bitcoin keep positions open for long stretches. But risks grow if prices swing hard against you and cause big losses. That's why fewer bitcoin traders pick these styles. Scalping and intra-day crypto trades help control your account funds better.

It's not a good idea for a bitcoin trader who is new to leave orders open overnight: it's best to always close open cryptocurrency orders at the end of the day.

Crypto Currency News Traders - Types of Bitcoin Traders - News Trading - This type of news-focused bitcoin investor makes deals when financial news is released, either predicting if the news will be good or bad, or setting up crypto orders that wait above and below the current bitcoin price. This news-based way of doing things is dangerous because the market changes a lot, and it might be hard to find someone to trade with. You might not be able to make a trade, or even worse, your safety net might not work. Using news to trade can make some bitcoin investors a lot of money, but it takes some know-how.

Bitcoin Bot Traders - Types of Bitcoin Traders - Automated Bitcoin Traders - the cryptocurrency trading robot trader - automated bitcoin trader is the type of bitcoin trader that uses automated bitcoin trading programs known as cryptocurrency trading robots - Expert Advisor Robots - EAs Automated Robots Trading Bots to trade the online btcusd crypto currency market. This automated bitcoin trader will setup an Automated Bitcoin Bot on their platform software & the automated bot will then open and close trades on behalf of the trader based on the trading strategy which has been used to program this automated cryptocurrency bot. If you're new to automated cryptocurrency trading and would like to find a btc usd trader using automated trading robots to help you as a trader come up with an automated bot, then you can find out more about automated trading on the Bitcoin EAs Article - MQL5 EA Robots Forum.

Learn More Courses & Lessons:

- Learning How to Effectively Use the MetaTrader 4 Online Bitcoin Software

- How to Place BTC/USD Indicators on Android for BTCUSD Charts in MT4 Platform

- A Calculator Tool for Determining Drawdown in BTCUSD Money Management

- Analytical Tools Employed in Day Trading and Analyzing Bitcoin

- Procedures for Transitioning to Live Trading on the MetaTrader 5 Software

- Displaying BTC USD Chart Timeframes on the MT5 Platform

- Best Session Times to Trade BTC/USD Markets

- A Calculator Tool for Determining Drawdown in BTCUSD Money Management

- Techniques for Analyzing and Interpreting Trading Charts on the MT4 Platform

- Brokers for BTC/USD: ECN and STP