True Strength Index (TSI) Technical Analysis & TSI Signals

Trend Strength Indicator - True Trend Indicator

Developed & Created by William Blau

The True Strength Index (TSI) functions as an indicator for momentum trading. The TSI calculation involves momentum measurements that react with greater agility and sensitivity to price fluctuations, positioning it as a leading indicator that closely tracks the direction of price movement within the Forex arena.

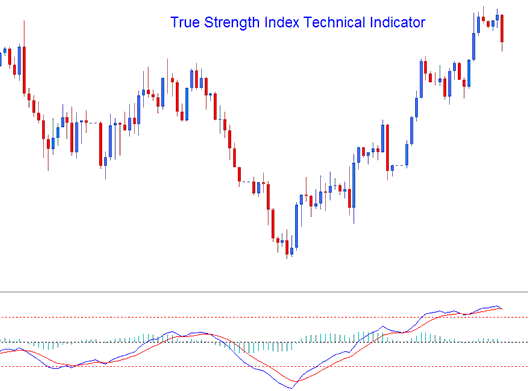

The True Strength Index is represented by a blue line, and this indicator also plots a corresponding signal line, which appears as a red line: these two lines are utilized to identify crossover signals.

Also, TSI draws a histogram that visually represents the difference between the TSI Line & the Signal line. This histo-gram goes beyond/below the centerline, histogram levels over the centerline indicate a bullish crossover signal, while centerline levels less than the center-line indicate a bearish cross-over signal.

Technical Analysis and How to Generate Trading Signals

The TSI uses a few different ways to create trading signals. You can use this indicator like the RSI to figure out the general direction of currency markets. You can also see when the TSI shows levels of being too high or low. Most common ways of making trading signals include:

Zero Line Histogram Crossovers for FX Trades (Not Line Crossovers)

- Buy - when the histogram crosses above 0 a buy signal gets generated

- Sell - when the histogram crosses below 0 a sell signal is generated

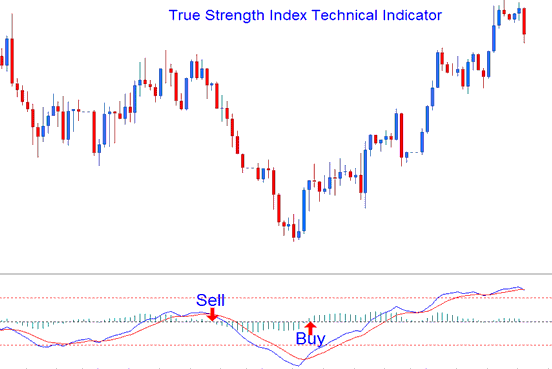

Signal line Trading Cross-over

- A buy gets derived & generated when the TSI line crosses above the SignalLine

- A sell gets derived/generated when the TSI line crosses below Signal-line

This signal is identical to the one mentioned above, and the timing aligns with the moments when the histogram crossovers occur.

Divergence Trade

Divergence is a technique used to identify potential trend reversal points in currency pairs. Common reversal divergence setups include specific patterns that signal shifts in market behavior.

Classic Trading Divergence

Classic Bullish Divergence: Lower lows in price and higher lows in the indicator

Classic Bearish Divergence: Higher highs in price and lower highs on the indicator

Divergence trading can also help identify potential trend continuation points in price movements. These continuation divergence setups are crucial for assessing sustained market trends.

Hidden Trading Divergence

Hidden Bullish Divergence: Price Higher Lows, Indicator Lower Lows

Hidden Bearish Divergence: Manifesting as lower peaks in the price action alongside higher peaks on the trading indicator.

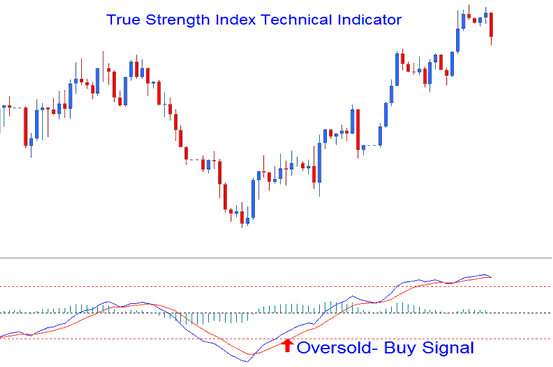

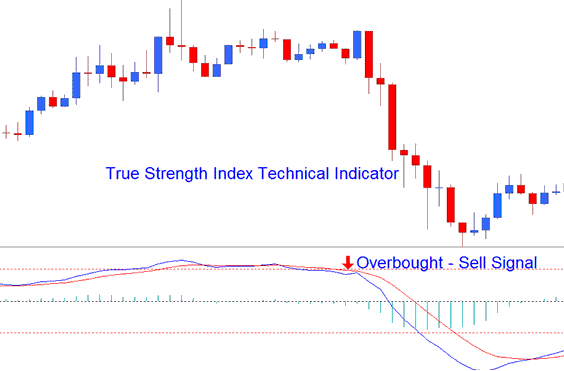

Overbought/Over-sold Levels in Indicator

This can be used to spot when prices have risen or fallen too much in the market's price changes.

- Overbought condition - levels being greater than the +25 level

- Over-sold condition - levels being lesser than the -25 level

When TSI crosses these technical levels, trades may be created or obtained.

Buy signal - when the levels cross above -25 level a buy gets generated.

Sell trade signal - when the areas cross below +25 level a sell signal is generated.

Over-sold - Buy Signal

Over-bought: sell trade signal,

The overbought/oversold levels are indicated using horizontal lines plotted at the +25 and -25 levels.

Get More Topics:

- How to set up the S and P ASX200 Index on the MetaTrader 5 platform.

- EUR vs MXN Chart

- How to Formulate Forex Money Management Rules Lesson Tutorial

- XAU vs EUR Chart

- Best Time to Trade USD/NOK EST

- Understanding FX Candlestick Charts within a Trading Context

- MT4 Chandes DMI Indicator Technical Analysis Described

- McGinley Dynamic Gold Indicator Analysis in XAU USD

- Technique of Calculating Where to Place Stop Loss XAU USD Orders Using XAUUSD Trend-lines

- The Significant Impact of Leverage on Amplifying XAU USD Profits and Losses