SWI20 Index

SWI20 Stock Index or Swiss Market Index 20 is a market indices that keeps track of top 20 firms in Six Swiss Exchange in Switzerland. This 20 stocks shown represent the blue chip stocks in Six Swiss Exchange Market - these are also the most liquid stocks in this Stock Index exchange.

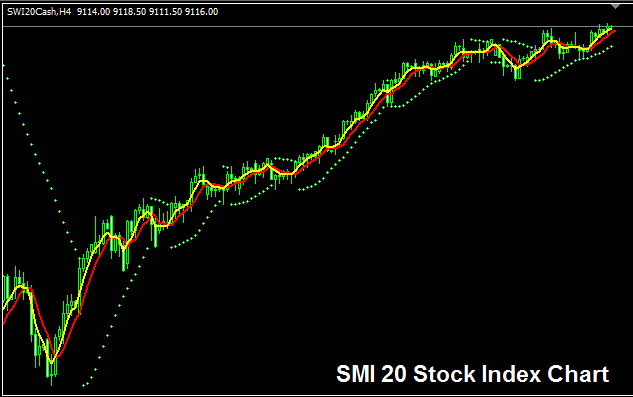

SWI20 Chart

SWI20 chart is illustrated and shown & illustrated above. On the above example this Stock Index is named SWI 20CASH. As a trader you want to find a broker that provides SWI20 chart so that you as a trader can begin to trade it. The Indices example shown above is that of SWI20 Stock Index on MT4 Forex Platform Software.

Other Data about SWI20 Index

Official Stock Index Symbol - SWI20

The 20 constituent stocks that makes up the SWI20 Index are selected from top firms in France. The 20 stocks constitute majority of the trade turnover volume in SIX Swiss Exchange Market. The calculation is reviewed yearly.

Strategy for Trading SWI20 Index

SWI20 Index tracks capitalization of top 20 firms in Switzerland. This Stock Index in general moves upwards over long-term because the Swiss economy also shows strong growth. The Switzerland economy also has one of the strongest banking system in the world - making the Switzerland economy one of the most reliable and solid economy.

As a stock index trader you want to be biased and keep on buying as the index heads and moves upward. When Swiss economic and business environment is doing and performing well most of these top stocks will continue moving up and hence this stock index will also move in an upwards trend. A good stock index trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down & Recession

During the economic slowdown & recession periods, corporations start to report slower profits & lowers growth projection. It is due to and because of this reason that investors start to sell stocks of companies that are posting lower profits & hence Index tracking these specific stocks also will start heading and moving downward.

Therefore, during these times, trends are a lot more likely to be going and heading downwards and you as a trader should also adjust your trading strategy accordingly to suit the prevailing downward trends of the index which you as a trader are trading.

Contracts and Specs

Margin Requirement for 1 Lot - CHF 100

Value per Pips - CHF 0.5

Note: Even though overall trend is generally moves upwards, as a trader you've got to consider and factor on daily price volatility, on some of the days the Indices may move in a range or even retrace & retracement, the market retracement move may also be a large one at times & therefore as a trader you need to time your trade entry accurately using this trade strategy & at same the time use proper and suitable money management guidelines/strategies just in case there's more unexpected market volatility. About Stock equity and money management guidelines courses: What's Stock equity money management methods/guidelines & Index equity money management plan/system.

More Lessons:

- What are Moving Average Envelopes Buy and Sell Forex Signals?

- Bollinger Bands Fib Ratio Trading Indicator

- Analysis of XAUUSD Parabolic Trends and Gold Momentum Trends

- Brokers with Minimum Deposit Trade Accounts

- How to Find and Get Learn Trade Website Tutorial Lesson

- Course to Trade IT40 Indices

- Divergence FX: How to Spot Divergence and Trade Divergence in Trade