How Stochastic Indicator Works

The Stochastic oscillator tool relies on time frames for its fast and slow lines. The periods for %K and %D lines vary based on the trader's goal with the Stochastic.

- A trader using the Stochastic oscillator indicator in combination with a trend indicator to see overbought & oversold levels, one can use periods 10 periods.

- The default period used by stochastic Indices oscillator indicator is 12.

Traders should not use stochastic indicator alone for making decisions, but should use this Stochastic oscillator indicator in combination with other indicators.

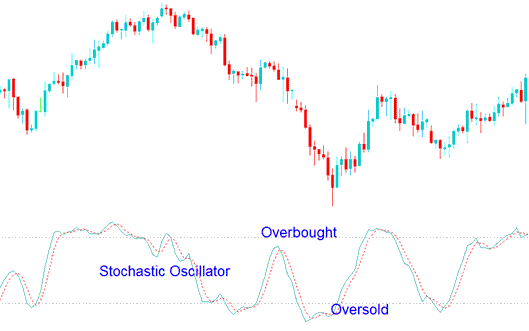

Within markets exhibiting little directional movement (ranging markets), this Stochastic oscillator can effectively highlight potential oversold or overbought zones that may serve as opportune points for taking profits.

Default oversold and overbought levels are 20 and 80. Some use 30 and 70.

Look for the 'overbought' area at the 80% mark of the stochastic Indices oscillator indicator.

To look for 'oversold' region 20% stochastic Indices oscillator mark is use.

The stochastic oscillator indicator shows overbought and oversold areas as dotted lines. These levels are adjustable and are commonly set at 30 and 70.

Overbought and Oversold Levels on Stochastic Oscillator

Examine More Lessons & Topics:

- How Do You Trade FX with News Trading Strategies?

- How to place the Volumes Indicator in a Forex chart on MT4

- Momentum Market Trends Trade Parabolic Gold Price Trends

- Trade the EU 50 Indices Chart

- Evaluating margin requirements per contract for GER30 indices trading.

- EU 50 Symbol on MT5 Platform

- Best Australia Forex Trade Brokers