What is Triple Exponential Average TRIX Indicator? - Definition of TRIX Indicator

Triple Exponential Average TRIX - Triple Exponential Average TRIX indicators is a popular technical indicator that can be found on the - Indicators List on this site. Triple Exponential Average TRIX is used by the traders to forecast price movement based on the chart price analysis done using this Triple Exponential Average TRIX indicator. Traders can use the Triple Exponential Average TRIX buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Triple Exponential Average TRIX indicator. By using Triple Exponential Average TRIX and other indicators combinations traders can learn how to make decisions about market entry and market exit.

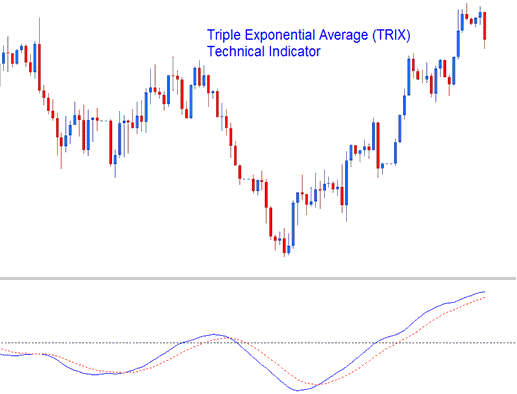

What's Triple Exponential Average TRIX Indicator? Triple Exponential Average TRIX Technical Indicator

How Do You Combine Indicators with Triple Exponential Average TRIX? - Adding TRIX in the MT4

Which Indicator is the Best to Combine with Triple Exponential Average TRIX?

Which is the best Triple Exponential Average TRIX combination for trading?

The most popular indicators combined with Triple Exponential Average TRIX are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Oscillator Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best Triple Exponential Average TRIX combination for trading? - Triple Exponential Average TRIX MT4 indicators

What Indicators to Combine with Triple Exponential Average TRIX?

Get additional indicators in addition to Triple Exponential Average TRIX that will determine the trend of the market price and also others that confirm the market trend. By combining indicators that determine trend & others that confirm the trend and combining these indicators with Triple Exponential Average TRIX a trader will come up with a Triple Exponential Average TRIX based system that they can test using a demo account on the MetaTrader 4 platform.

This Triple Exponential Average TRIX based system will also help traders to determine when there is a market reversal based on the indicators signals generated & hence trades can know when to exit the market if they have open trades.

What is Triple Exponential Average TRIX Based Trading? Indicator based system to interpret and analyze price & provide trade signals.

What is the Best Triple Exponential Average TRIX Strategy?

How to Choose & Select the Best Triple Exponential Average TRIX Strategy

For traders researching on What is the best Triple Exponential Average TRIX strategy - the following learn guides will help traders on the steps required to course them with coming up with the best strategy for trading market based on the Triple Exponential Average TRIX system.

How to Create Triple Exponential Average TRIX Strategies

- What is Triple Exponential Average TRIX System

- Creating Triple Exponential Average TRIX System Template

- Writing Triple Exponential Average TRIX System Rules

- Generating Triple Exponential Average TRIX Buy and Triple Exponential Average TRIX Sell Signals

- Creating Triple Exponential Average TRIX System Tips

About Triple Exponential Average TRIX Example Explained

Triple Exponential Average (TRIX) Analysis and TRIX Signals

Created and Developed by Jack Hutson

TRIX is a triple smoothed oscillator that is designed to eliminate spikes that cause fake outs in the calculations, these spikes or market cycles that are shorter than the selected indicator period used to calculate and plot are ignored.

Triple Exponential Average is an oscillator indicator which oscillates above and below a centerline mark. The center line level is used to determine bullish and bearish trends. TRIX will measure the energy of an uptrend or a down-trend. Above the center-line shows bullish trends and below center line shows bearish trends

FX Analysis and How to Generate Signals

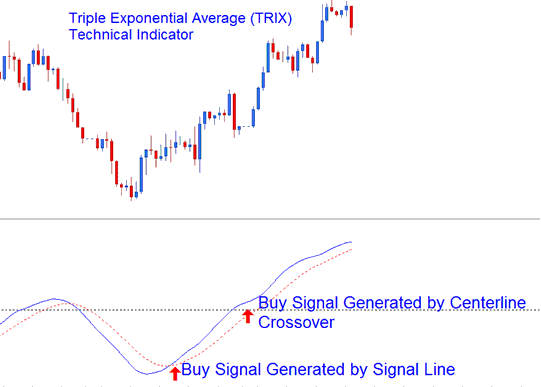

Bullish Buy Trade Signal

A buy signal can be derived & generated using 2 techniques and methods:

- The first one is the centerline crossover signal where values/readings above the line are bullish.

- The second one is used to generate a signal when the signalline crosses above TRIX line.

Bullish Buy Trading Signal

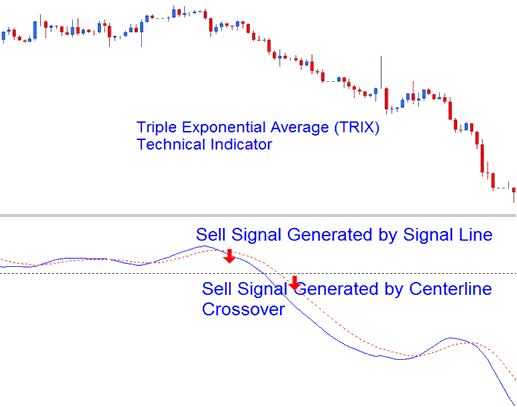

Bearish Sell Trade Signal

A sell signal can be derived & generated using two techniques:

- The first one is the centerline crossover signal where values/readings below the line are bearish.

- The second one is used to generate a signal when the signal-line crosses below TRIX line.

Bearish Sell Trade Signal

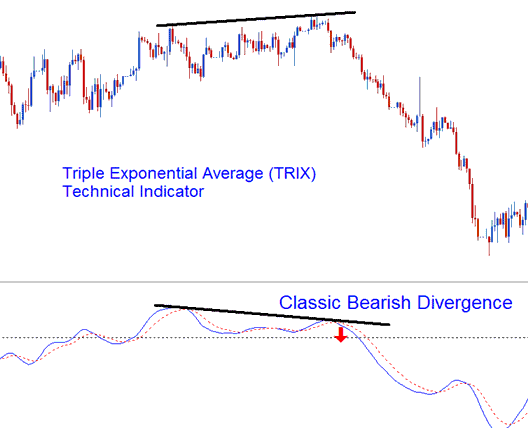

Divergence Trading

Divergence can be used to generate trading signals. Traders can look for divergence between price and the technical indicator & decide which direction to trade.

Divergence Trading

Study More Lessons and Tutorials and Courses: